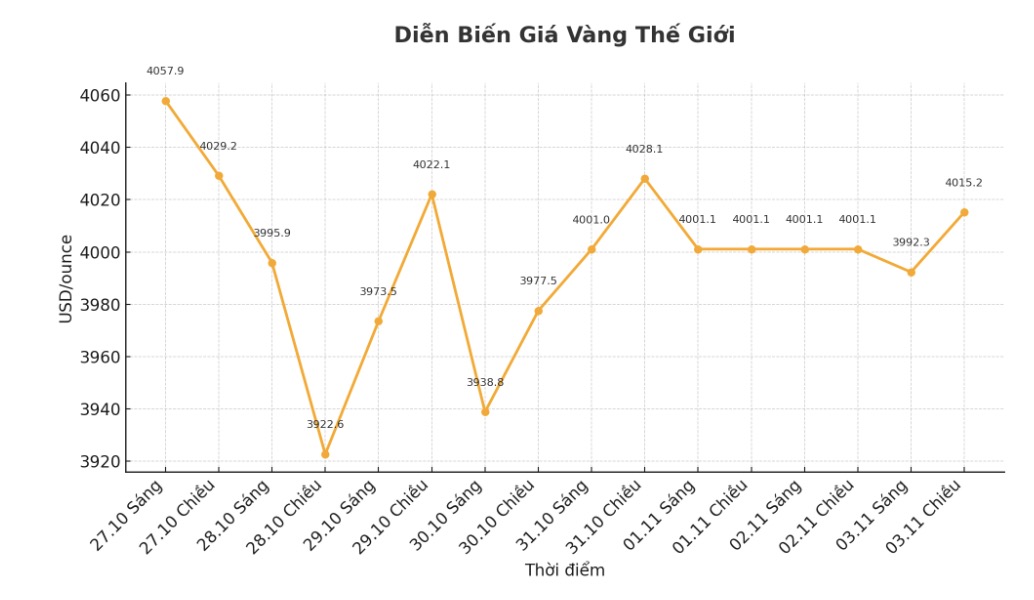

Gold prices held steady around $4,000/ounce in the first trading session of the week. The precious metal is under pressure from a strong US dollar as investors reduce expectations of the US Federal Reserve (FED) continuing to cut interest rates in the short term, while the US-China trade tensions are also cooling down demand for gold.

At 5:04 a.m. GMT, the December US gold futures price increased by 0.4% to $4,010/ounce.

Gold prices have fallen about 9% from a record $4,381.21 an ounce reached on October 20, as the US dollar rose to a nearly three-month high.

Golds upward momentum is lacking due to a number of technical factors, while the US dollar remains quite strong, which has a negative impact on gold, said Kelvin Wong, senior market analyst at OANDA.

The Fed cut interest rates by another 25 basis points on October 29, the second time this year. However, Fed Chairman Jerome Powell's "Havy" statement later made investors skeptical about the possibility of the Fed continuing to ease policy in 2025.

Traders now see onlyund1% chance of a Fed rate cut in December, down from more than 90% before Powell's speech, according to CME FedWatch tool.

Gold - un interest-bearing assets often benefit from a low interest rate environment and when the economy is unstable.

Investors are now paying attention to US ADP employment data and ISM PMI this week, which are seen as economic indicators that could influence the Fed's "tail" view.

Currently, golds safe haven role has been somewhat reduced due to the cooling of US-China trade tensions. The market may be shifting towards a more risk-off sentiment, especially in stocks, Mr. Wong added.

US President Donald Trump said last week that he had agreed to partially reduce tariffs on China in exchange for Beijing controlling the smuggling of fentanyl, buying more US soybeans, and increasing rare earth exports.

In other precious metals markets, spot silver rose 0.2% to $48.75 an ounce, platinum rose 1.5% to $1,590.8 an ounce, while palladium fell 0.1% to $1,432.18 an ounce.

See more news related to gold prices HERE...