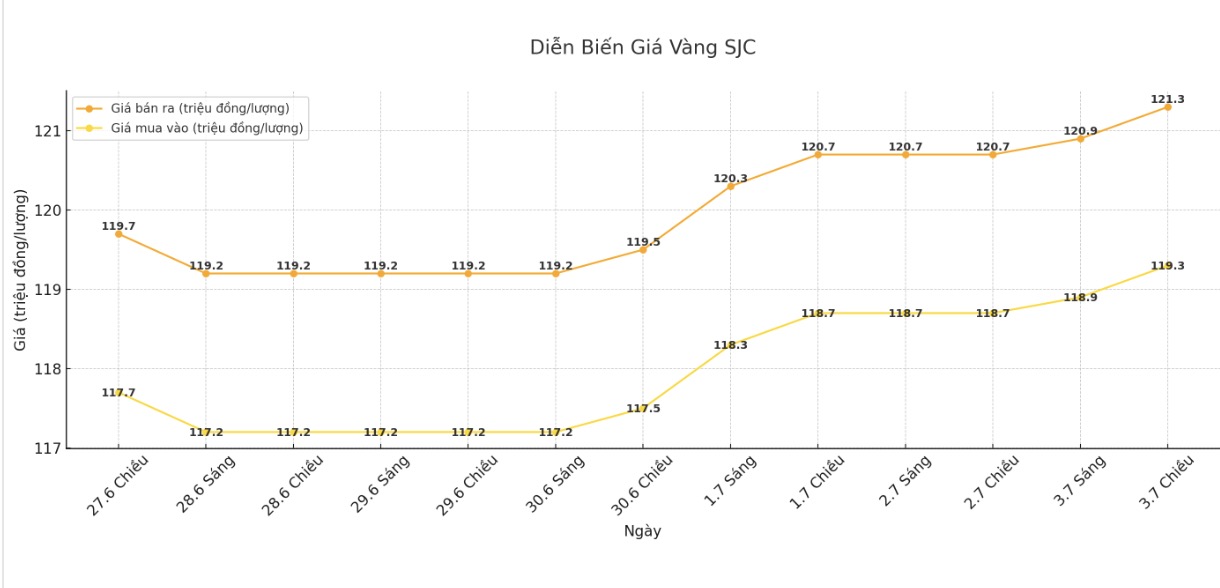

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out); increased by VND 600,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.3-121.3 million VND/tael (buy - sell); increased by 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell); increased by 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.6-121.3 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

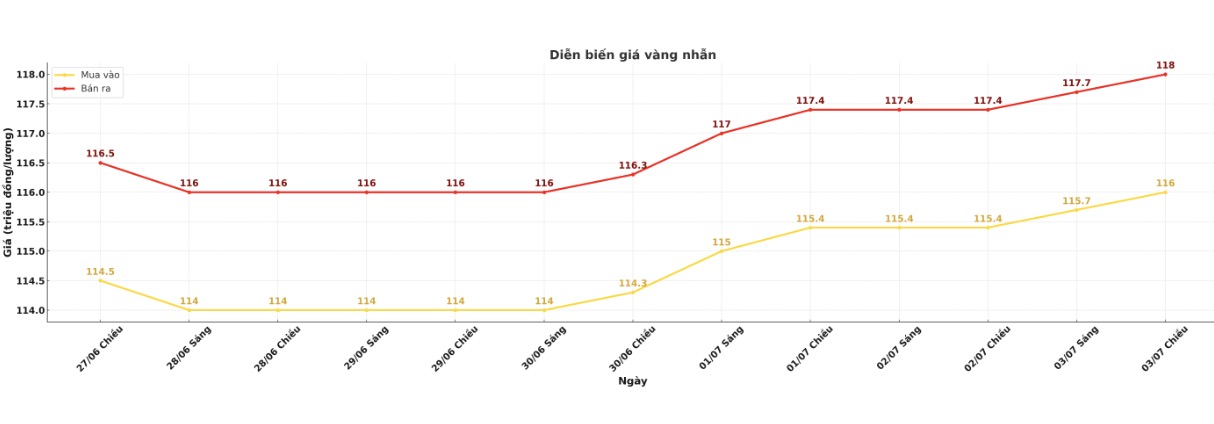

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116-118 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

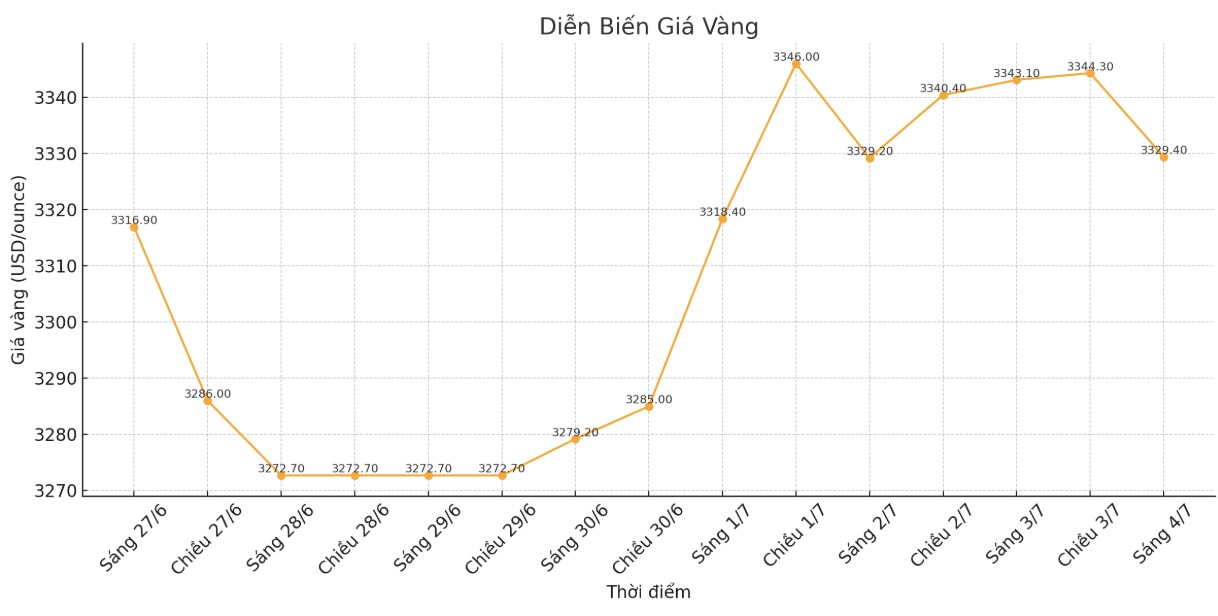

World gold price

Recorded at 0:42, spot gold was listed at 3,329.4 USD/ounce, down 14.4 USD.

Gold price forecast

World gold prices fell amid a series of newly released US economic data showing that the labor market maintained strength beyond forecasts, increasing expectations that the US Federal Reserve (FED) will keep interest rates higher for longer.

In June, the US economy added 147,000 non-farm jobs, much higher than the forecast of 111,000, while the unemployment rate unexpectedly fell to 4.1%.

In addition, data for April and May were adjusted up, further consolidating the assessment that the job market has not cooled down. The number of unemployment claims last week also decreased to 233,000, with an average of four weeks of continued improvement.

Right after a series of positive figures, gold prices plummeted. On Thursday, gold prices fell nearly 0.9% to $3,327.18/ounce, and on Friday they continued to lose more than 1%, closing at $3,323.7/ounce.

Experts say that with a solid labor market, the FED will find it difficult to loosen policy in the short term. Chris Zaccarelli - Investment Director of Northlight Asset Management - predicted that the FED could delay until the end of the third or fourth quarter to calculate the interest rate cut.

However, the jobs report also showed that wage inflation is slowing, with average earnings per hour in June rising just 0.2%, below forecasts. This helps ease inflation concerns but shows that income growth is starting to correct.

Some experts note that most of the new jobs are in the public sector, with potential unsustainable risks. However, this data is enough to reinforce the view that the FED maintains a cautious stance, continuing to put pressure on gold.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...