SJC gold bar price

As of 5:20 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.7/20.7 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.7 - 20.7 million VND/tael (buy - sell); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.7-120.7 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.6 million VND/tael.

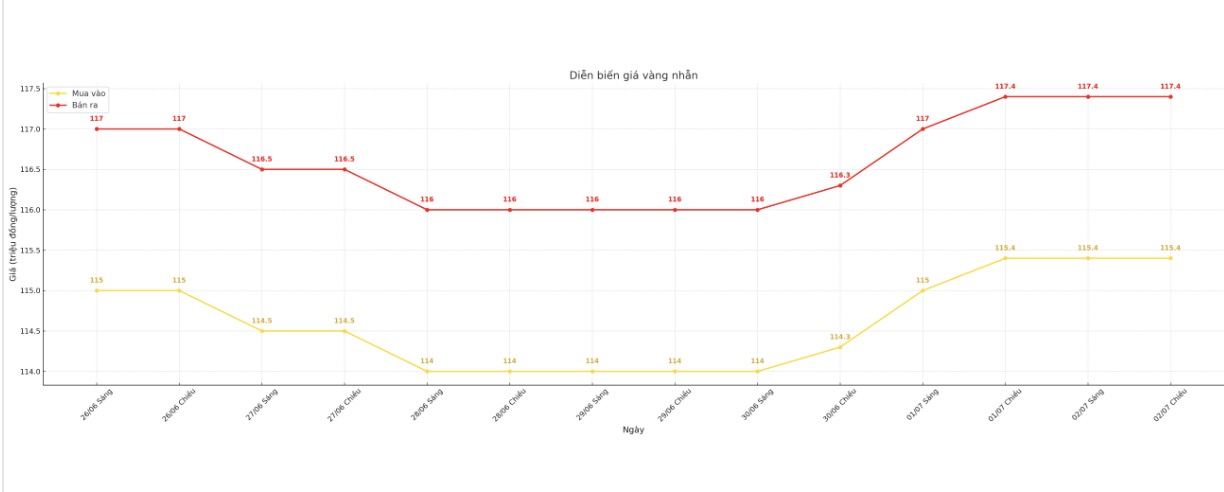

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at 115.4-117.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.1-117.1 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

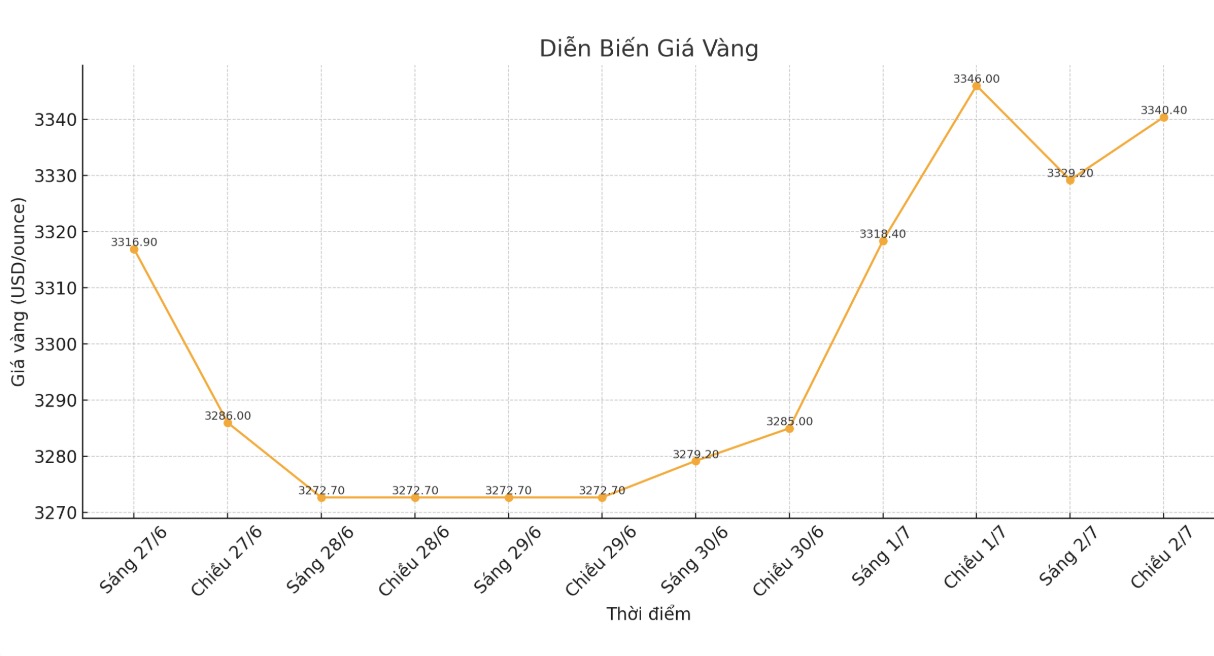

World gold price

The world gold price was listed at 5:30 p.m. at 3,340.4 USD/ounce, down 5.6 USD.

Gold price forecast

Gold prices fell slightly in the trading session on Wednesday, as cautious investors did not bet big in the face of a series of US employment data expected to clarify the policy direction of the US Federal Reserve (FED).

Giovanni Staunovo, an analyst at UBS, said: In recent weeks, investors have not adjusted much of their expectations for the Fed to cut interest rates further this year. We still believe that concerns about public debt, pressure forcing the Fed to adjust interest rates and weaker US economic data will support gold prices.

Analysts have mixed views on the outlook for gold prices. Expert Jimickards predicts that gold could reach $3,400/ounce by the end of July 2025 if geopolitical factors return to support, such as instability in the Middle East or weakening the US economy.

However, UBS Global Wealth Management warned that if the Fed continues to maintain high interest rates due to persistent inflation, gold prices could fall to $3,200/ounce in the short term.

Soni Kumari from ANZ said that reducing safe-haven demand, combined with risk-off sentiment after the US-China deal, will continue to put pressure on gold prices in the coming weeks.

However, gold is still supported in the long term by central bank demand and global economic risks, especially when geopolitical factors can be re-ignited at any time.

Forecasting the future, the World Bank said that gold prices are on track to set a historical highest annual average. Silver prices are expected to continue to increase thanks to persistent demand, while limited supply conditions will support platinum prices.

However, if global tensions escalate further, gold prices could well exceed current forecasts, while weaker industrial activity could curb demand and push silver and platinum prices below forecasts, the analysts concluded.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...