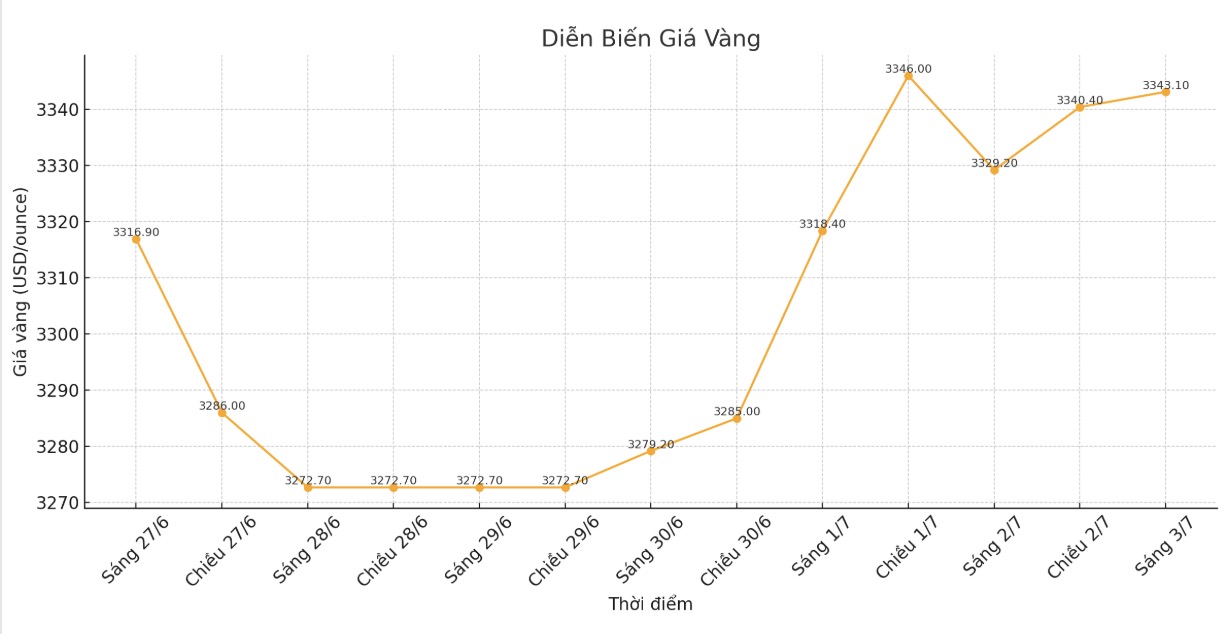

Gold prices have returned to the familiar level of over $3,300/ounce, while silver prices have maintained a consolidation momentum above $36/ounce. A portfolio manager believes that both precious metals still have room to increase.

In a recent interview, Mr. Ryan McIntyre - Senior Executive partner at Sprott said that although he is still optimistic about gold, he is currently paying more attention to silver in the short term.

Mr. McIntyre's positive view was given when the gold/esilience ratio fell below 92, much lower than the multi-year peak of over 100 in April. The most recent record, spot silver reached 36.4 USD/ounce, up more than 1% on the day, while gold was at 3,344.28 USD/ounce, up 0.24%.

The concern about a global recession easing and easing trade tensions are supporting the cyclical industrial demand for silver, while gold prices continue to accumulate. Mr. McIntyre predicts that both silver and gold will tend to increase in price as individual investors seek assets to protect asset value and purchasing power.

He said he has a slightly optimistic view on silver in the short term, as the metal still needs to catch up with gold's rally. Although silver is not held by central banks as a reserve asset, it is still a metal with important monetary value for individual investors.

Gold is still considered the top currency globally. But at this time, silver is an attractive valuable investment opportunity. For me, gold has always held a long-term position in the portfolio. Silver is added flexibly, based on valuation factors, he said.

Although many investors focus on industrial consumption demand accounting for 60% of the silver market and continuing to create a large deficit, Mr. McIntyre emphasized the role of silver as a tangible asset.

He pointed out that rising US government debt is creating sovereignty risks across the global economy. These risks are attracting growing attention as investors avoid government bonds and seek alternative monetary assets.

Governments are still maintaining huge GDP deficits, and people are starting to realize that those numbers are unbalanceable. The current financial situation is really worrying.

When that happens, there will be more capital withdrawn from stocks to move to intangible assets. When gold prices are above $3,000/ounce, investors will start looking for value in silver. I predict that gold prices will continue to increase and pull silver up, regardless of whether industrial demand is affected by economic activity," he said.

Mr. McIntyre's warning was issued in the context of the US government debt exceeding 37,000 billion USD. Meanwhile, the US Senate has just passed a new budget bill, which, according to the US Congressional Budget Office, could increase the deficit by $3,000 billion in the next 10 years.

The bill is currently being transferred to the House of Representatives for consideration.

Mr. McIntyre believes that gold prices may fluctuate around $3,300/ounce in the summer as investors adjust their expectations for the new price level. However, he also warned that increasing public debt is still a big risk for the stock market.

People say gold is overpriced and the market is too crowded with participants. But I don't see it as crowded as the S&P 500. There are still many investors who can participate in the precious metals market compared to stocks and some of them will be attracted by the value opportunity in silver - he shared.