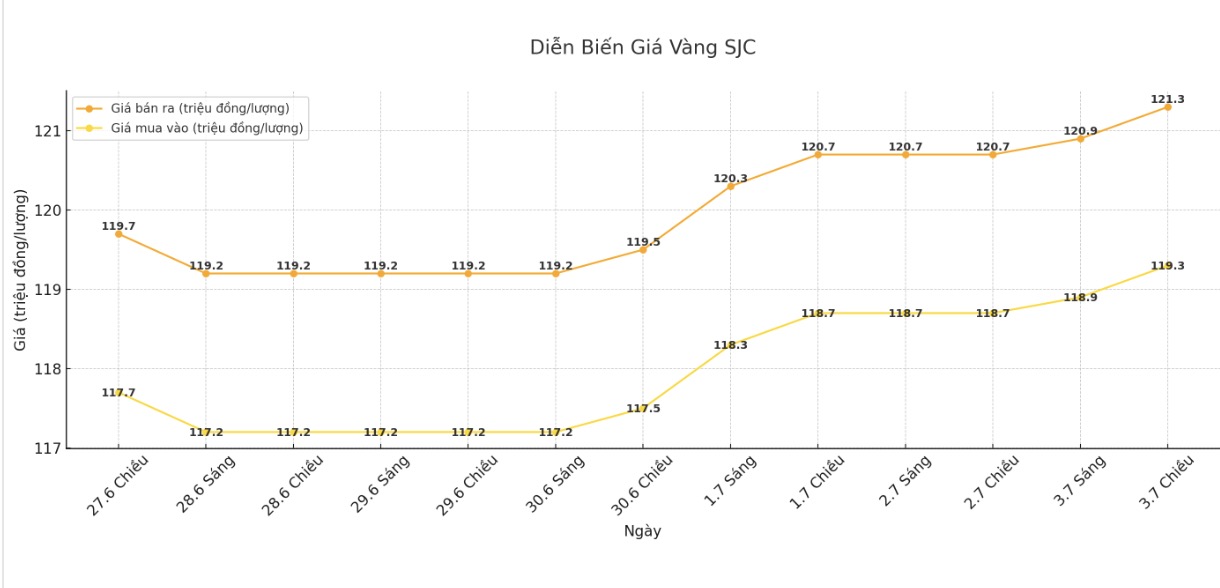

SJC gold bar price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out); increased by VND 600,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.3-121.3 million VND/tael (buy - sell); increased by 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell); increased by 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.6-121.3 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

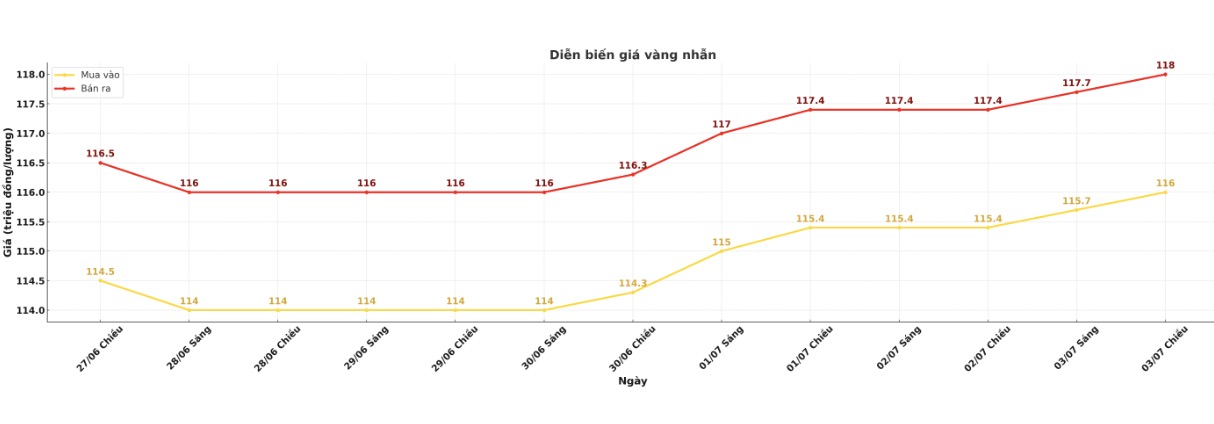

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 116-118 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

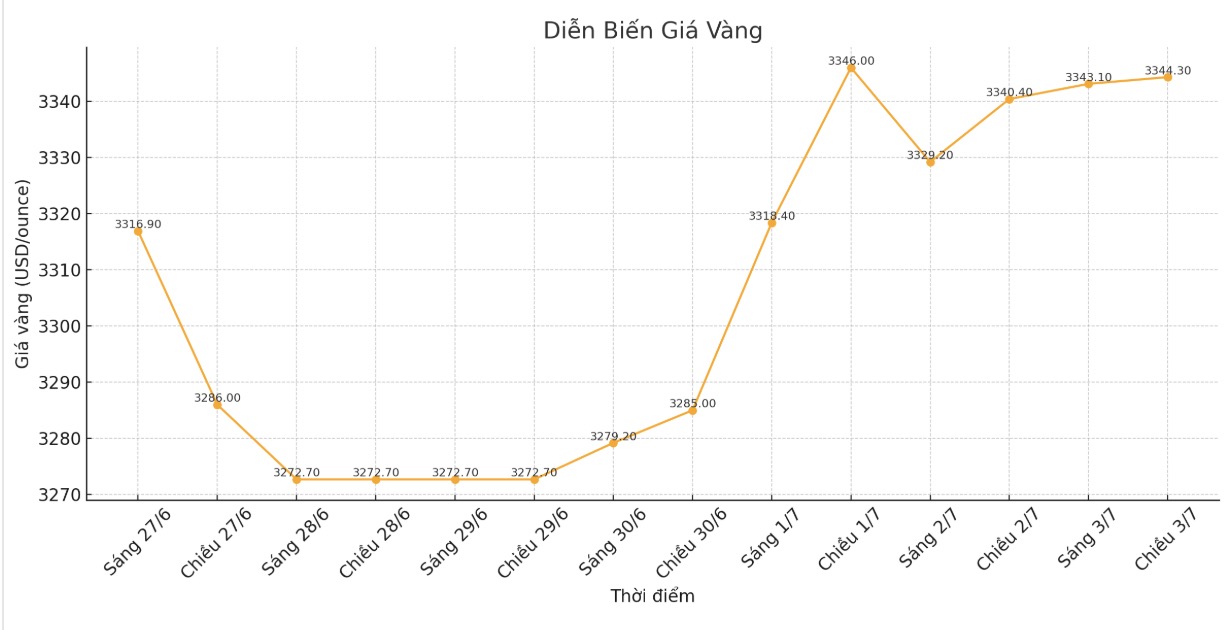

World gold price

The world gold price was listed at 5:30 p.m. at 3,344.3 USD/ounce, up 3.9 USD.

Gold price forecast

Gold prices are in a tug-of-war as investors await US employment data due later in the day to bet on the policy direction of the US Federal Reserve (FED).

Kelvin Wong - senior market analyst at OANDA - said: "Currently, gold prices seem to be consolidating in the range of 3,320 to 3,360 USD/ounce, with the market sentiment tending to wait instead of opening up large positions ahead of US non-farm payrolls and ISM service PMI data".

Data just released by ADP shows that US private employment decreased by 33,000 in June, marking the first decline in more than two years, as economic uncertainty hampered recruitment, but the low number of layoffs still contributed to maintaining the stability of the labor market.

The non-farm payrolls report due out on Thursday is expected to show the US economy added 110,000 jobs in June, down from 139,000 in May.

Wong commented: I think the main concern right now is the progress of US tax agreements with major economies that are still unfinished.

US and Indian negotiators are working to complete a tax cut before Trump's deadline of July 9.

Gold - an un interest-bearing asset - often has positive developments in the context of economic instability and a low interest rate environment.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...