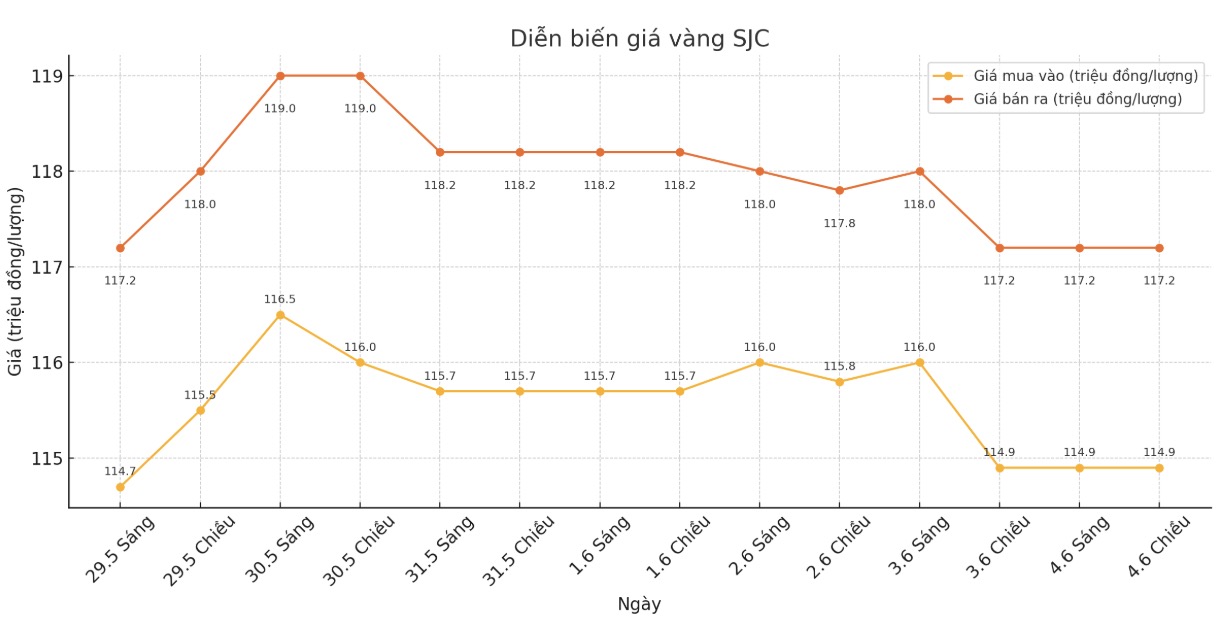

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 114.9-117.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars listed by DOJI Group was at VND 114.9-117.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.9-117.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.4-117.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.8 million VND/tael.

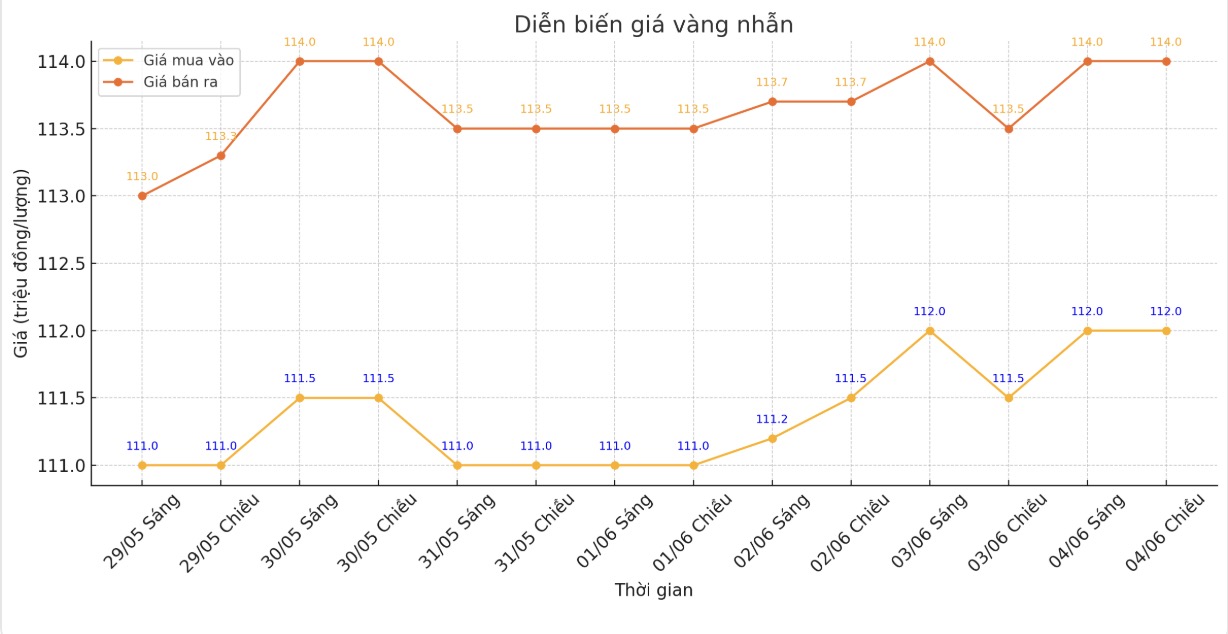

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND112-114 million/tael (buy in - sell out), an increase of VND500,000/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.2-116.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.2-124.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

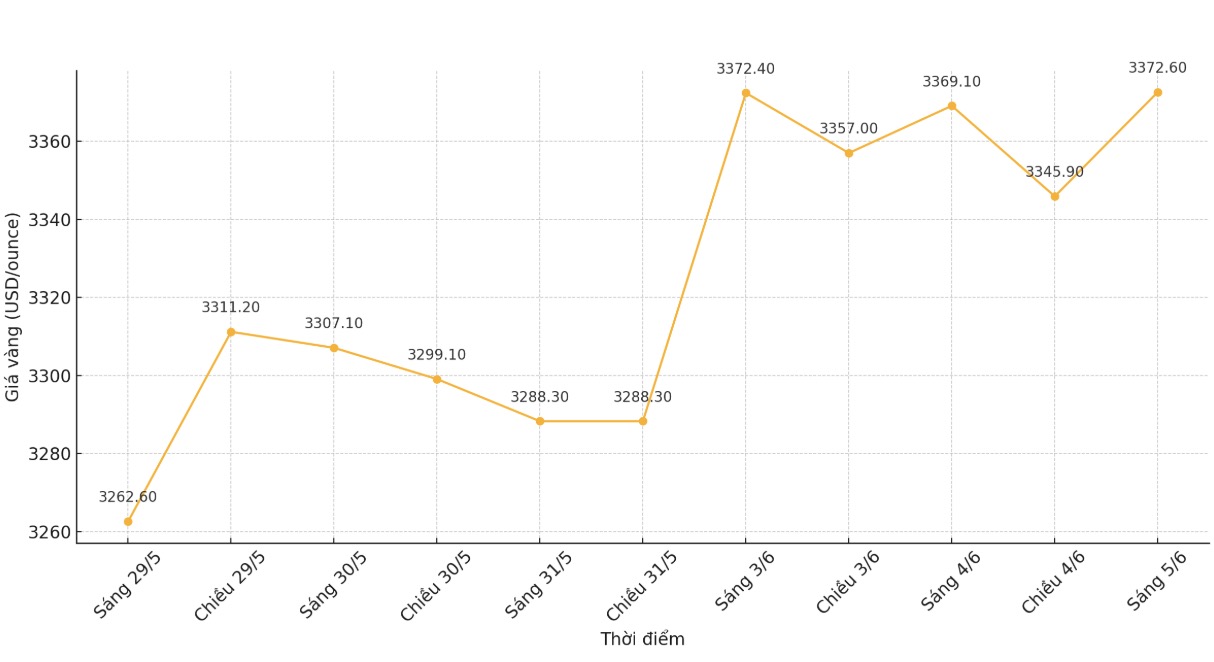

World gold price

At 6:00 a.m., the world gold price was listed at 3,372.6 USD/ounce, up 14.8 USD.

Gold price forecast

Gold prices increased after a number of US weak economic data were released, causing the USD index to decrease and US Treasury bond yields to decrease.

Risk-off sentiment in the market is generally still weak, which continues to promote purchases of safe-haven assets such as gold and silver.

August gold contract increased by 25.4 USD to 3,402.5 USD/ounce. July delivery silver price increased slightly by 0.022 USD to 34.66 USD/ounce.

The ADP National Employment Report for May released this morning showed a weak increase of 37,000 jobs, much lower than the forecast of 110,000. The Institute for Supply Management (ISM)'s service sector PMI index released in the mid-morning was also weaker than expected. US President Donald Trump posted on social media: ADP data is available! Powell now has to lower rates, but it is too late. Gold investors are expecting US interest rates to be cut.

US stock indexes increased slightly near noon. However, market sentiment is still reserved as the US-China trade war has not shown any signs of cooling down.

Donald Trump said on Wednesday that Chinese President Xi Jinping was tough and extremely unlikely to reach a deal, just days after he accused China of violating its pledge to lift tariffs and limit trade.

Technical analysis shows that buyers in the August gold market are holding a clear advantage in the short term. The next target for buyers is to close above $3,450/ounce. Meanwhile, the sellers are aiming to push the price below 3,200 USD/ounce.

The first resistance level was 3,417.8 USD/ounce, then 3,450 USD/ounce. The first support level was at the bottom of the night at $3,366.9, followed by $3,350/ounce.

In outside markets, the USD index is falling. Nymex crude oil futures fell slightly and traded around $63.25/barrel. The yield on the 10-year US Treasury note is currently at 4.389%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...