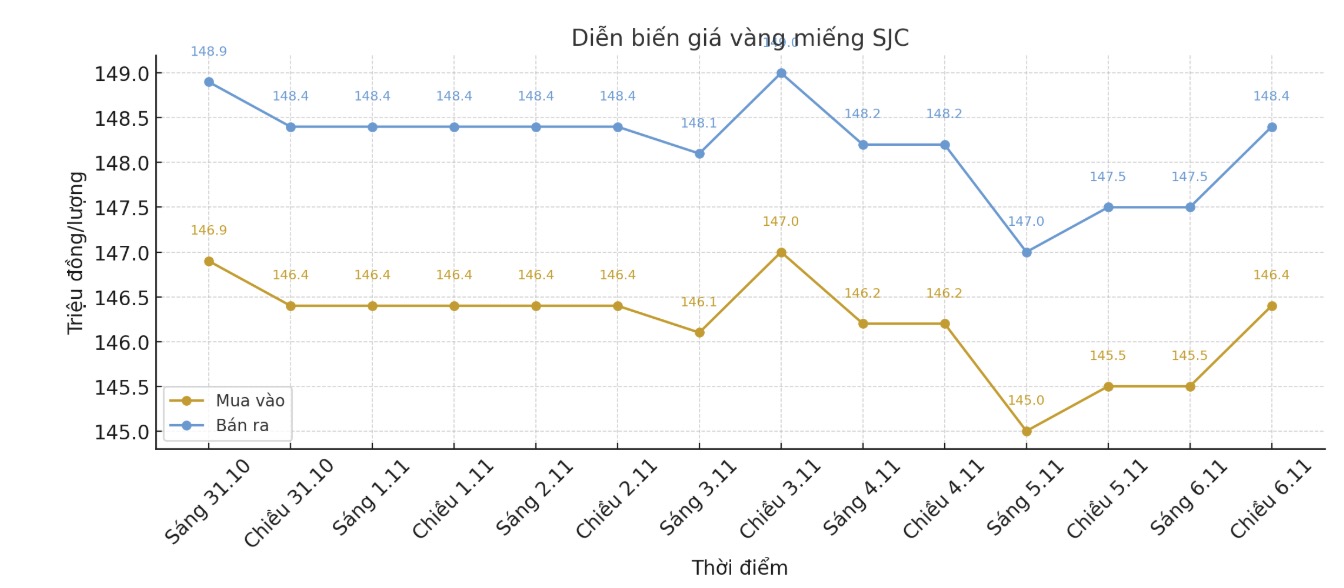

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

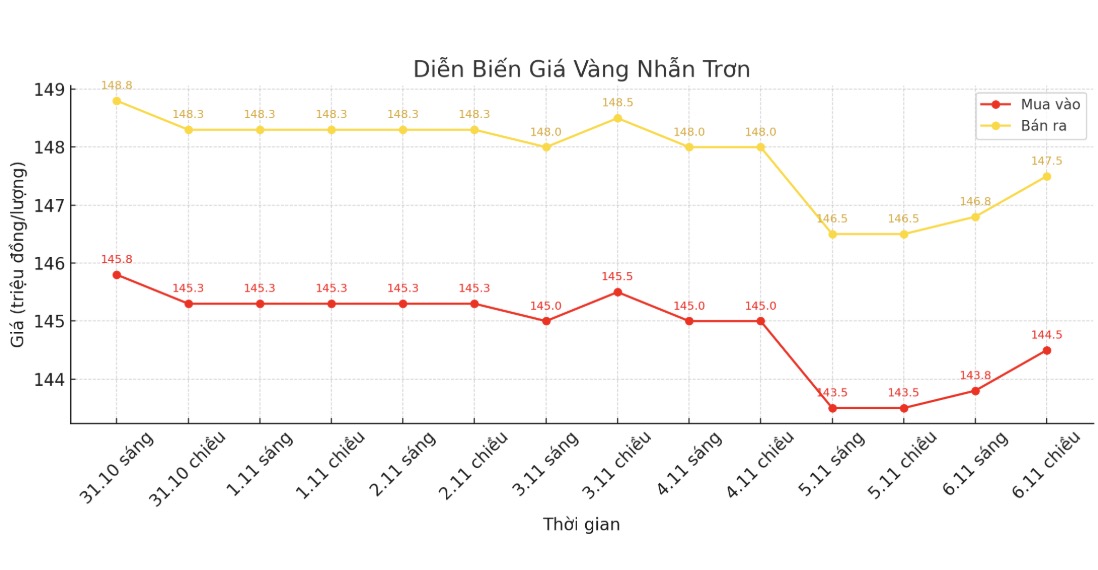

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 144.5-147.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

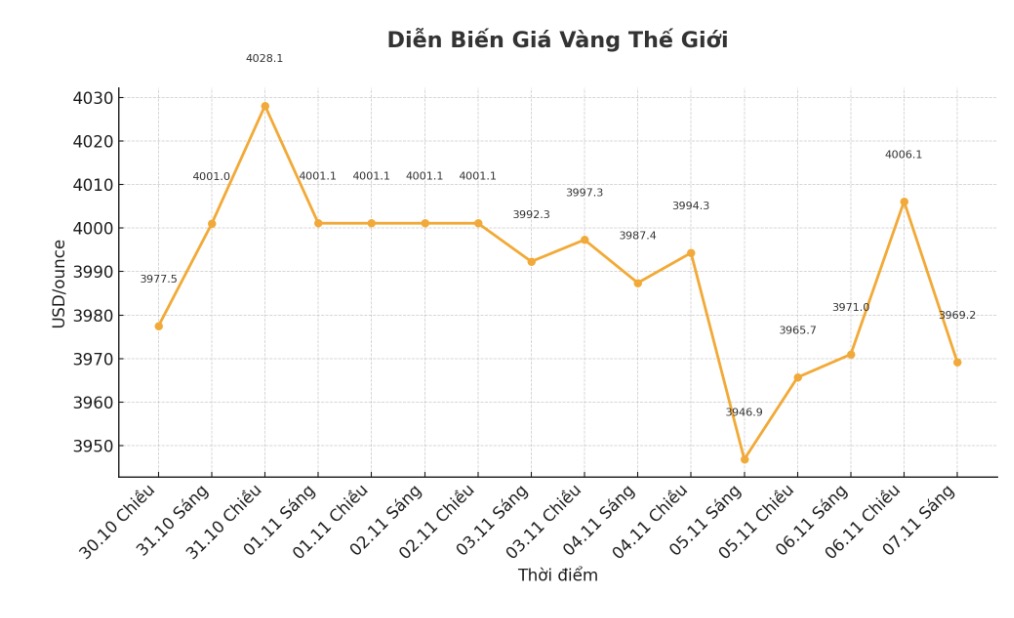

World gold price

The world gold price was listed at 0:30 at 3,969.2 USD/ounce, down 10.7 USD.

Gold price forecast

World gold prices have lost their previous upward momentum due to strong selling pressure on most of today's futures commodity markets. The strong sell-off in the US stock market has not helped these two safe-haven metals at least for now.

The declining USD and falling US Treasury yields have not supported the market.

December gold futures fell $6.1 to $3,986.30 an ounce. December silver futures also fell $0.382 to $47.635 an ounce.

Technically, the next upside target for bulls is to close above a solid resistance level at $4,100/ounce. On the contrary, the bear's downside target is to push prices below the important technical support level of $3,800/ounce.

The first resistance level seen at today's peak was 4,028.7 USD/ounce, then 4,059.9 USD/ounce. The first support level was at the bottom of the session at $3,973.2/ounce, then reached the low of this week at $3,935.7/ounce.

In outside markets, the USD index is currently lower. Crude oil prices also weakened, trading around 5:99.25 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.2%.

The world gold market operates mainly through two valuation mechanisms. The first is the spot market, which is the place to quot prices for immediate buying - selling and delivery transactions. Second is the futures market (futures), which sets prices for future deliveries. Due to declining market liquidity at the end of the year, December gold futures are currently the most actively traded on the CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...