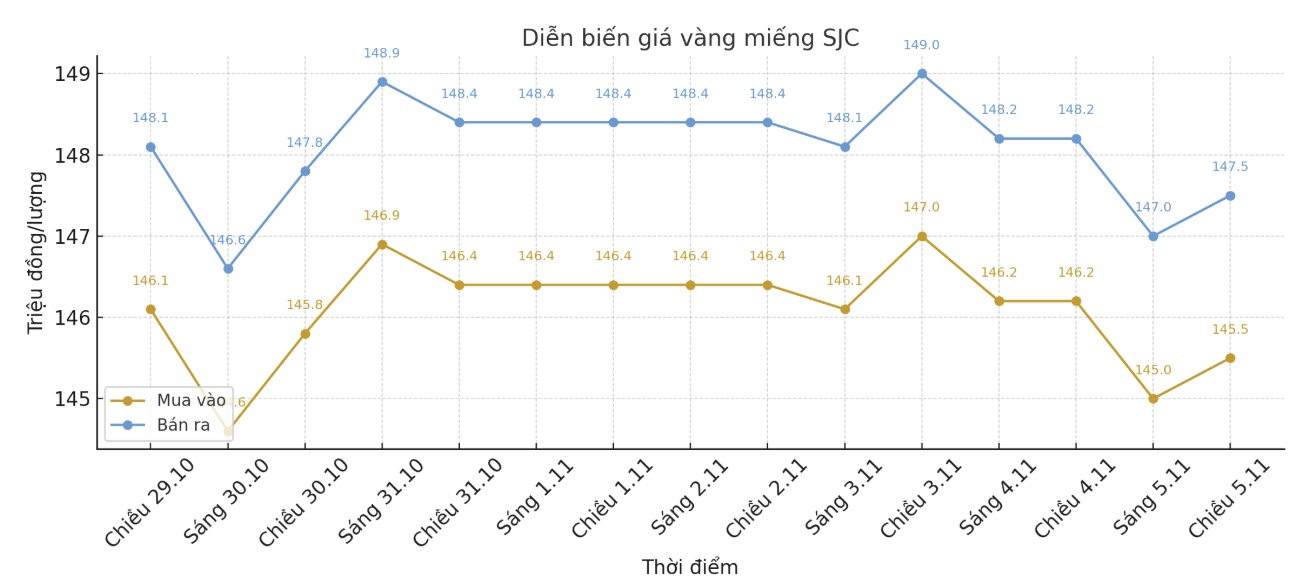

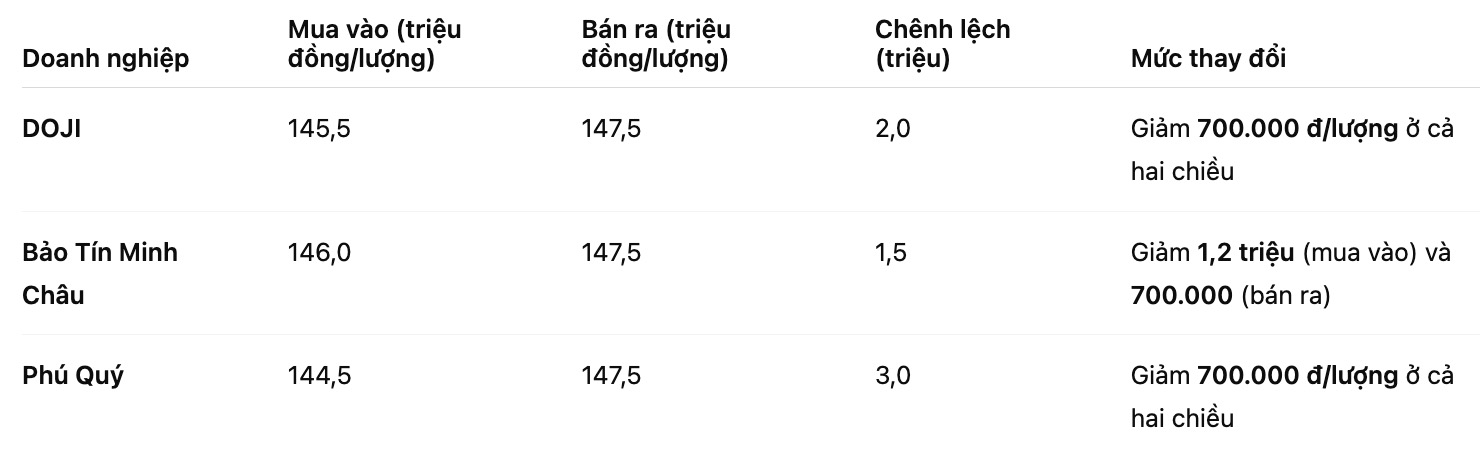

SJC gold bar price

As of 5:45 p.m., DOJI Group listed the price of SJC gold bars at VND145.5-147.5 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146-147.5 million VND/tael (buy - sell), down 1.2 million VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND144.5-147.5 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

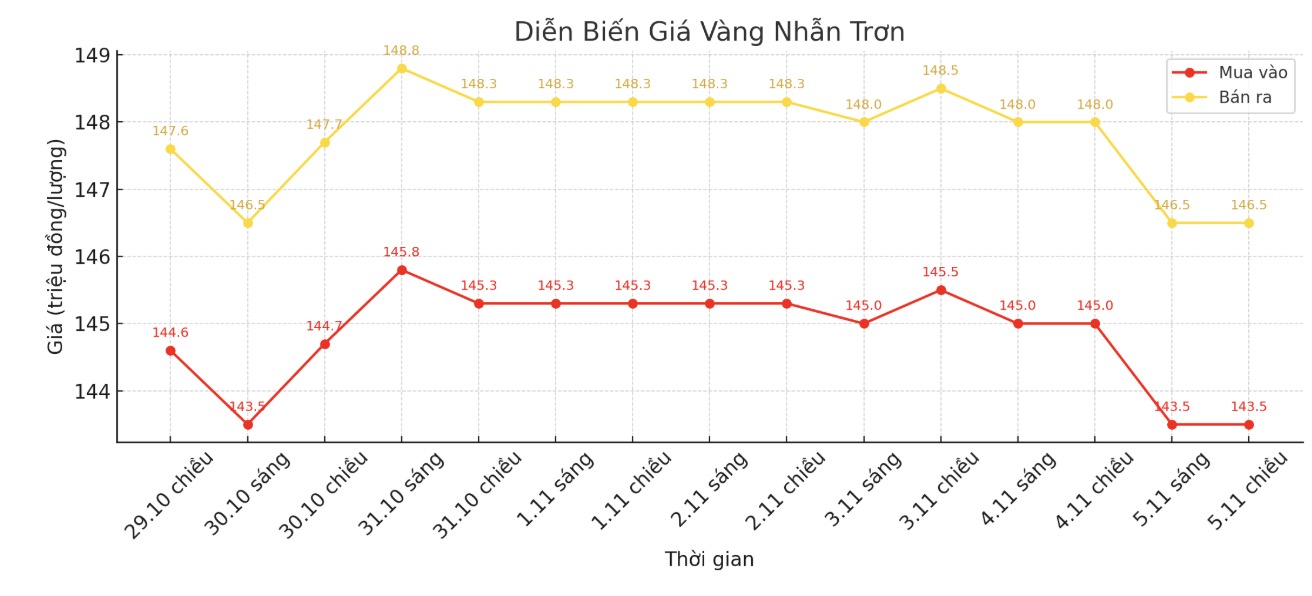

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 143.5-146.5 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 144.8-147.8 million VND/tael (buy - sell), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 144.5-147.5 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

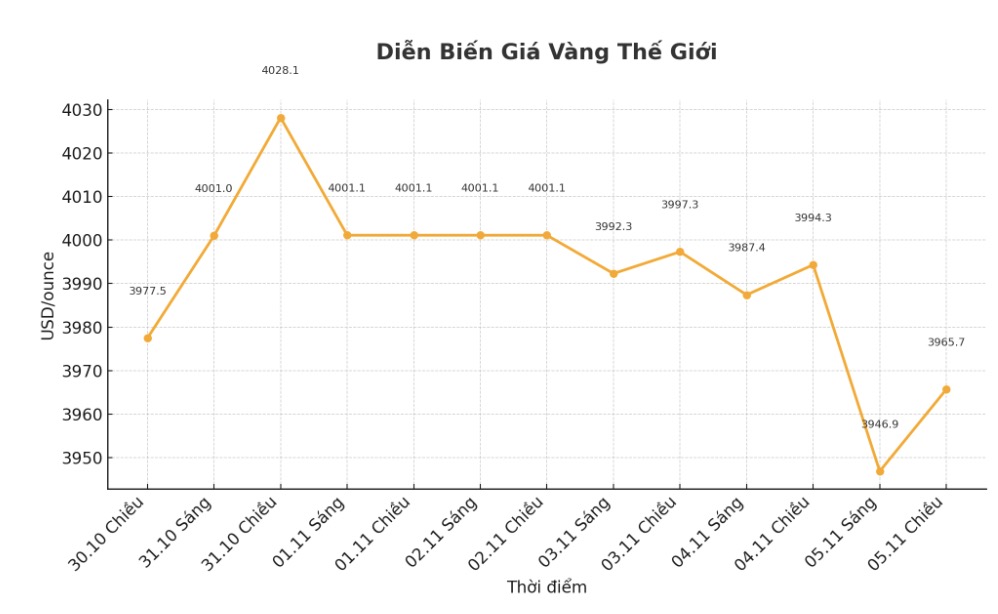

World gold price

The world gold price was listed at 5:45 p.m., at 3,965.7 USD/ounce, down 2.4 USD compared to a day ago.

Gold price forecast

World gold has not been able to recover the threshold of 4,000 USD/ounce despite a sharp decrease in global stocks. This comes as a wave of technology stock sell-offs from Tokyo to Frankfurt spread, pushing the volatility to its highest level since April and causing safe-haven assets such as gold and government bonds to increase in price.

The Asian market suffered the most losses overnight: Japan's Nikkei index fell nearly 7% compared to the record level on Tuesday, while Korean stocks fell to 6.2% before recovering slightly, closing the session down 2.9%.

In Europe, technology stocks were the group that fell the most in the STOXX 600 index, causing this index to lose 0.3%. Germany's DAX fell 0.7%, while the Netherlands' AEX - where Nvidia's supplier is ASML - also fell 0.3%. In the US, the S&P 500 e-mini futures fell another 0.1%, following a 1.2% loss of the main index last night.

After a series of hot increases, gold prices entered the cooling phase. Experts say this is just a temporary break before entering the growth cycle in early 2026.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that in the past two weeks, "market sentiment has shifted from excitement to caution, as investors reassess the level to which the 2025 stories - interest rate cuts, fiscal pressures, geopolitical risks and central banks' demand for gold - have been reflected in prices".

He noted that the festive season in India often boosts demand for gold jewelry. The market has now entered a stagnant period after the holiday something that is common every year and will likely stabilize again when year-end demand appears, supported by the recent price adjustment Hansen commented.

He also highlighted a notable development in China: the government has ended a long-standing VAT exemption policy for jewelry retailers who buy gold through the Shanghai Gold Exchange and the Shanghai Commodity Exchange.

According to Hansen, this change will cause retail prices to increase slightly and may reduce jewelry sales, but the macro-economic impact is limited. Investment gold in the form of bars, coins and ETFs is still completely exempt from taxes, ensuring that major channels that drive Chinas record physical demand are not affected, he wrote.

Schedule of releasing important economic data for the week

Wednesday: ADP Employment Report, ISM survey for the service sector.

Thursday: Bank of England (BoE) monetary policy meeting.

Friday: Preliminary survey of consumer confidence - University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...