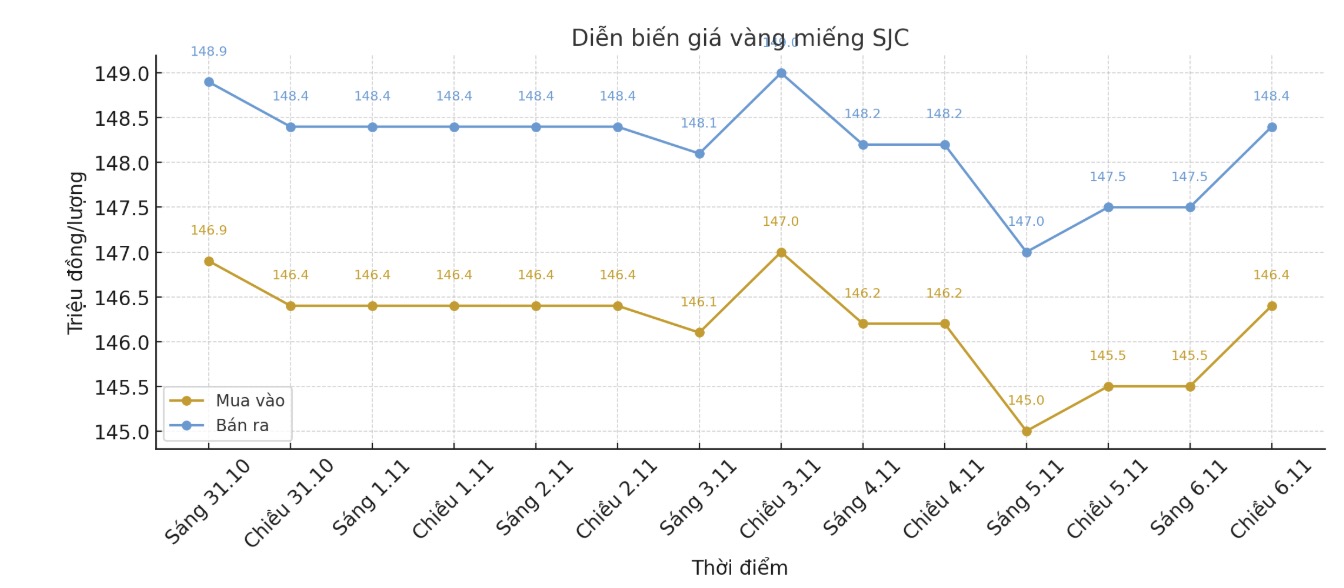

SJC gold bar price

As of 7:50 p.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

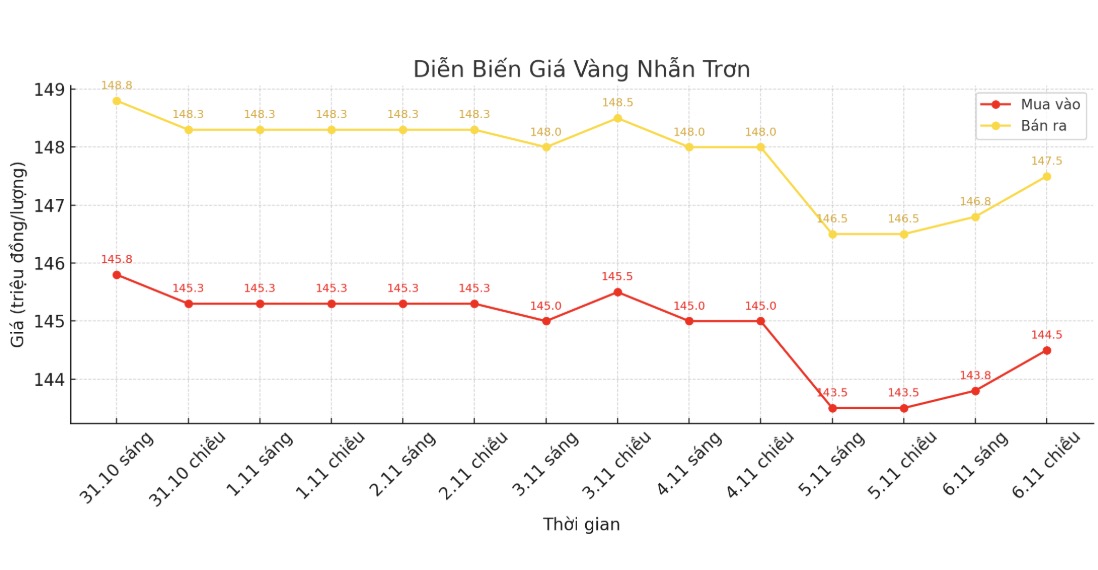

9999 gold ring price

As of 7:50 p.m., DOJI Group listed the price of gold rings at 144.5-147.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

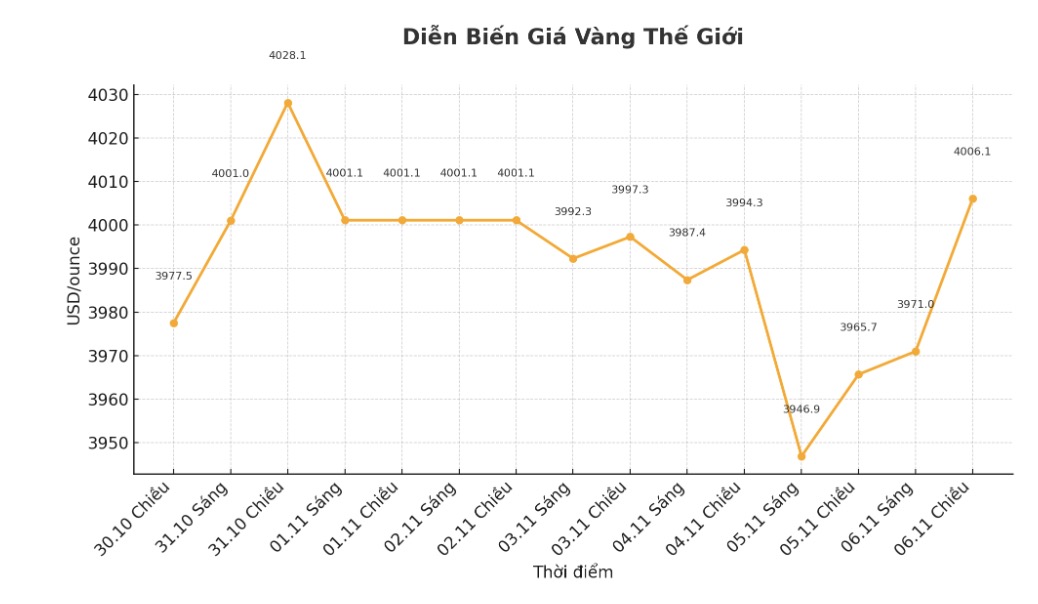

World gold price

The world gold price was listed at 5:45 p.m., at 4,006.1 USD/ounce, up 40.4 USD compared to a day ago.

Gold price forecast

Gold and silver prices rose despite a stronger-than-expected ADP private-use jobs report the most comprehensive jobs report in the context of a government shutdown. This partly reassures buyers, who were surprised by the precious metal's decline along with yesterday's risky assets," said independent metals trader Tai Wong.

The ADP report showed the US private sector added 42,000 jobs last month, exceeding Reuters' forecast of 28,000. A strong job market often makes it possible to cut interest rates lower and can keep interest rates higher for longer.

US stocks fell from record highs on Wednesday due to concerns that the market had increased too much.

A part of safe-haven demand returned in midweek as the global stock market was still rocky, amid concerns that US stocks were overvalued and were forming an AI bubble, wrote senior analyst Jim Wyckoff of Kitco Metals.

Last week, the US Federal Reserve cut interest rates, and Chairman Jerome Powell said this could be the last cut this year.

Traders now rate the probability of another interest rate cut in December at 63%, down from more than 90% last week.

Gold - a non-yielding asset - often benefits in a low interest rate environment and when the economy is unstable.

In another notable development, Perth mint's gold sales (one of the world's most prestigious gold and silver foundries, headquartered in Perth, Western Australia - Western Australia) hit a three-year high in October, while silver sales surged 83% compared to the previous month - the highest in the past two years.

Accordingly, sales of gold products, including coins and gold bars, reached 85,603 ounces in October, up sharply from 36,595 ounces in September - equivalent to an increase of 186% over the same period last year. Meanwhile, silver sales rose 83% month-on-month to 1.061 million ounces, the highest level since September 2023.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...