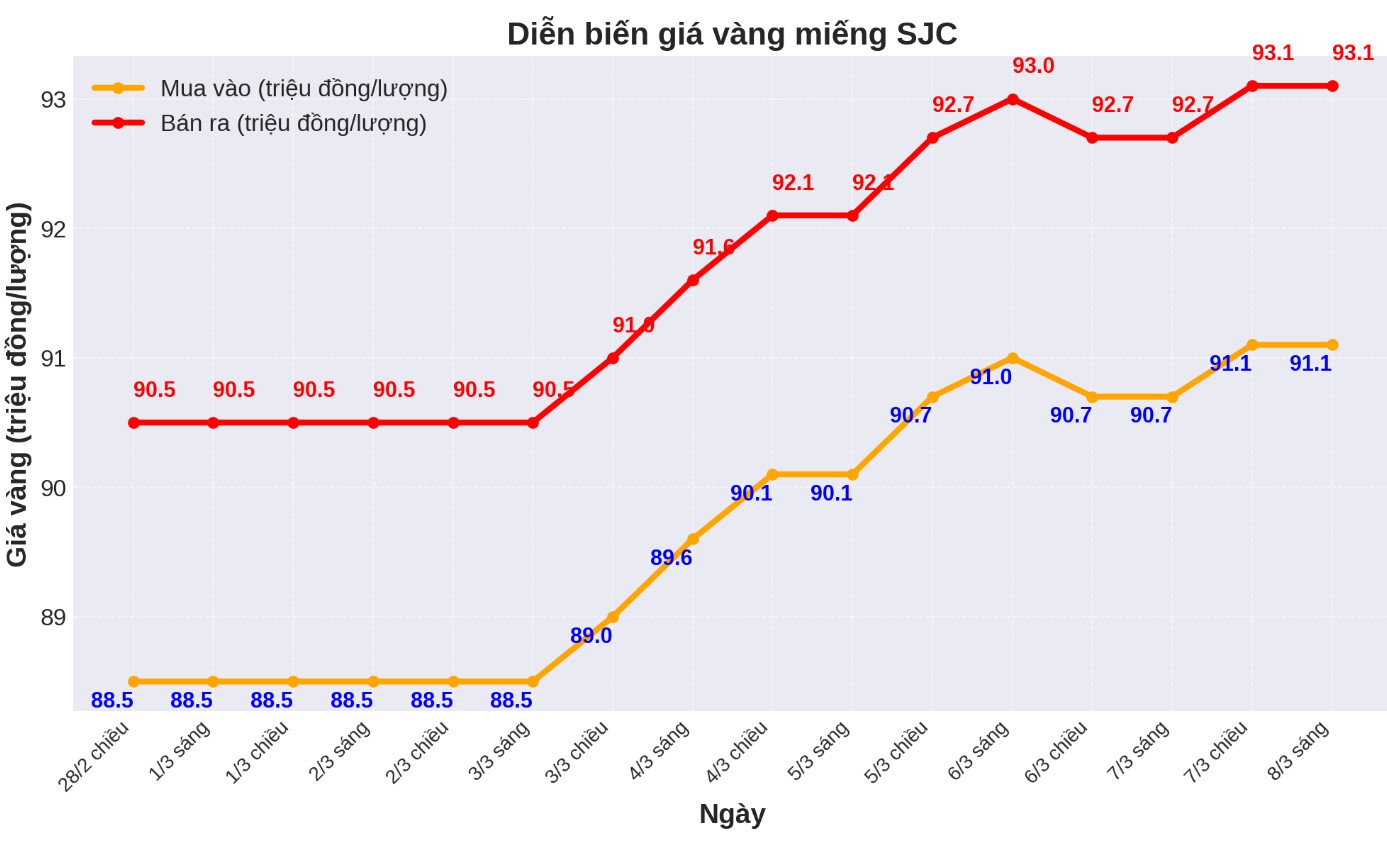

Updated SJC gold price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND91.1-93.1 million/tael (buy - sell), an increase of VND400,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND91.1-93.1 million/tael (buy - sell), an increase of VND400,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND91.1-93.1 million/tael (buy - sell), an increase of VND400,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2 million VND/tael.

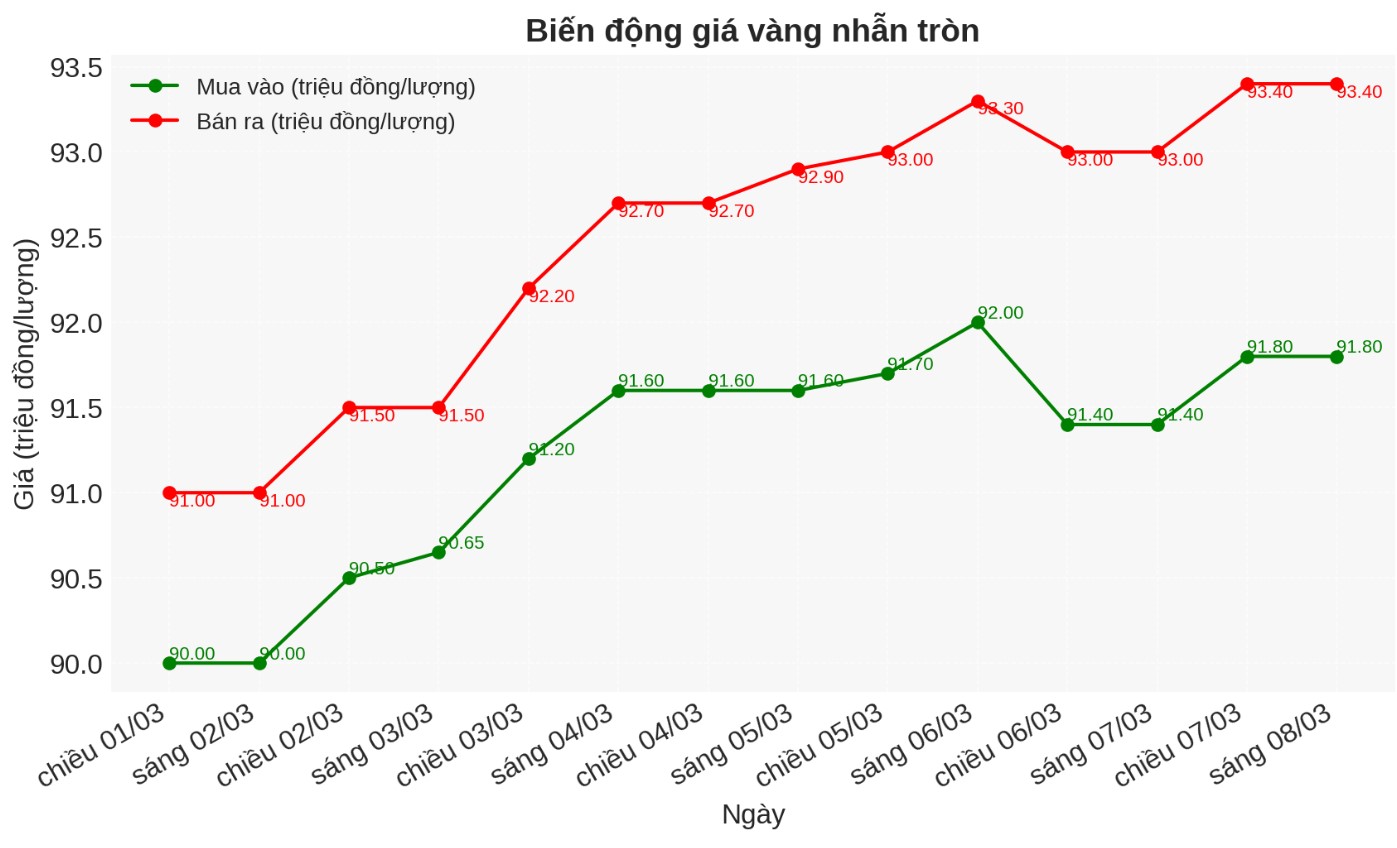

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 991.8-93.4 million/tael (buy - sell); increased by VND 400,000/tael for buying and kept unchanged for selling. The difference between buying and selling is listed at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92-93.5 million VND/tael (buy - sell); increased by 400,000 VND/tael for both buying and selling. The difference between buying and selling is 1.5 million VND/tael.

In recent trading sessions, plain gold rings have often fluctuated in the same direction as the world. In the context of the world market recording a strong increase, the domestic gold ring price this morning may increase.

World gold price

As of 2:22 a.m. on March 8, the world gold price listed on Kitco was at 2,908.1 USD/ounce, down 3 USD/ounce.

Gold price forecast

World gold prices fell but remained above $2,900/ounce as the USD fell. Recorded at 2:22 a.m. on March 8, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.840 points (down 0.18%).

Gold prices were supported when an important US economic report showed weaker-than-expected data. Gold contracts for delivery in April increased by 2.2 USD to 2,929.3 USD/ounce. The price of silver delivered in May decreased by 0.293 USD to 33.045 USD/ounce.

The US Department of Labor's February employment report has just released a showing that non-farm payrolls rose by 151,000, below Dow Jones Newswires' forecast of 170,000. This figure is also compared to the adjusted increase of 125,000 in the January report.

The unemployment rate was 4.1%, higher than the forecast of 4.0% and remained unchanged from the previous month. Gold and silver markets have reacted little to this data, but the USD index continues to decline and US bond yields go down.

Asian and European stock markets mostly fell in the overnight session. US stock indexes are expected to open slightly after falling to their lowest level in many months on Thursday. The Wall Street Journal titled: "Commercial tensions hit US stocks".

In overnight news, Japanese government bond yields rose to their highest level since the 2008 financial crisis, fuelling speculation that the Bank of Japan could continue to raise interest rates. Meanwhile, German bond yields also increased after the country announced a new borrowing and spending plan.

According to a report from SP Angel, the People's Bank of China is holding the yuan exchange rate stable despite fluctuations in the trade war, while the weakening of the USD helps increase China's purchasing power in the international market. The yuan has risen to its highest level since November after the Chinese government reaffirmed its 5% GDP growth target.

Federal Reserve Chairman Jerome Powell will speak this afternoon at a currency conference in New York.

The April gold contract still holds a strong technical advantage in the short term. The next upside target for buyers is to close above the resistance level of 2,974.00 USD/ounce.

On the contrary, the sellers need to push prices below the important technical support level at the bottom of the previous week at 2,844.1 USD/ounce. The first resistance level was at the peak of this week's 2,941.3 USD, followed by 2,950.00 USD. The first support level was $2,900.00, followed by Tuesday's low of $2,892.5.

Outside markets, Nymex crude oil prices have increased to about 67.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.232%.

See more news related to gold prices HERE...