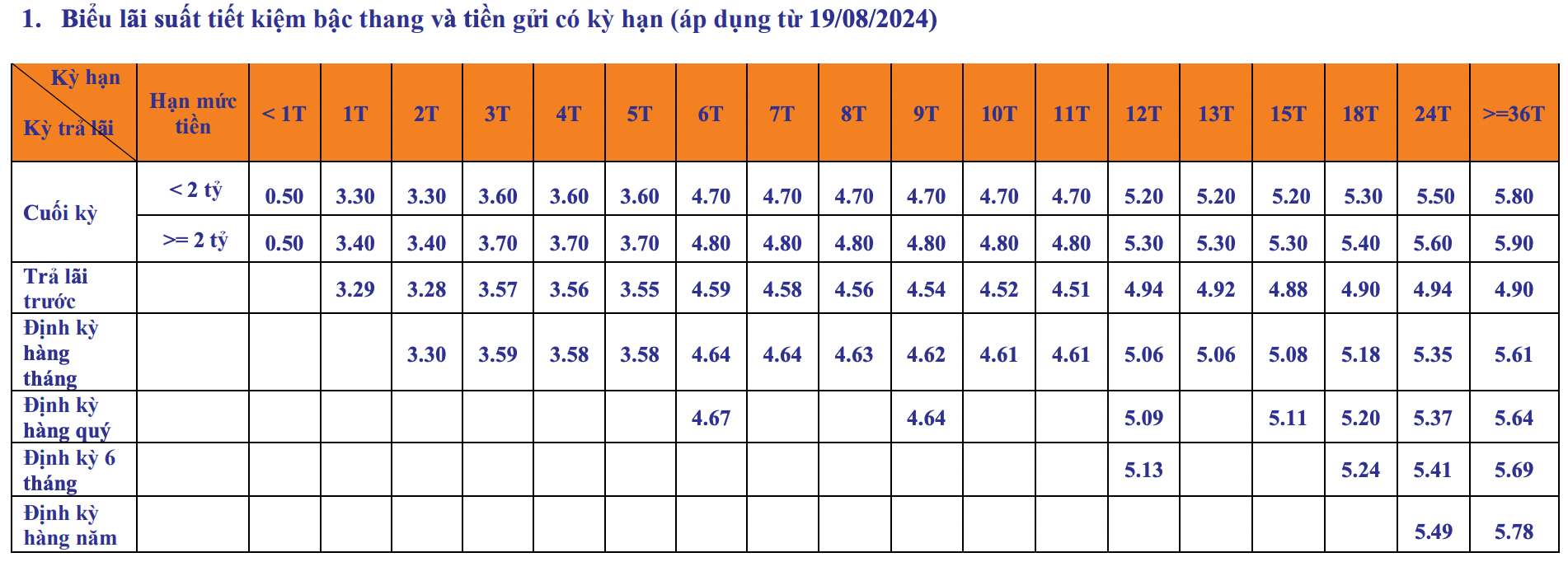

For savings deposits at the counter, interest is received at the end of the term, SHB lists the interest rate for 1-month and 2-month terms at 3.3%/year. For 3-5 month terms, the interest rate is 3.6%/year. For 6-11 month terms, customers enjoy a deposit interest rate of 4.7%/year.

For a term of 12 - 15 months, SHB is listing the mobilization interest rate at 5.2%/year. The term of 18 months is 5.3%/year; the term of 24 months is 5.5%/year and the term of 36 months or more is 5.8%/year. Of which, 5.8%/year is the highest mobilization interest rate when making regular savings deposits at the counter.

Notably, for savings deposits of VND2 billion or more, an interest rate 0.1 percentage point higher than the limit of less than VND2 billion will be applied, equivalent to 3.4 - 5.9%/year.

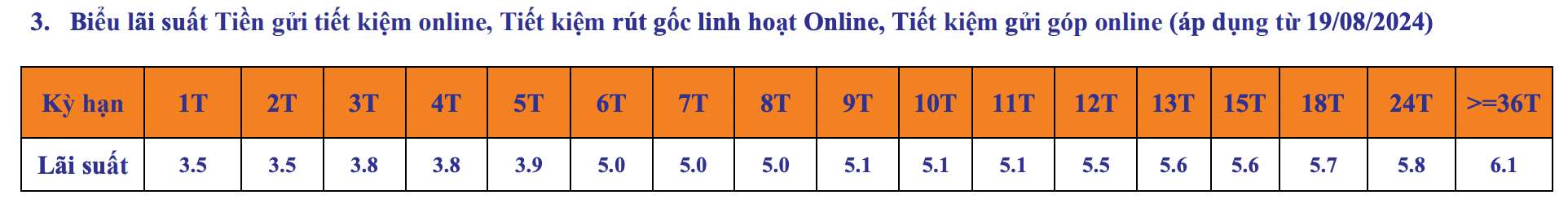

At the end of August, SHB's online deposit interest rates ranged from 3.5 - 6.1%/year. The 1-month and 2-month terms had a mobilization interest rate of 3.5%/year. The 3-month to 5-month terms had a mobilization interest rate of 3.8 - 3.9%/year.

For a term of 6 - 8 months, the interest rate is 5%/year. For a term of 9 - 11 months, the interest rate is 5.1%/year.

For a 12-month term, the current interest rate is 5.5%; for a 13-month and 15-month term, the same interest rate is 5.6%/year; for an 18-month term, it is 5.7%/year and for a 24-month term, it is 5.8%/year, with no new adjustments.

Notably, SHB offers the highest savings interest rate in the form of online savings of 6.1%/year for customers depositing money for a term of 36 months or more.

How much interest do I receive if I save at SHB for 24 months?

You can refer to the interest calculation method to know how much interest you will receive after saving. The interest calculation formula is as follows:

Interest = Deposit x deposit interest rate %/12 x number of months of deposit.

For example, you deposit 200 million VND into SHB Bank, term 24 months and enjoy interest rate 5.8%/year, the interest received is as follows:

200 million VND x 5.8%/12 months x 24 months = 23.2 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.