The difference is anchored

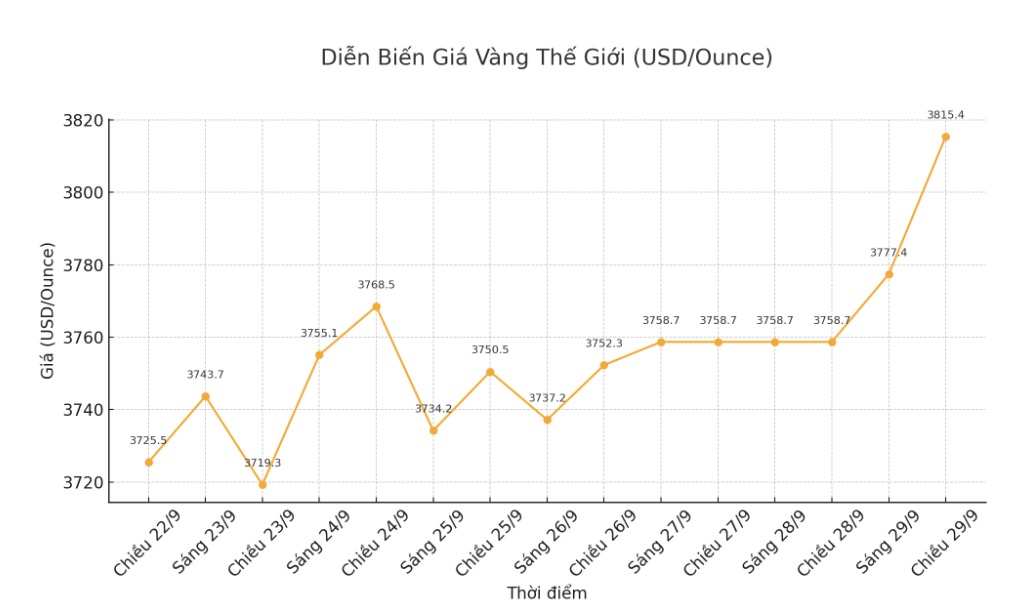

Recorded on September 29, the difference between the domestic price of SJC gold bars sold (about VND 136.5 million/tael) and the world gold price of 3,815.4 USD/ounce (when converted to Vietcombank's selling price of VND 26,451 VND/USD), currently about VND 14.8 million/tael.

The difference is still quite high, but significantly lower than the 19 - 20 million VND/tael in early September.

The first move to help prevent the widespread expansion of gold price differences is the surprise inspections and checks of the gold market. The State Bank of Vietnam (SBV) has coordinated with the Ministry of Public Security, the Government Inspectorate and local authorities to inspect many gold trading enterprises, focusing on complying with regulations on invoices, documents, preventing money laundering and hoarding, speculation, and price manipulation.

This is considered an important measure to increase transparency, limiting the situation of price hike, causing the gap between domestic and world markets to widen.

In parallel with inspection work, the Government issued Decree No. 232/2025/ND-CP dated August 26, 2025, amending and supplementing a number of articles of Decree 24/2012/ND-CP on management of gold trading activities.

This Decree abolishes the State's monopoly on the production of gold bars and the monopoly on importing raw gold to produce gold bars, paving the way for businesses and commercial banks that are eligible to participate in the production and import of gold bars. The Decree takes effect from October 10, 2025.

According to the new regulations, enterprises that want to produce gold bars must have a charter capital of VND1,000 billion or more, while commercial banks need a minimum charter capital of VND50,000 billion. Licensed organizations must connect and provide transaction data to the State Bank, publicize product quality and standards, and all gold transactions worth VND20 million or more in a day must be conducted through bank accounts. These regulations both create conditions for many economic sectors to participate in the market and ensure close supervision, thereby contributing to narrowing the gap between domestic and world gold prices.

Breaking monopoly, setting up gold exchange to pull domestic prices close to the world

Speaking with Lao Dong reporter, Professor Tran Tho Dat - Chairman of the Science and Training Council, National Economics University, said that the large difference in domestic and world gold prices in recent times can be explained by both management mechanism and market factors.

"First of all, the monopoly mechanism for producing SJC gold bars has created a situation of "one market", causing domestic gold prices to not be able to keep up with international developments.

Secondly, the domestic gold supply is limited due to the import of raw gold under strict management of the State Bank, while the demand for gold storage and investment of people is still high, especially during the period of many economic fluctuations.

Third, the lack of connection with the international market makes gold in Vietnam not respond in a rhythmic manner to global fluctuations, leading to a situation where domestic prices increase rapidly but decrease more slowly than the world" - Professor Tran Tho Dat said.

The Chairman of the Science and Training Council, National Economics University, said that to narrow this gap, some synchronous solutions are needed. "In addition to switching from a monopoly mechanism to a licensing mechanism, allowing many businesses to qualify to participate in the production and trading of gold bars, thereby increasing supply and reducing monopoly pressure on prices; it is necessary to gradually liberate the import of raw gold for jewelry gold manufacturing businesses and licensed units, to ensure enough supply in the market, limiting the virtual shortage.

In addition, it is advisable to establish a centralized gold exchange linked to the world market to form a transparent price level, reducing opportunities for manipulation and speculation.

In addition, it is necessary to develop alternative investment tools such as gold certificates, gold ETFs or futures contracts to reduce the demand for physical gold, thereby cooling down direct demand pressure.

Finally, enhancing communication and financial education to help people have more safe and legal investment channels other than gold is also an important factor in gradually reducing the gap" - Professor Tran Tho Dat said.