Gold price developments last week

Gold prices have increased sharply this week as the US government's closure has become another reason for investors to withdraw from the USD and seek safe-haven assets, pushing the price of this precious metal closer to the mark of 3,900 USD/ounce.

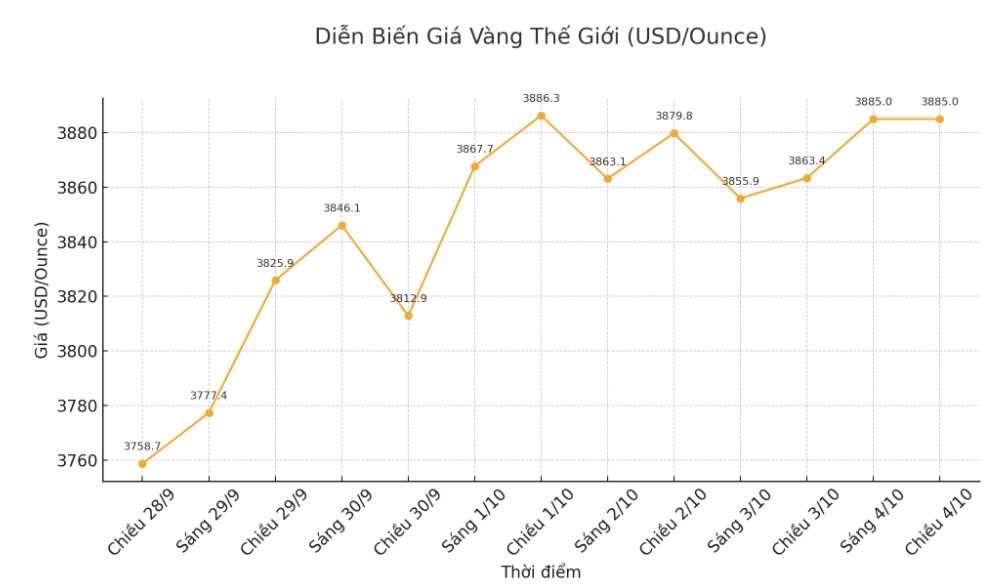

Spot gold prices opened the week at $3,768.19 an ounce and never returned to this level again. After midnight, gold prices surpassed $3,800/ounce, and by the opening session in North America on Monday, spot prices had reached $3,826/ounce.

This price quickly became a solid short-term support level for gold. The precious metal continued to increase in the night-time trading session, reaching a short-term peak of 3,870 USD/ounce at 2:30 am.

After the increase created a double peak, weak buying power caused gold to have a strong sell-off, retreating to check the threshold of 3,800 USD/ounce at 5:00 (Eastern time). However, this support zone remained strong, and by the US session on Tuesday, prices quickly returned to the $3,825/ounce zone.

This time, US investors also took the lead, pushing gold prices up rapidly, reaching $3,854/ounce before 11:00, and up to $3,860/ounce right before closing the trading session.

The Asian session then continued to push gold prices to $3,869 an ounce, before the European market pushed prices to a weekly high of $3,894 an ounce at 5:00 a.m. Eastern time on Wednesday.

Gold then entered a rare accumulation phase, adjusting to $3,856 an ounce and recovering to $3,893 an ounce just before the North American market opened on Thursday morning.

However, this time, US traders were skeptical, causing gold to have the second sharp decline of the week, down to 3,828 USD/ounce at 11:45. However, by the end of the session, gold had recovered half of its decline and kept the support zone around $3,857/ounce.

After a short decline to test the $3,840/ounce mark in the Asia session, gold entered the final rally of the week, reaching $3,866/ounce at 6:45 and reaching $3,887/ounce when the North American market opened.

After a final adjustment of $3,867 an ounce, US traders pushed gold closer to a weekly high of $3,892 an ounce, before ending the week at around $3,880 an ounce.

Gold price forecast for next week

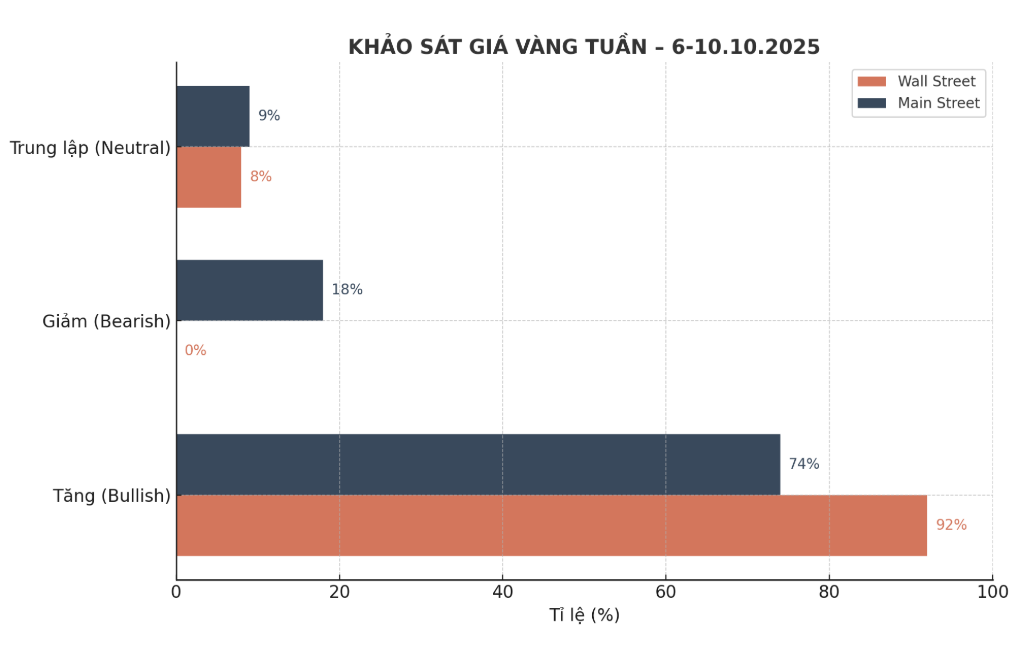

A survey of gold with Wall Street experts shows that optimism is still majority after a week of strong gold trading. Small investors are also gradually catching up with this positive sentiment, with expectations that gold prices will continue to increase next week.

Of the 12 analysts participating in the survey, 11 people (equivalent to 92%) predict gold prices will increase next week. No expert predicts a price drop. The remaining 1 person (8%) believes that gold prices will move sideways.

Meanwhile, the online survey for individual investors attracted 253 participants. As a result, 186 people (74%) expect gold prices to rise next week. 45 people (18%) predict gold will fall and 22 people (9%) see prices moving sideways.

The overwhelming proportion of both experts and individual investors shows growing confidence in the precious metal's rally, especially in the context of macroeconomic factors continuing to support gold as a safe-haven asset.

Economic data to watch next week

Next week, there will be quite a few economic data closed by the US government, the market will pay attention to the statements of the US Federal Reserve (FED) official.

Last week, the market revolved around job indicators some were announced, others were delayed. There will be almost no more economic data from the US government next week, unless there is progress in government reopening negotiations.

The focus will be on the minutes of the Fed's September monetary policy meeting released on Wednesday, helping the market better understand the Fed's view on interest rates and inflation.

By Friday, the market will receive the results of the preliminary survey on US consumer confidence in October conducted by the University of Michigan - an important indicator reflecting people's psychology towards the economy and personal financial situation.

In addition, speeches from a series of Fed officials including Raphael Bostic, Michelle Bowman, Adriana Kugler, Neel Kashkari, Michael Barr and Lorie logan Musalem will be closely watched by investors, in the context of a shortage of official data from the government.

See more news related to gold prices HERE...