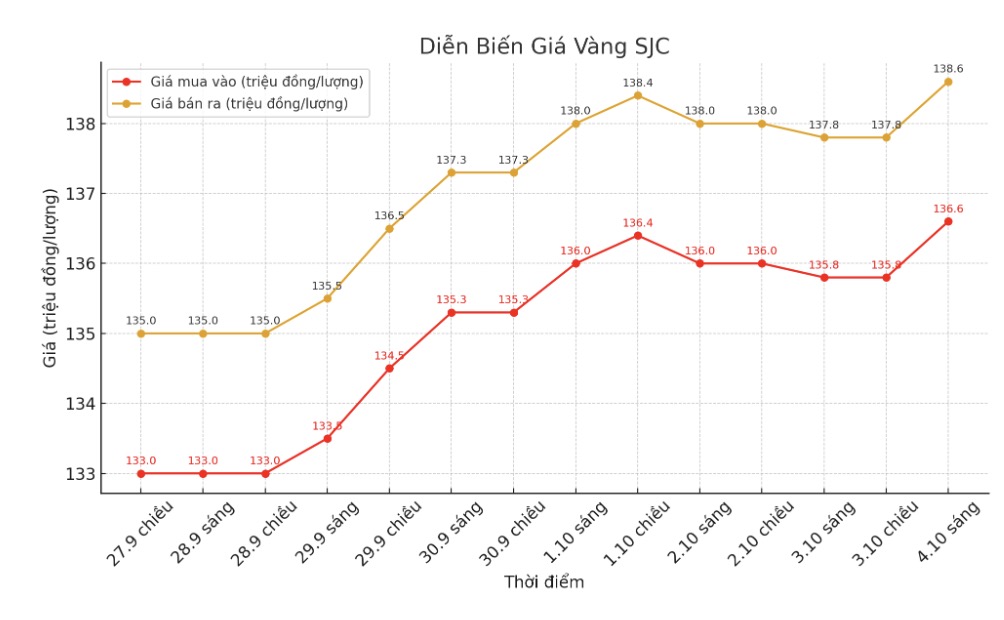

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 136.6-138.6 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 136-138.8 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 132.6-135.6 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 133.6-136.6 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 132.5-135.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

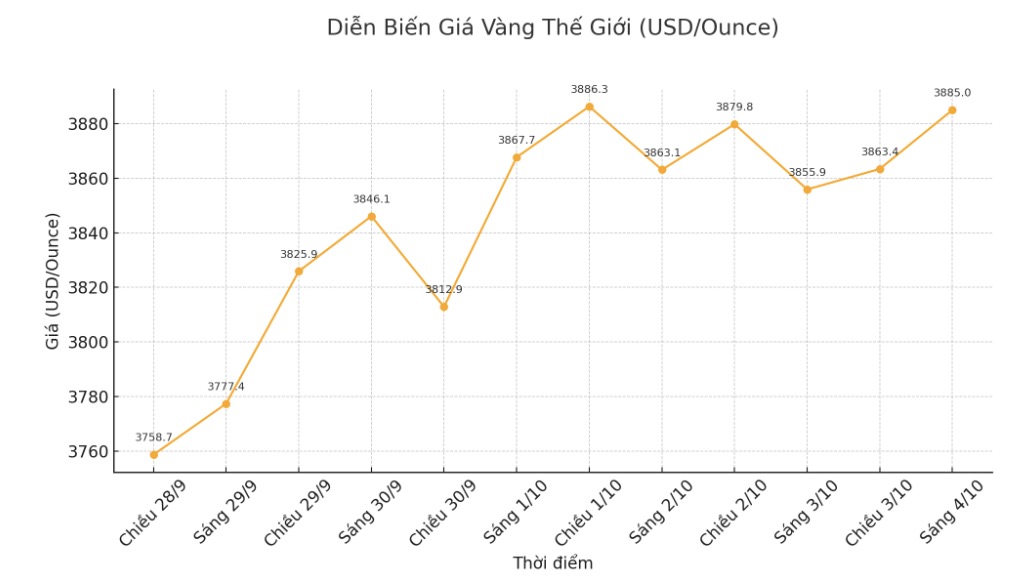

World gold price

At 9:20 a.m., the world gold price was listed around 3,885 USD/ounce.

Gold price forecast

In the Q4/2025 outlook report, Fawad Razaqzada - Market Analyst at City Index and FOREX.com commented that gold prices could reach 4,000 USD/ounce by the end of this year, but did not rule out risks.

With an increase of more than 40% since the beginning of the year and on track to record the best annual increase since 1979, Mr. Razaqzada said it was difficult to ignore the increase in gold, despite emphasizing that the precious metal was in a state of extremely overbought.

"The signs of overbought are flickering, but price action is still steady in the uptrend. When there is no clear sign of reversal on the chart, it can be considered a confirmation of what we already know: the trend is very strong" - he wrote.

Technically, Razaqzada said the key support level was $3,500 an ounce, with small supports at $3,700 and $3,600 an ounce. Under these milestones, $3,435/ounce is a notable area, marking the foundation of the breakout in the third quarter of 2025.

If it breaks through this area, the scenario will be more complicated, with the red line at $3,300/ounce - the bottom of the last big fluctuations before the recent strong rally began, he said, adding: As long as there is no clear reversal model, the scenario remains unchanged even though the technical indicator is overbought. Every decrease is bought in a healthy goose market.

Although the gold market has begun to show signs of correction risks, Mr. Razaqzada emphasized that the uptrend is still supported by solid fundamental factors.

Technical analysis: Technically, December gold futures bulls still have a strong advantage in the short term. The next upside target for buyers is to close the session above a solid resistance level of $4,000/ounce. The short-term downside target for the bears is to push prices below the solid technical support level at $3,750/ounce.

The first resistance level was seen at this week's record peak of $3,923.3/ounce and then $3,950/ounce. The first support level was at an overnight low of $3,861.1 an ounce and then a low of $3,842.8 an ounce on Thursday.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...