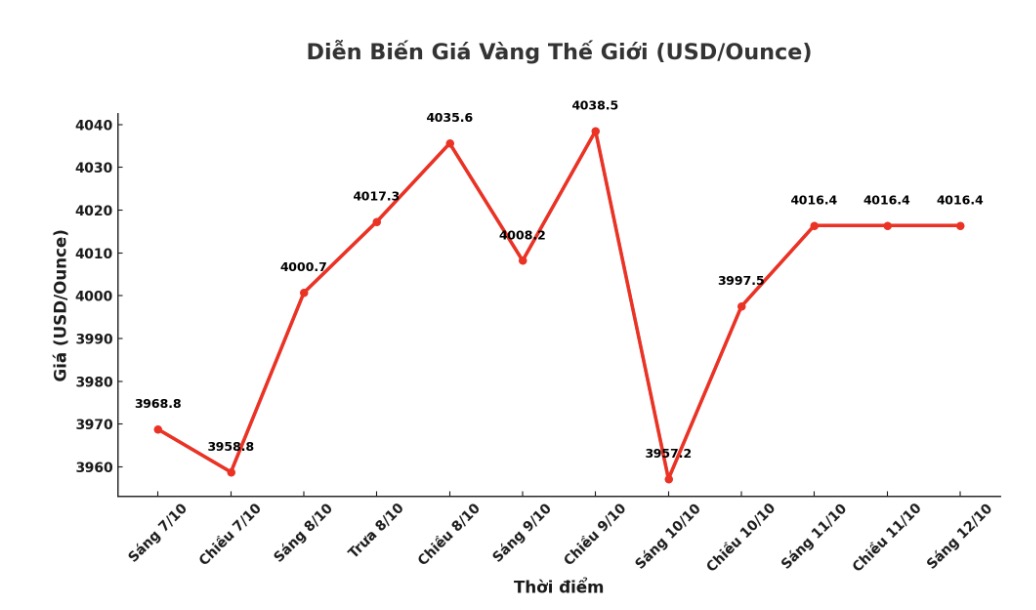

Gold price developments last week

Gold prices have sent investors through a volatile week, surpassing the unimaginable threshold of $4,000/ounce for the first time, marking the eighth consecutive week of increase.

At the beginning of the week, spot gold was at 3,890.51 USD/ounce and quickly established a higher peak - bottom chain. By midnight, prices had reached $3,940/ounce, then surpassed $3,962/ounce just two hours after North American markets opened.

After forming a three-peak model around $3,974 in the Asia session, gold decreased slightly to the support zone of $3,945/ounce, but strong buying pressure returned, pushing prices to $3,986/ounce at 11:00 a.m. (US time). The adjustment to $3,965 was short-lived, before prices approached a peak on the day when North American markets closed.

The Asian Games then created a decisive breakthrough: gold was pushed close to $4,000/ounce at 9:15 p.m. and completely surpassed this mark at 9:30 p.m. Tuesday.

Surprisingly, the rally remains strong rising to $4,050 an ounce at 5:45 a.m. and approaching $4,060/ounce at 12:30 p.m. on Wednesday. However, as the North American market was about to close, the increase weakened significantly, and the next Asian session pulled prices down to $4,010/ounce. After two tests of this support zone, European investors have helped prices return to near the previous peak.

However, the sudden decline appeared right when the North American market opened on Thursday, causing prices to plummet to 4,007 USD/ounce in just 45 minutes. Unable to surpass the 4,025 USD threshold, gold recorded the strongest correction of the week, down to 3,950 USD/ounce at 1:45 p.m. (US time).

This level becomes a solid support zone. After a test back at midnight, gold prices rebounded, surpassing $4,000/ounce by 5:30 a.m. and peaking at $4,016/ounce at 11:15 a.m. on Friday.

After a slight decline to $3,982/ounce, buyers still dominated, bringing prices back above $4,000/ounce when the market closed the trading week.

Gold price forecast for next week

A recent gold survey shows that after prices surpassed the $4,000/ounce mark, half of Wall Street analysts have cooled down their optimism, switching to a neutral stance, while individual investors have also been more cautious about the gold price outlook for next week.

This week's survey recorded opinions from 17 analysts. Eight (47%) predict gold prices will continue to rise next week; two (12%) expect prices to fall; the remaining seven experts (41%) predict gold prices will remain flat.

On the other hand, 295 individual investors participated in Kitco's online poll. Of these, 202 people (69%) believe gold prices will continue to rise, 52 people (18%) expect prices to fall, and 41 people (14%) expect prices to fluctuate within a narrow range next week.

Economic data to watch next week

The US government is still in a closed state, so next week will continue to be missing important economic data. However, investors will still monitor the latest signals of manufacturing sector health from the New York and Philadelphia Federal Reserve, and pay attention to comments at annual meetings of the International Monetary Fund (IMF) and the World Bank (WB) in Washington.

Fed Chairman Jerome Powell will attend a seminar hosted by the National Association for Business Economics (NABE) on Tuesday.

On Wednesday morning, the US will release the Empire State manufacturing index, and Thursday will be the FED Philadelphia manufacturing survey two reports that investors consider an important measure of the US economic production situation.

See more news related to gold prices HERE...