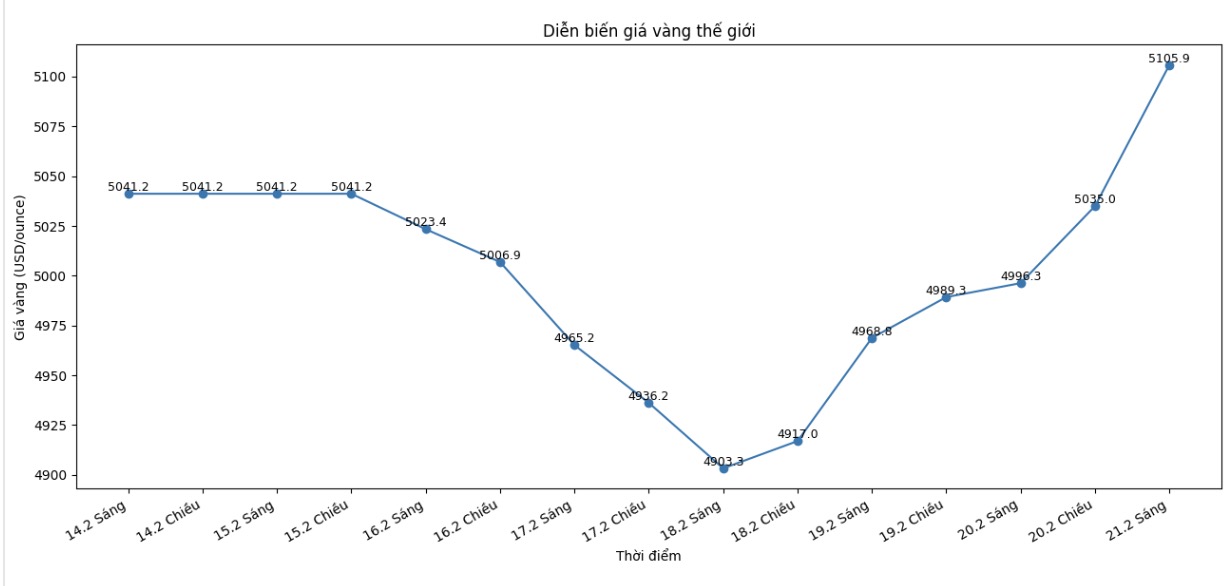

World gold price movements last week

Gold prices recorded a prolonged weakening trend in the first days of the week, as the market lacked buying power from Chinese traders who were on Lunar New Year holidays.

However, after successfully regaining the support level of 5,000 USD/ounce, a wave of geopolitical tensions erupted at the end of the week, triggering safe-haven demand, pushing gold prices back up sharply, to 5,100 USD/ounce.

Spot gold prices opened the week at 5,022.85 USD/ounce. However, the market lacked clear momentum in the early stages, as gold prices struggled to hold the support level of 5,000 USD/ounce in the Sunday night trading session, before under selling pressure right after 8:00 AM on Monday.

The opening session in North America pulled prices back close to the 5,000 USD/ounce mark but could not break through. In the Asian session on Monday evening, downward pressure increased, pulling spot gold prices down to 4,936 USD/ounce at around 7:45 am, then continued to fall to 4,879 USD/ounce in the early morning of Tuesday.

The European session helped the market improve somewhat, with gold prices continuously creating higher peaks, reaching about 4,943 USD/ounce at 7:15 am (Eastern time). However, when North America entered the race, the price quickly turned down, touching 4,870 USD/ounce at 8:45 am and setting a near-week low of 4,850 USD/ounce at noon.

After retesting the 4,859 USD/ounce zone, a support level maintained at the beginning of the Asian session, helping gold prices recover. The first sustainable increase in the week brought the price up to 4,939 USD/ounce in the early morning of Wednesday.

Wednesday became a prominent session, when spot gold prices surged from 4.910 USD/ounce at 6:30 am, back to the 5,000 USD/ounce mark at 10 am. However, the weakening momentum afterwards caused prices to fall back to around 4,960 USD/ounce in the evening.

On Thursday, gold entered the only accumulation phase of the week, fluctuating in the range of about 40 USD around the 5,000 USD/ounce mark.

Closing the week, the precious metal increased sharply. Spot gold price went from 5,000 USD/ounce at midnight to 5,004 USD/ounce at 4 am on Friday. After opening in North America, the price reached 5,055 USD/ounce, then at one point slightly decreased to 5,0022 USD/ounce after information that the Supreme Court ruled on tariffs. However, gold quickly rebounded, to 5,073 USD/ounce before 1 pm (Eastern time).

Escalating tensions in the Middle East have caused investors to turn to gold as a hedging channel. Gold prices maintain stable buying power, approaching the short-term resistance zone of 5,100 USD/ounce at the end of the session and continuing to trade around this level at the time the article was written.

Gold price forecast for next week

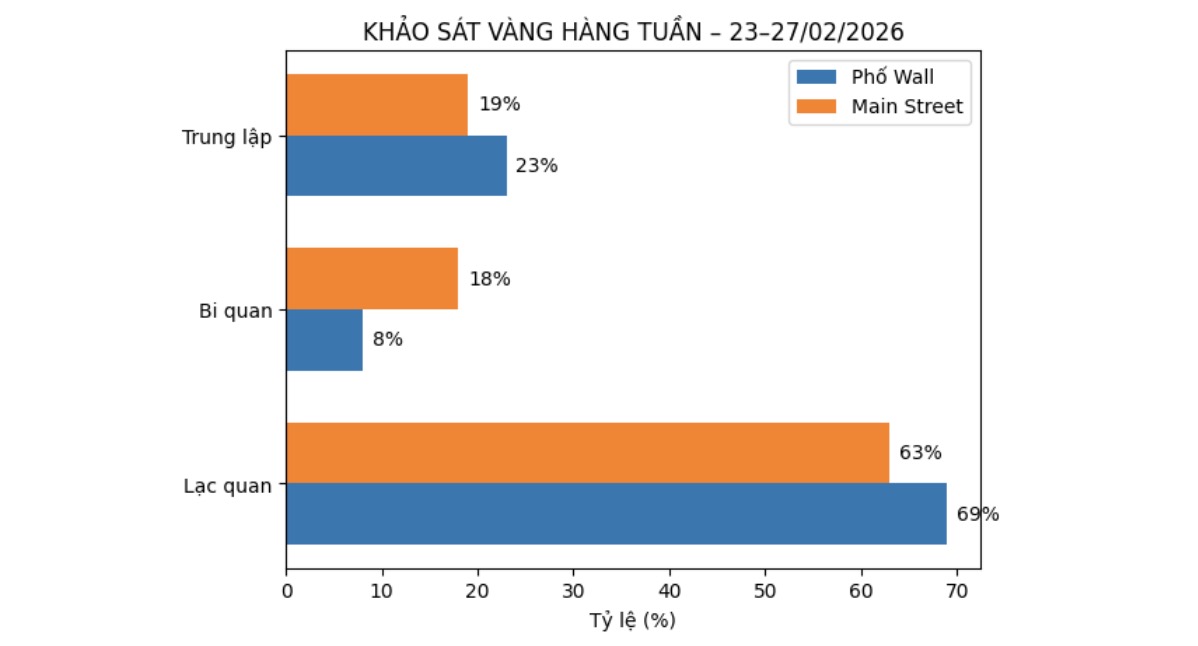

The latest weekly gold survey with Wall Street experts shows that optimistic sentiment is strongly returning on Wall Street. While small investors (Main Street) continue to maintain a majority leaning towards an upward trend for the third consecutive week.

This week, 13 analysts participated in the survey. 9 experts, equivalent to 69%, expect gold prices to break through decisively above the 5,100 USD/ounce mark next week. Only 1 person (8%) forecasts a price decrease, while the remaining 3 analysts (23%) believe that the risk of increase - decrease is in a balanced state in the short term.

In the opposite direction, Kitco's online poll recorded 298 votes. Main Street investor sentiment has remained almost unchanged for the past three weeks.

189 small traders (63%) believe that gold prices will continue to rise next week, while 53 people (18%) forecast that the precious metal will weaken. The rest, including 56 investors (19%), believe that prices will remain flat in the near future.

Economic data to be tracked next week

Next week, the economic data release schedule is generally quite sparse, but the market still welcomes important indicators such as consumer confidence and production price inflation.

Traders will also follow US President Donald Trump's State of the Union address to look for signals on future policy orientations.

In addition, the Chinese market will reopen after a week-long Tet holiday, expected to bring new momentum to gold price movements.

On Tuesday morning, investors turned their attention to the February US Consumer Confidence Report. On the same evening, the focus shifted to President Trump's State of the Union address.

By Thursday, the weekly number of US jobless claims was the only indicator of the labor market in the week. The series of events closed on Friday morning with the February Producer Price Index (PPI) report.

See more news related to gold prices HERE...