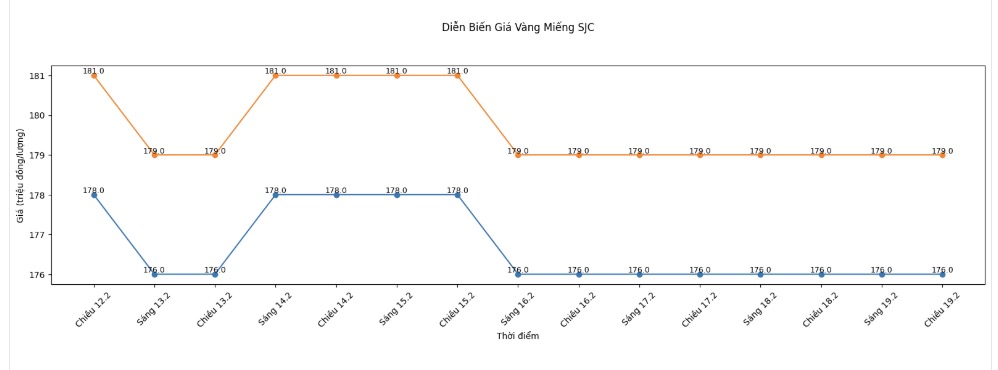

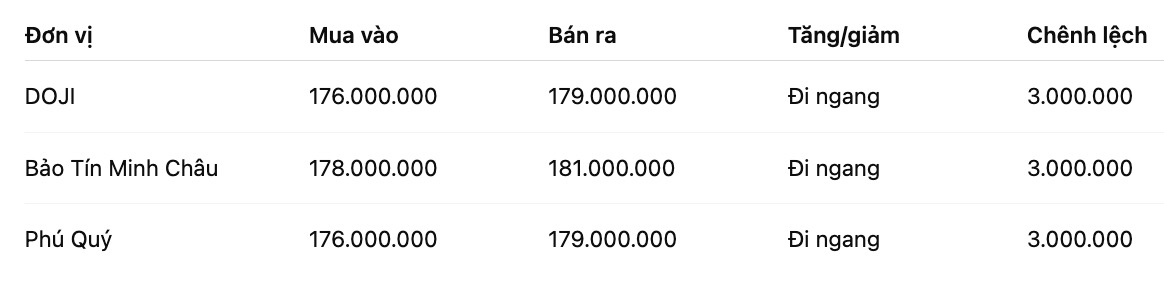

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

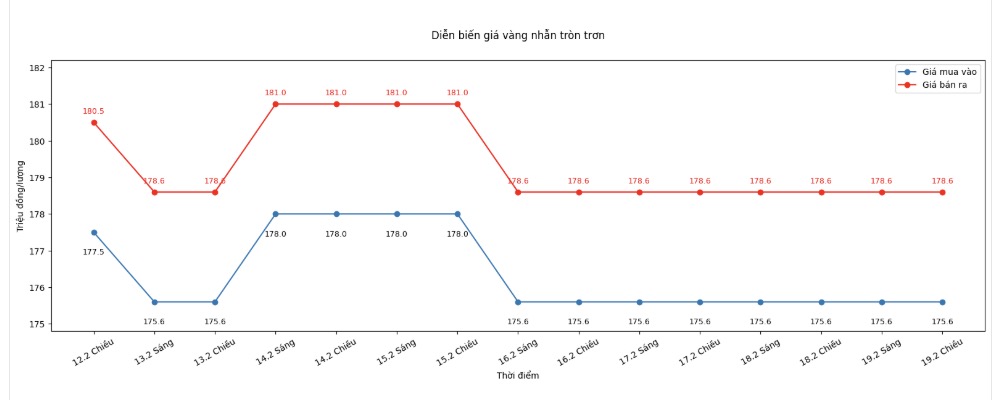

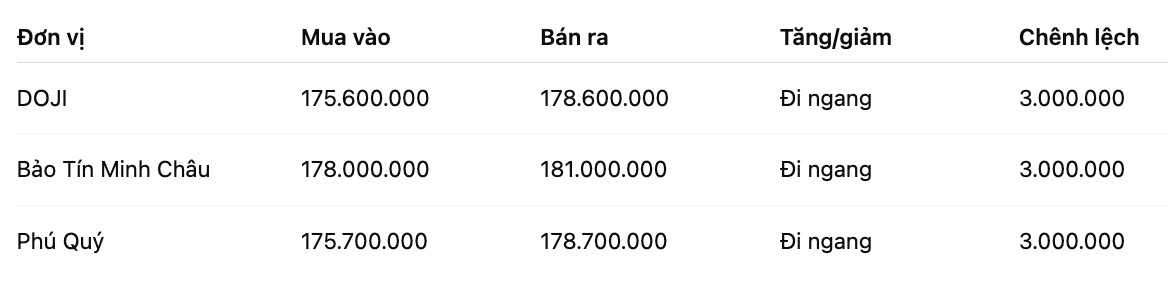

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

The buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

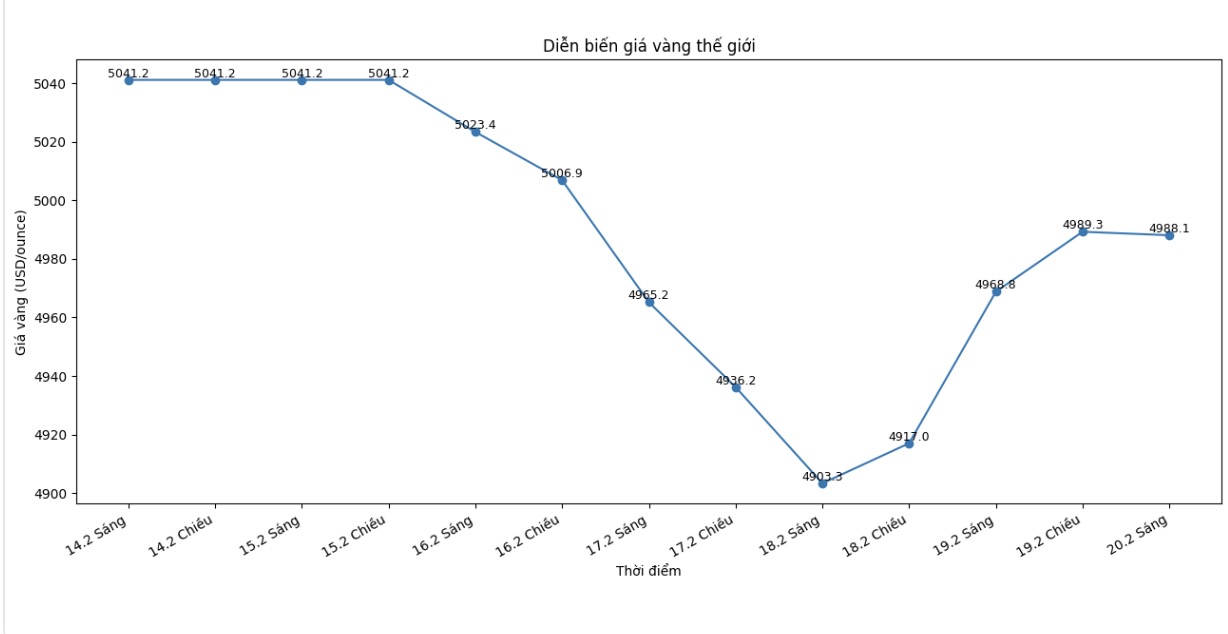

World gold price

At 2:21 AM, world gold prices were listed around the threshold of 4,988.1 USD/ounce, down 7.1 USD/ounce.

Gold price forecast

Gold and silver recovered in the context of the precious metals market slowing down at the end of the week as the focus of investors shifted to geopolitical developments in the Middle East.

Information related to US-Iran tensions is dominating market trends.

In terms of monetary policy, the minutes of the Federal Open Market Committee (FOMC) January meeting show that policymakers tend to be more "hawkish" than expected. Some members expressed concern about inflationary pressure and left open the possibility of raising interest rates if inflation remains above target.

The Fed's tougher stance is often seen as a factor putting pressure on gold and silver, as high interest rates reduce the attractiveness of non-performing assets.

Technically, analysts believe that buyers on the April gold futures market are aiming to conquer the resistance zone of 5,250 USD/ounce. In the opposite direction, sellers may increase pressure if the price falls below the support level of 4,670 USD/ounce.

The nearest resistance levels are currently around 5,074.4 USD/ounce and 5,100 USD/ounce, while the support buffer zone is defined at 4,900 USD/ounce and 4,854.2 USD/ounce. The market rating index according to the Wyckoff method is currently at 6.5, showing that technical advantage still leans towards the buying side.

External markets also sent noteworthy signals. The USD index edged up, crude oil prices rose sharply and are fluctuating around 66.50 USD/barrel, the highest level in eight months, while the yield of 10-year US Treasury bonds remained near 4.1%.

The combination of a strong USD, high yields and rising energy prices continues to create a volatile trading environment for precious metals.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...