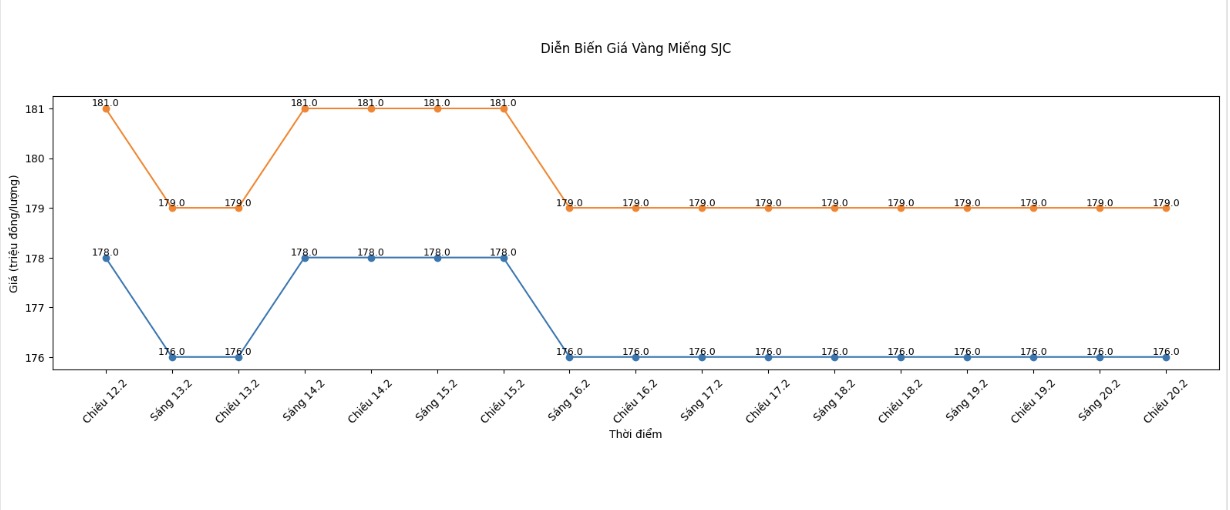

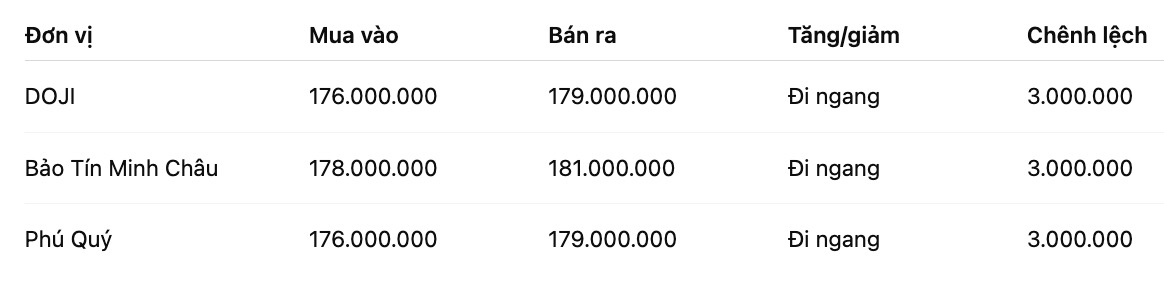

SJC gold bar price

As of 7:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

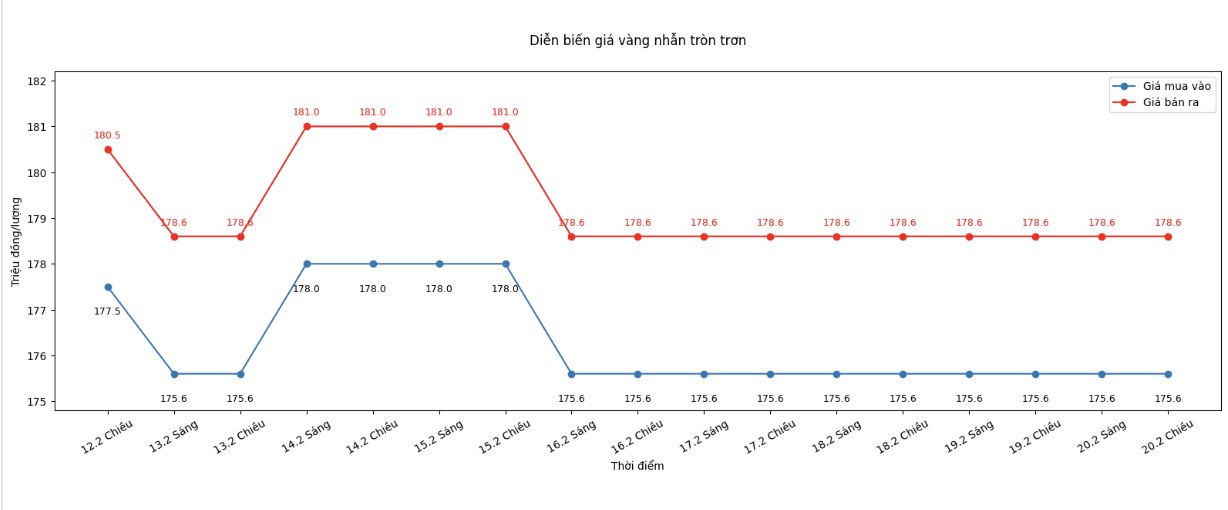

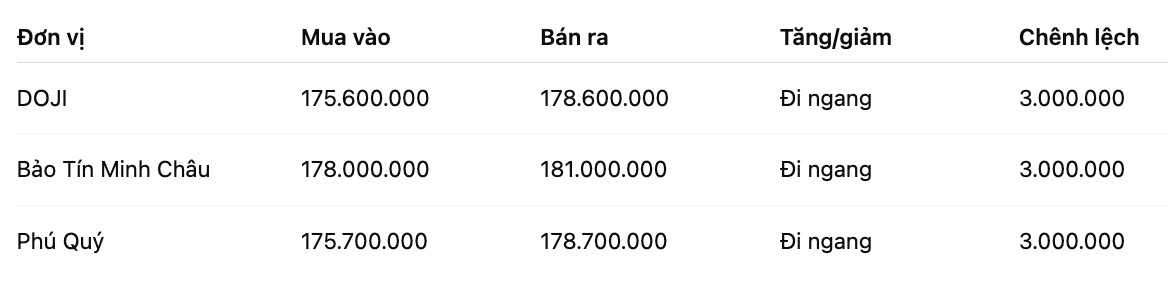

9999 gold ring price

As of 7:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

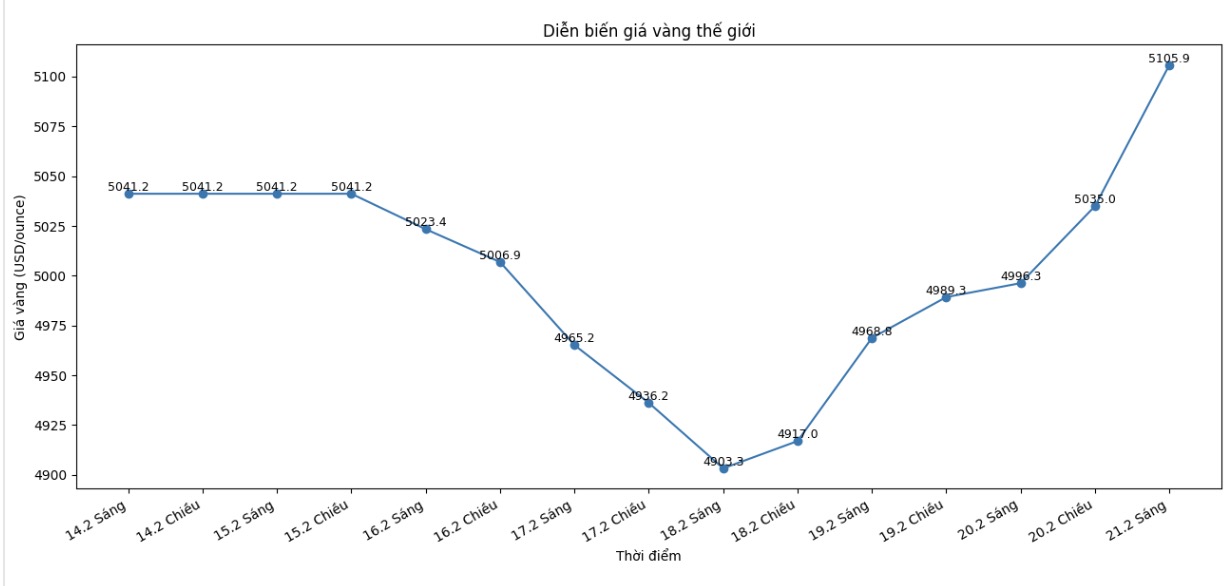

World gold price

At 7:42 AM, world gold prices were listed around the threshold of 5-105.9 USD/ounce, up 117.8 USD/ounce.

Gold price forecast

Gold and silver prices jumped sharply as safe-haven demand rose in both metals as the US is said to be approaching the brink of conflict with Iran.

The world is watching a large-scale US military build-up in the Middle East. According to Bloomberg, the US military is deploying a powerful force in the region, including two aircraft carriers, fighters and refueling aircraft.

The USD shows strength this week. The greenback is heading for its strongest weekly gain in four months as traders lower expectations of the US Federal Reserve (Fed) cutting interest rates, amid geopolitical risks strengthening the USD's safe-haven role.

Bloomberg said the Dollar Spot Index rose 0.9% in the week, the largest increase since October. Concerns about rising inflation and recent US economic data made the prospect of monetary policy easing this year less clear, thereby supporting the USD.

Crude oil prices are hovering near a six-month high. Nymex crude oil contracts traded around $66.00/barrel at the beginning of the day, fluctuating near a six-month high and heading for a 5% increase in the week.

The market is concerned about the risk of supply disruption, in which the US-Iran conflict scenario could cause Tehran to restrict traffic through the Strait of Hormuz - a vital route through which about 1/5 of global crude oil exports from the Middle East pass through.

Notable US economic data of the day. The first estimate of Q4 growth last year is expected to be released at 7:30 AM CST. According to The Wall Street Journal, GDP may increase at an annual rate of 2.5%, slowing down from the previous quarter's level of 4.4%. Another important indicator is the Fed's preferred inflation measure: personal income and spending in December, which is expected to show that inflation calculated according to the PCE index remains at 2.8% for 12 months to the end of December.

Key external markets recorded the USD index almost flat, crude oil prices stabilized around 66.25 USD/barrel. The benchmark 10-year US Treasury bond yield was around 4.1%.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...