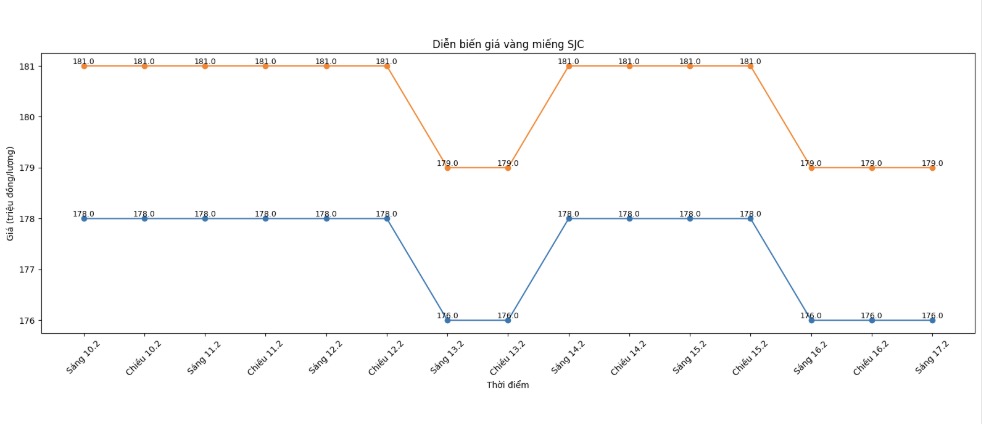

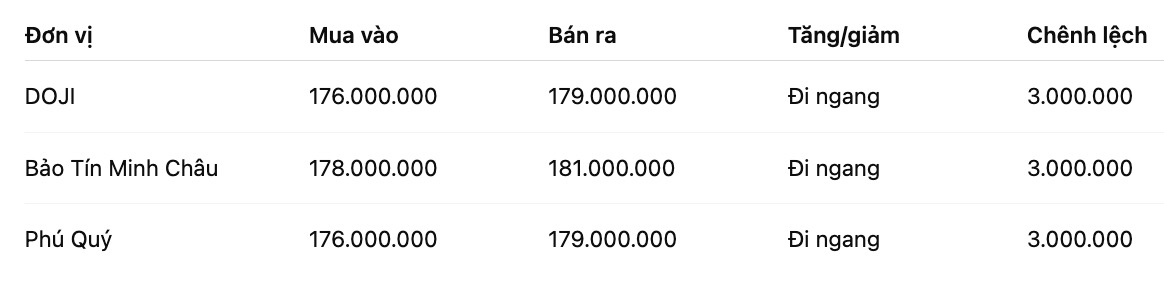

SJC gold bar price

As of 5:35 PM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

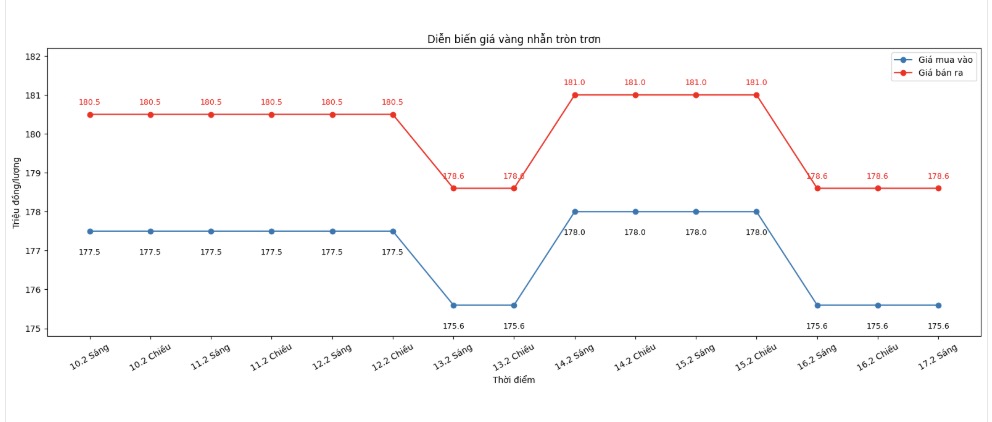

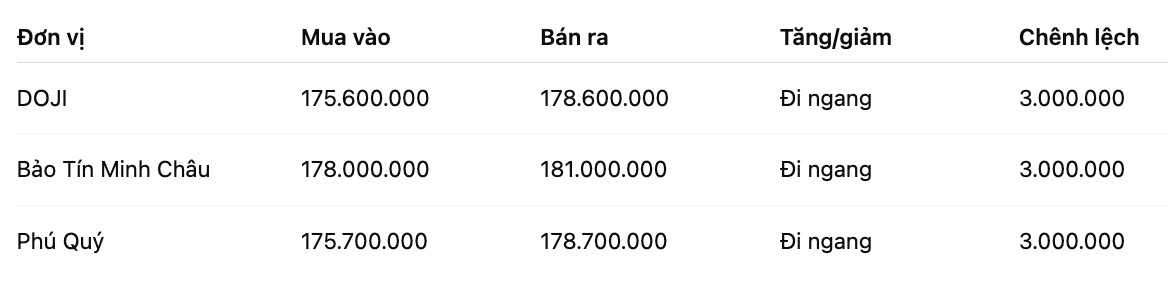

9999 gold ring price

As of 5:35 PM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

The buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

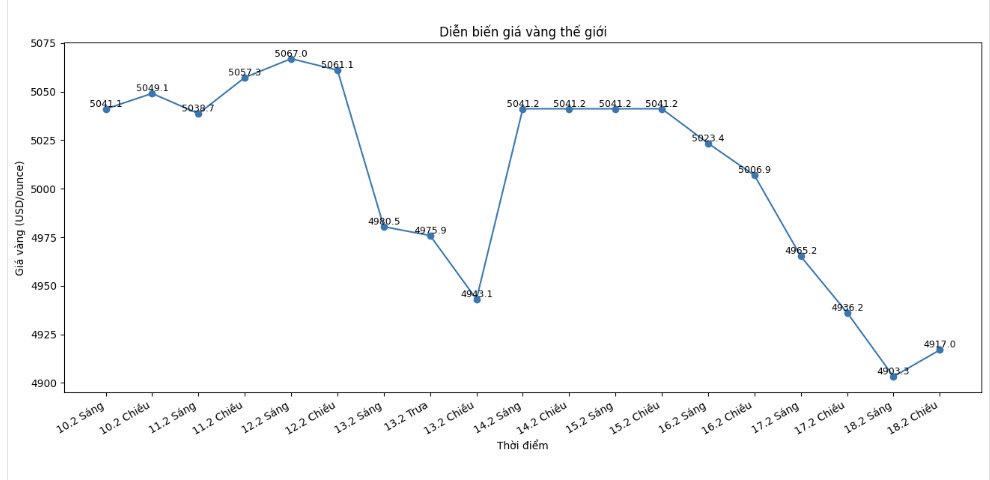

World gold price

At 5:35 PM, world gold prices were listed around the threshold of 4.917 USD/ounce; down 19.2 USD compared to the previous day.

Gold price forecast

After a period of hot increase and continuously setting new highs, the gold market is forecast to experience significant corrections if supporting factors weaken. Many international financial institutions believe that the long-term trend of gold is still positive, but the risk of deep decline cannot be underestimated.

According to analysis from J.P. Morgan, two variables that may put great pressure on gold prices in the near future are changes in the behavior of central banks and the psychology of individual investors. In which, the gold buying demand of central banks is considered an important pillar for the current high price level.

J.P. Morgan experts note that if structural buying power from the central bank bloc stagnates or reverses direction, the gold market may face a supply-demand shock. History has recorded large-scale gold sell-offs that have negatively impacted prices, although this scenario is currently assessed as having a low probability in the short term.

In addition, cash flow from individual investors is also a noteworthy factor. This group tends to react quickly to macroeconomic and geopolitical fluctuations. In the context of global risk cooling down or the emergence of more attractive alternative shelters, profit-taking pressure may increase, leading to strong correction sessions.

In the opposite direction, many forecasts still maintain optimistic views. ANZ Bank believes that gold is unlikely to reverse the upward trend in the short term, and at the same time raise the price target to 5,800 USD/ounce for the second quarter of 2026. According to ANZ, the prospect of interest rate reductions, prolonged geopolitical instability and increased investment demand continue to be the foundation for supporting precious metals.

Meanwhile, UBS Wealth Management also believes that gold still has room to rise as real interest rates in the US tend to decrease and economic and political risks have not completely disappeared.

We expect gold to continue its upward trend, possibly reaching $6,200/ounce by mid-year," said Dominic Schnider, Head of APAC Commodities and Foreign Exchange, UBS Wealth Management.

Overall, analysts believe that gold is likely to maintain strong fluctuations in the coming months. The medium-term trend is still positively assessed, but deep corrections may appear alternately, especially when market sentiment changes rapidly in the face of monetary and geopolitical policy signals.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...