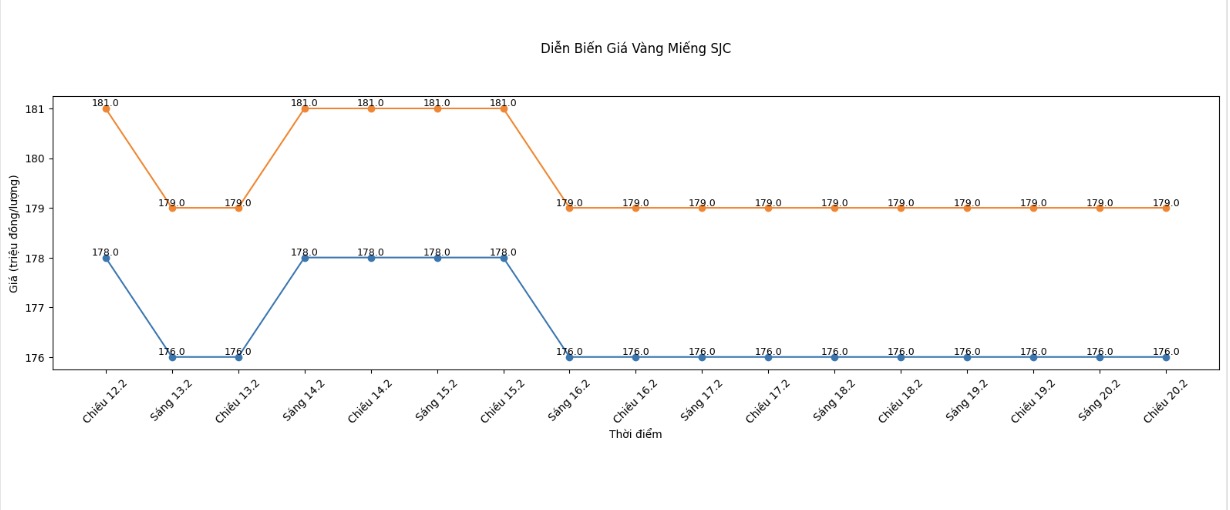

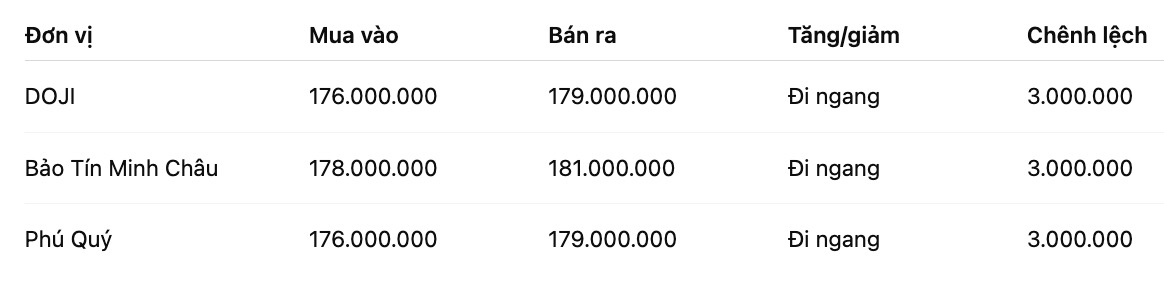

SJC gold bar price

As of 6:00 PM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

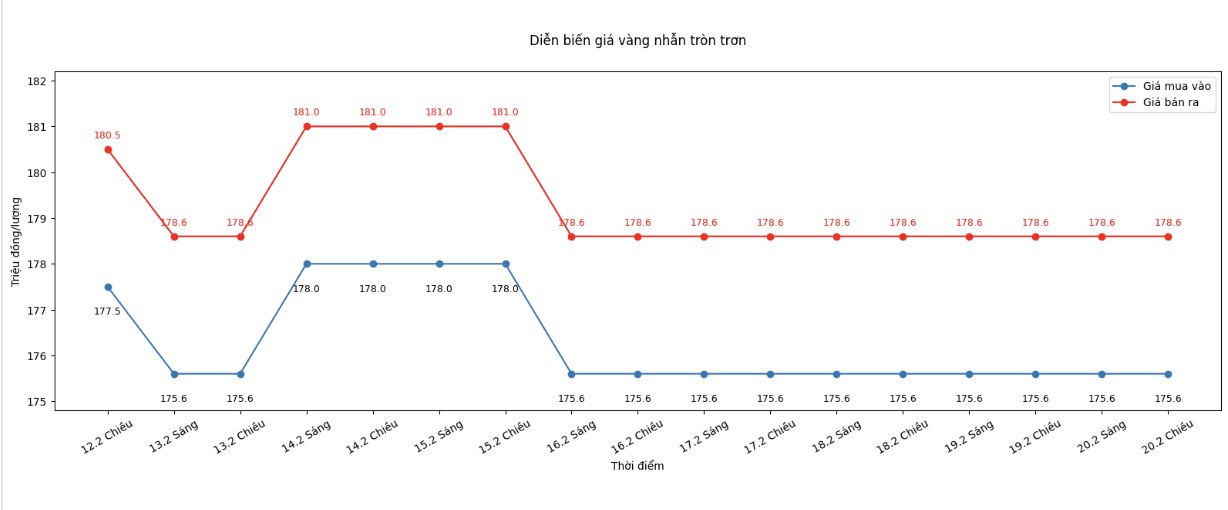

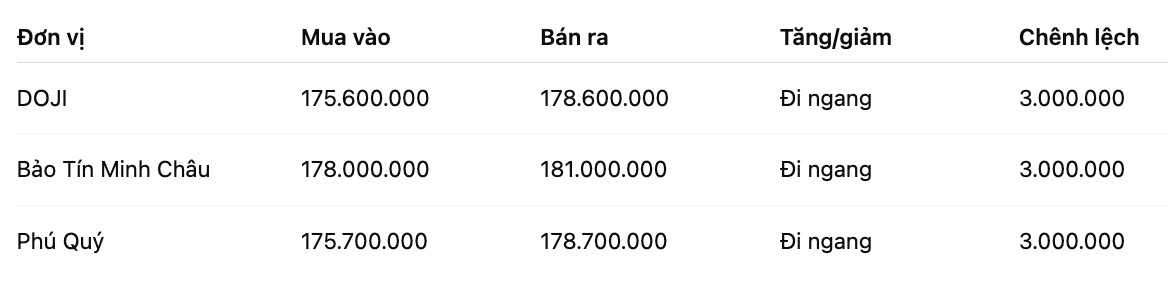

9999 gold ring price

As of 6:00 PM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

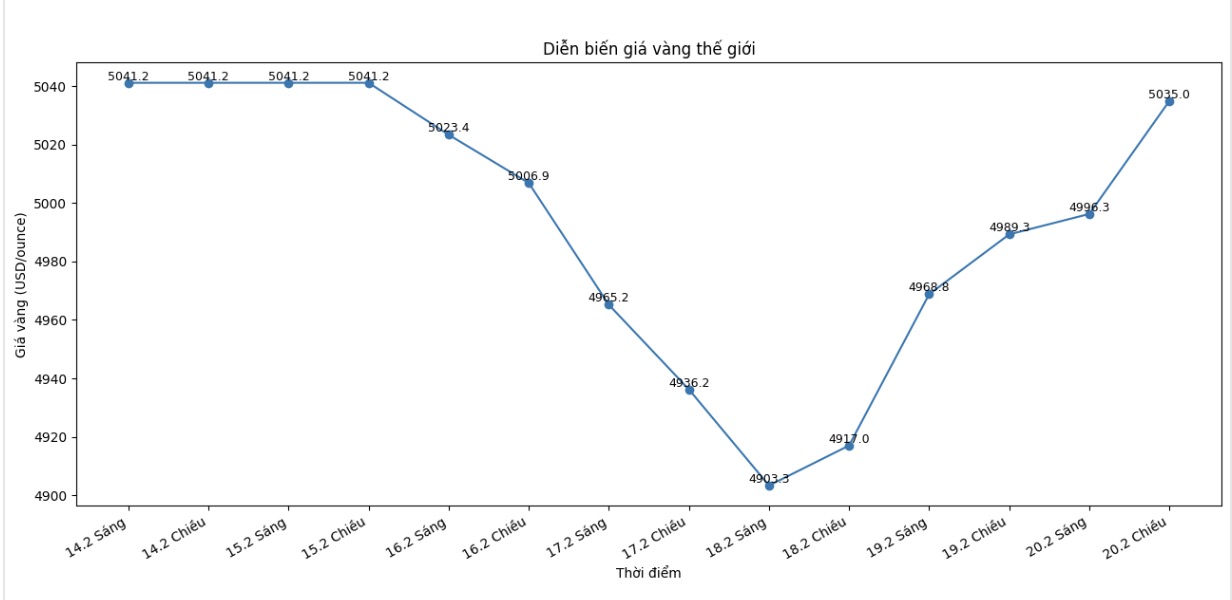

World gold price

At 5:39 PM, world gold prices were listed around the threshold of 5,035 USD/ounce; up 45.7 USD compared to the previous day.

Gold price forecast

World gold prices surged in the last session of the week thanks to safe-haven cash flow and the decline in European bond yields.

However, for the whole week, the precious metal still recorded a slight decrease as the USD maintained its strength and the market was cautious in the face of US inflation data.

The driving force to support gold prices comes from the geopolitical context that still contains risks, especially tensions between the US and Iran. In parallel, the yield of eurozone government bonds continued its downward trend for the second consecutive week.

According to Mr. Peter Fertig - an analyst at Quantitative Commodity Research, the decrease in yield has lowered the opportunity cost of holding gold - an asset that does not generate yields, thereby supporting the price of precious metals.

The focus of the market is currently on the US Personal Consumption Expenditure (PCE) index, an inflation measure prioritized by the US Federal Reserve (Fed). Forecasts from economists show that the core PCE may increase by 0.3%.

The actual results will play an important role in shaping monetary policy expectations. Currently, traders mostly lean towards the possibility that the Fed will keep interest rates unchanged in the March meeting, but still leave scenarios open for the second half of the year.

In an environment of low interest rates or expectations of interest rate cuts, gold usually benefits.

From a long-term perspective, some international financial institutions maintain a positive stance. Goldman Sachs believes that if central banks' gold buying activity accelerates again and investors increase allocation as the Fed begins its loosening cycle, gold prices tend to "rise slowly but sustainably" this year.

Sharing the optimistic view, Ms. Helen Amos - Managing Director of BMO Equity Research, said that geopolitical instability and the trend of stock diversification may bring gold closer to the $6,500/ounce mark by the end of 2026, although price fluctuations are forecast to remain high.

In the short term, the gold market is forecast to continue to fluctuate strongly according to US economic data, yield developments and geopolitical news. Investors are recommended to closely monitor signals from the Fed, and manage risks before unexpected corrections.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...