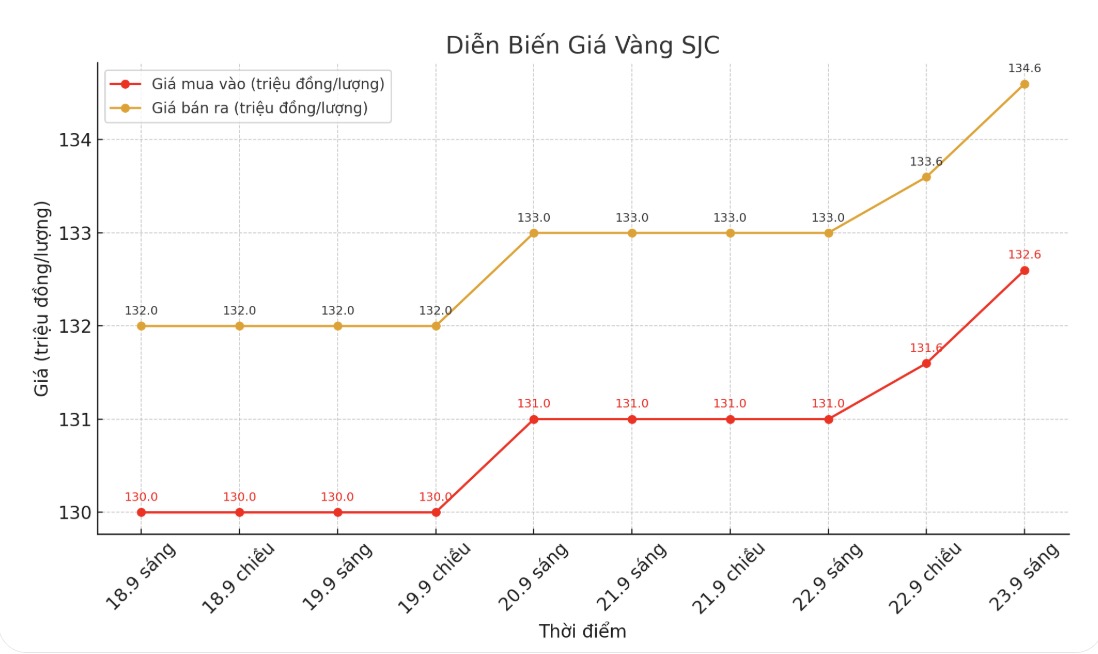

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 132.6-134.6 million VND/tael (buy in - sell out), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.6-134.6 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132-144.6 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1.6 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

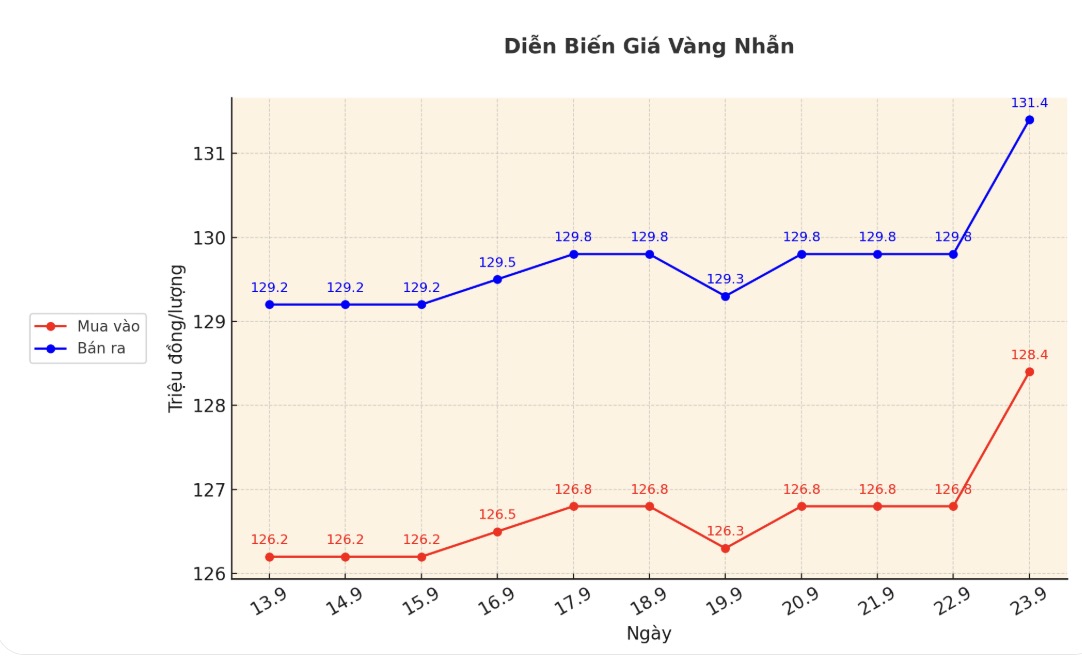

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 128.4-131.4 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.4-131.4 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

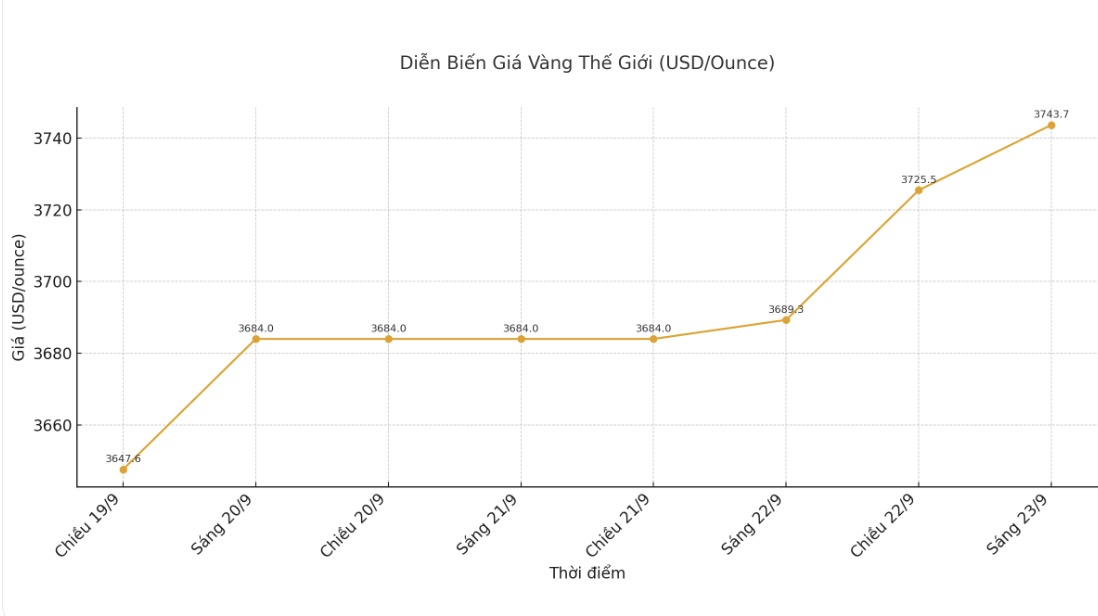

World gold price

At 9:15 a.m., the world gold price was listed around 3,743.7 USD/ounce, up 54.4 USD.

Gold price forecast

Soni Kumari - commodity strategist at ANZ Group Holdings Ltd., commented that the technical factors are currently quite positive and the expectation of stronger interest rate cuts is increasing. Silver has broken the resistance level of $43/ounce, while gold has surpassed the $3,708/ounce mark, showing that the uptrend still has room.

Rich Checkan - Chairman and CEO of Asset Strategies International believes that gold prices will increase this week: "The Fed Chairman and FOMC did as expected. Reduced interest rates make alternative investment channels less attractive. Along with tensions in Ukraine, Poland, Gaza and the Caribbean, gold and silver could break out after a short profit-taking streak.

James Stanley - Senior Strategist of Forex.com shared the same view: The Fed has just cut interest rates when inflation is around 3%. Although the message is not really gentle, I do not think that this central bank will switch to tightening. Deep corrections in gold are an opportunity for buyers.

Adrian Day - Chairman of Adrian Day Asset Management - assessed the 0.25 percentage point cut as a reasonable accommodation in the context of internal division of the FED. He said the market responded well to the move, but also commented that Mr. Powell's guiding role will decline as his term is about to end.

Day stressed that the gold market is increasingly diverse, no longer completely dependent on the Fed's interest rate policy, because many central banks and Asian investors buy gold for personal reasons, not relying on US policy.

However, if the Fed delays cutting in October, gold prices may have to adjust, especially as investors are betting on a 94% chance of cutting and expecting prices to reach $4,000/ounce by the end of the year.

On the other hand, Alex Kuptsikevich - Senior Expert of FxPro - predicted that gold could fall in the short term after setting dozens of new peaks this year, up more than 40% since the beginning of the year and surpassing the record for inflation in 1980.

He noted that ETF inflows into gold have increased by 43% since the beginning of the year, but investors turning to buying USD and US stocks could temporarily put pressure.

Schedule of announcing economic data affecting gold prices this week

Tuesday: US S&P Flash PMI.

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...