Gold price developments last week

Last week, thanks to the combination of technical analysis, fundamental factors and economic data, gold prices had a week of strong increases rare for many years, continuously breaking important resistance levels and setting new peaks.

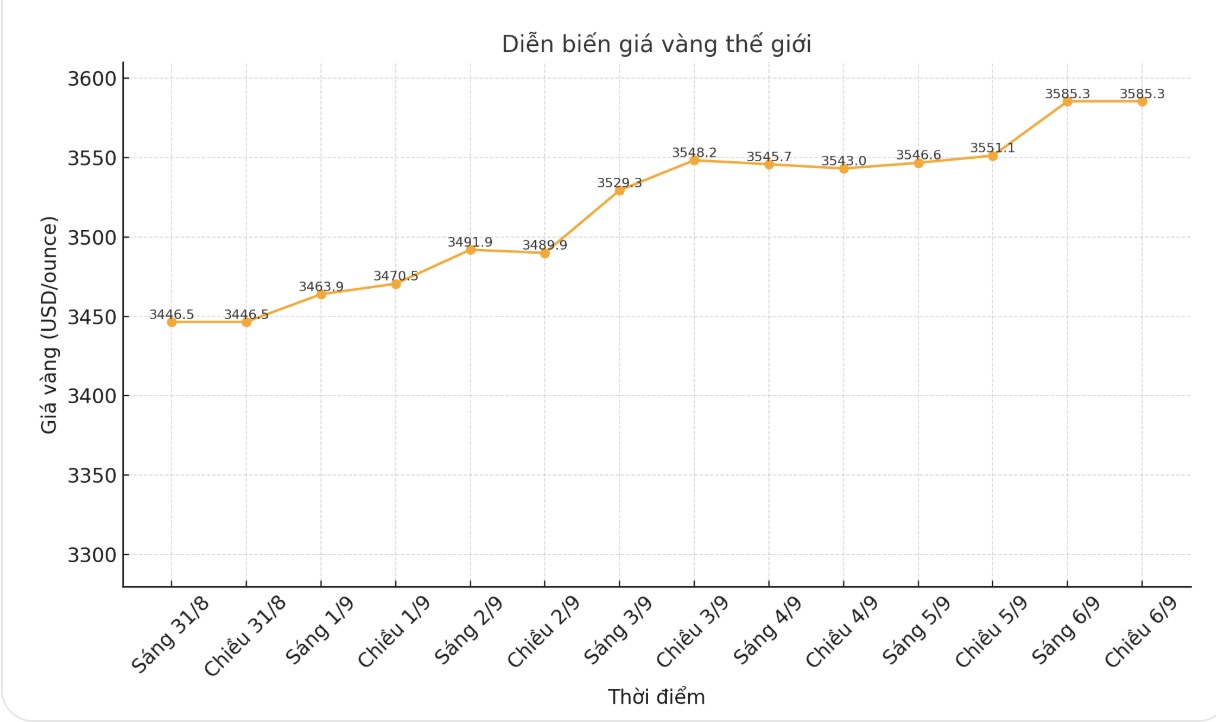

Spot gold started the week at $3,446.61 an ounce, after testing $3,440 an ounce, the precious metal quickly rebounded, reaching $3,483 an ounce just before 11pm EDT and $3,488 an ounce at the start of the European trading session on Monday morning.

The thin trading volume during the US Labor Day holiday caused the increase to be unstable, gold returned to the test of the mark of 3,470 USD/ounce per day. However, when the Asia session opened on Monday evening, gold quickly surpassed the resistance level of 3,500 USD/ounce, to nearly 3,503 USD/ounce before retreating to the 3,470 USD/ounce zone.

When the North American market reopened on Tuesday morning, gold prices quickly rose to $3,526/ounce by noon and closed at $3,539/ounce.

Meanwhile, the Asian night session moved sideways within a narrow range of 10 USD, but in the European session, buying pressure continued to push prices up. This increase extended throughout the North American session on Wednesday, setting a new record for gold, approaching the 3,580 USD/ounce mark.

After a slight adjustment at the end of the North American session on Wednesday, the market entered the testing phase in the Asian session, when gold retreated to 3,515 USD/ounce at 11:00 p.m. (EDT) before bouncing back to 3,530 USD/ounce and entering the only accumulation phase of the week on Thursday, as investors awaited the non-farm payrolls report - the last major catalyst of the week.

The jobs report failed to meet expectations, pushing gold from $3,550 an ounce just before the announcement (8:30 EDT) to a new record of $3,583 an ounce shortly thereafter. From here, it is only a matter of time before gold surpasses the $3,600/ounce mark at noon (EDT).

Even at unprecedented prices, gold remains almost unchanged, holding above $3,590 an ounce until the market closes the week.

Gold price forecast for next week

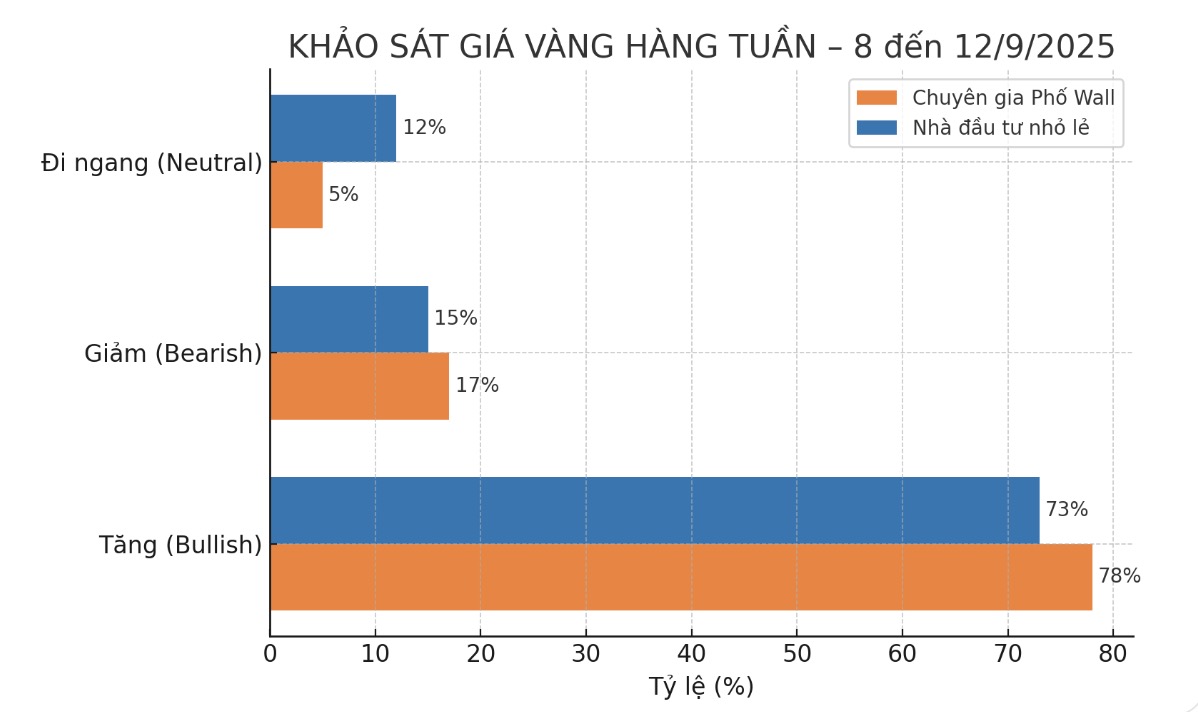

According to the survey, there are 18 Wall Street experts participating, of which 14 people (equivalent to 78%) predict gold prices will increase next week. Only 3 experts (17%) see the price as falling, while the remaining 1 person (5%) sees gold as flat.

There were 219 votes from small investors. The results showed that 160 people (73%) believe gold prices will continue to rise, 33 (15%) predict prices will decrease, while 26 people (12%) expect gold to accumulate next week.

Economic data to watch next week

There will be quite a bit of economic data next week, but the reports and information released are of great significance as inflation returns to the spotlight.

On Wednesday, the market will welcome the US producer price index (PPI) in August, with both the overall and core figures forecast to fall sharply compared to July.

Then on Thursday, traders will watch the European Central Bank (ECB) monetary policy meeting - where the market has assessed the likelihood of keeping interest rates unchanged at 2.15% - and immediately after that the US consumer price index (CPI) report for August.

In addition, weekly jobless claims will also be monitored for further evidence of the weakening US labor market.

The trading week ended on Friday morning with a preliminary survey of University of Michigan consumer confidence, which also focused on inflationary factors this year.

See more news related to gold prices HERE...