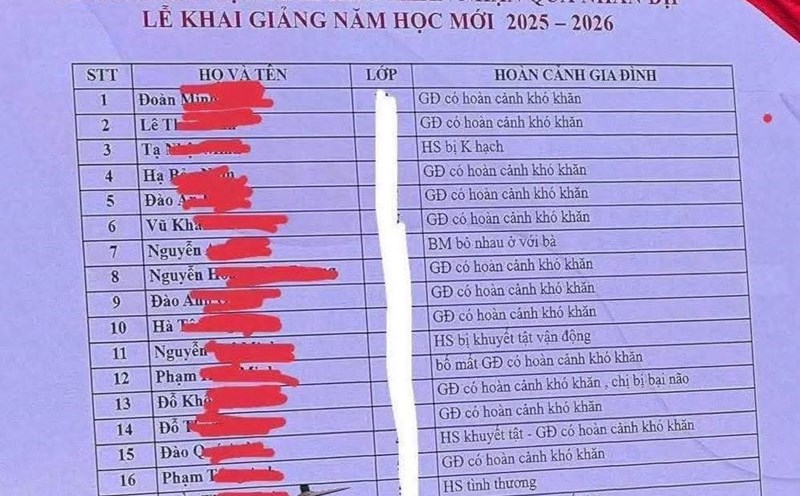

SJC gold bar price

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at VND133.9-135.4 million/tael (buy in - sell out), an increase of VND1 million/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 133.9-135.4 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.9-135.4 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

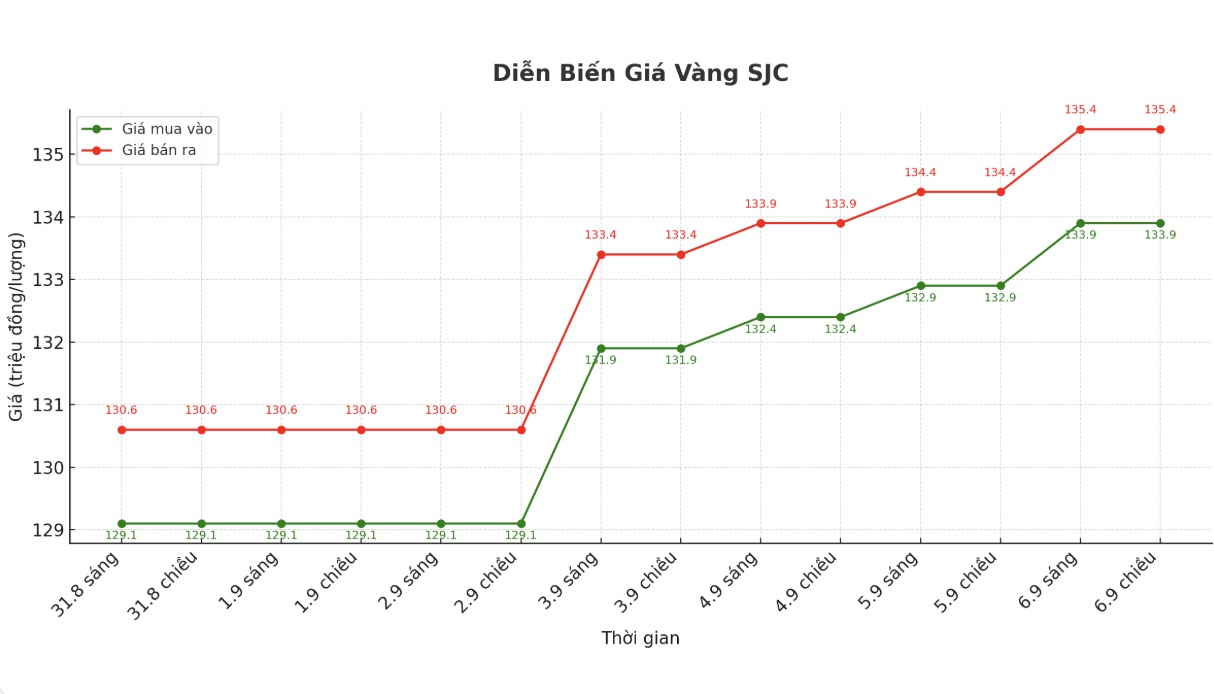

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 127.7/30.7 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.8-130.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

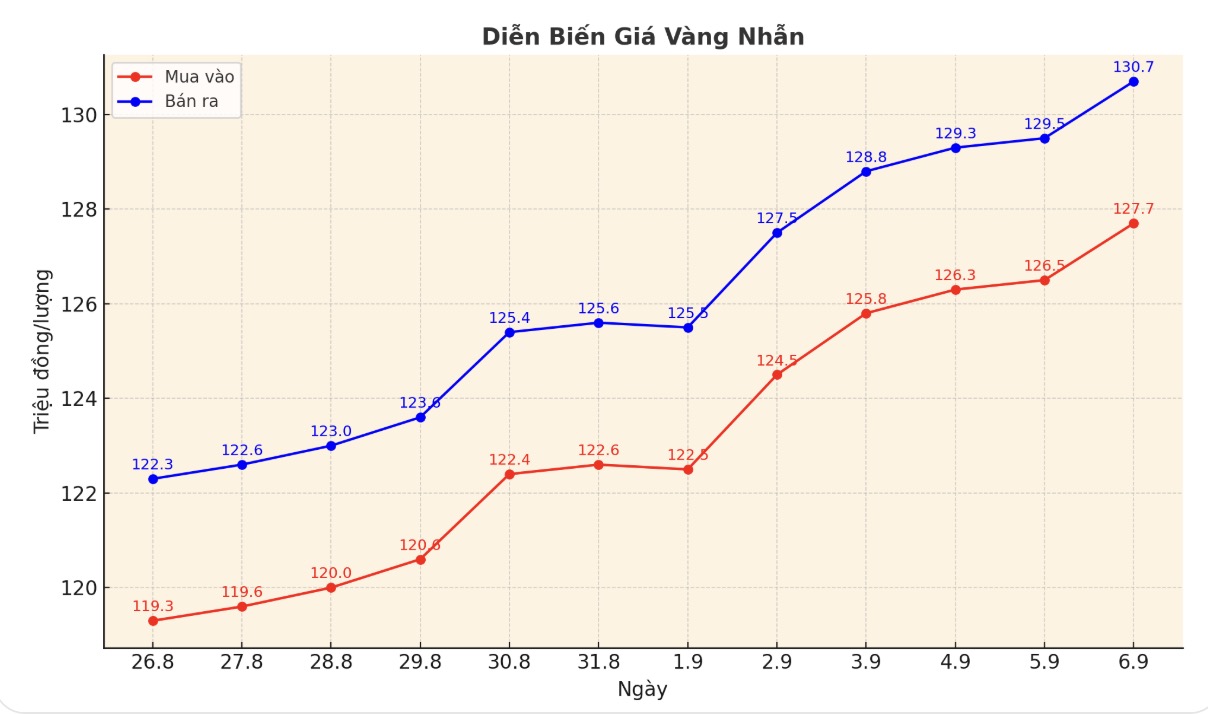

World gold price

The world gold price was listed at 5:30 p.m. at 3,551.1 USD/ounce, up 8.1 USD.

Gold price forecast

Disappointing US jobs data has given the Federal Reserve a green ticket to cut interest rates this month, thereby pushing gold out of accumulation and back to record levels.

almost monetary policy movements were shaped on Friday after data from the US Bureau of Labor Statistics showed that the country's economy only created 22,000 more jobs in August, much lower than expected.

This weak data adds strength to gold, helping prices sometimes reach $3,600/ounce before the end of the week.

Although many people may be surprised by the recent breakthrough in gold prices, in fact, experts have warned investors about this possibility throughout the summer.

Gold can be an extremely boring asset when moving sideways for a long time, but when it explodes, the increase can be unstoppable.

Once again, expected resistance levels are like slowing edges on golds rally. Analysts now see $3,500/ounce as a new key support level, replacing $3,350/ounce just a week ago.

Factors that driven gold's nearly 3-year rally are still around. Gold continues to be attractive as an alternative asset, as confidence in the "special" of the US economy shows signs of decline.

This is not just a wave of speculation, but reflects investors' increasingly clear perception of the value of holding tangible assets in the context of increasing public debt, causing higher inflation and weakening economic activity.

In particular, gold is still strongly supported by demand from central banks as they continue to diversify reserves, moving away from the USD.

Lukman Otunuga - Senior Market Analyst at FXTM - commented: "The explosive increase on Friday is like a high-speed train heading towards the psychological threshold of 3,600 USD/ounce.

With a foundational foundation supporting buyers, there is still room for gold prices to increase, but technically, prices are being overbought and can be adjusted.

If gold prices fall below $3,570 an ounce, sellers could target $3,540 an ounce and even $3,500 an ounce before the uptrend returns.

Ole Hansen - Head of Commodity Strategy at Saxo Bank said that with the current momentum, gold could move towards 3,800 USD/ounce in the next 3-4 months, especially as expectations of stronger interest rate cuts are growing, along with geopolitical risks and the Fed's independence.

Robert Minter - ETF Strategy Director at abrdn predicts gold will reach the target of 3,700 USD/ounce by the end of the year, even if the short term shows signs of overbought. He emphasized that central bank demand and investors before interest rate cuts are playing a pivotal role.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...