According to the latest data from the World Gold Council (WGC), gold prices have remained high, causing demand from countries to decline, but emerging markets continue to be a stable buying group.

Ms. Marissa Salim - Senior Research Team Leader for Asia - Pacific at WGC said: Global central banks net bought 10 tons of gold in July based on reported data, a moderate net allocation compared to previous months.

Despite the slowing net buying rate, central banks remain net buyers of gold even at current prices.

Despite the lower figure than the pace of recent years, central banks in emerging markets continued to buy more gold in July.

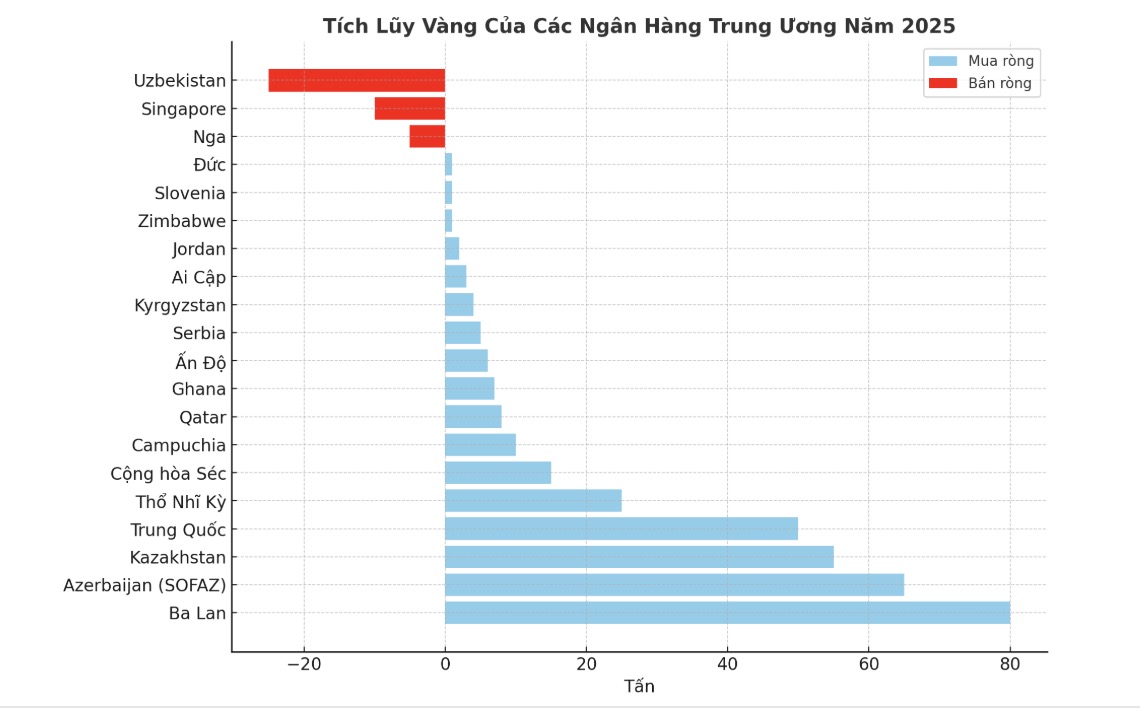

The National Bank of Kazakhstan has added 3 tons, bringing the total accumulated gold since the beginning of the year to 25 tons the third largest central bank to buy gold, after Poland and Azerbaijan. The Central Bank of the Republic of Turkey, the People's Bank of China and the Czech National Bank each added 2 tons of gold, Salim wrote.

She added: The taste of these three central banks remains the same, the gold buying rate is increasing but steadily. Turkey has been net buyers for 26 consecutive months, since June 2023; the Czech National Bank has maintained its gold buying streak for 29 consecutive months, since March 2023. The Peoples Bank of China has also extended its 9-month streak of continuous gold purchases, with total purchases reaching 36 tons during this period.

The National Bank of Poland is still the largest net buyer in 2025, with 67 tons as of the beginning of the year, although it has barely bought more since May.

Salim also said that the Central Bank of Uganda has announced a pilot program lasting two to three years to buy domestic gold from manual miners, "in order to build an official foreign exchange reserve and reduce dependence on traditional foreign assets".

The initiative comes after the announcement in August 2024 that the central bank would begin buying domestically mined gold.

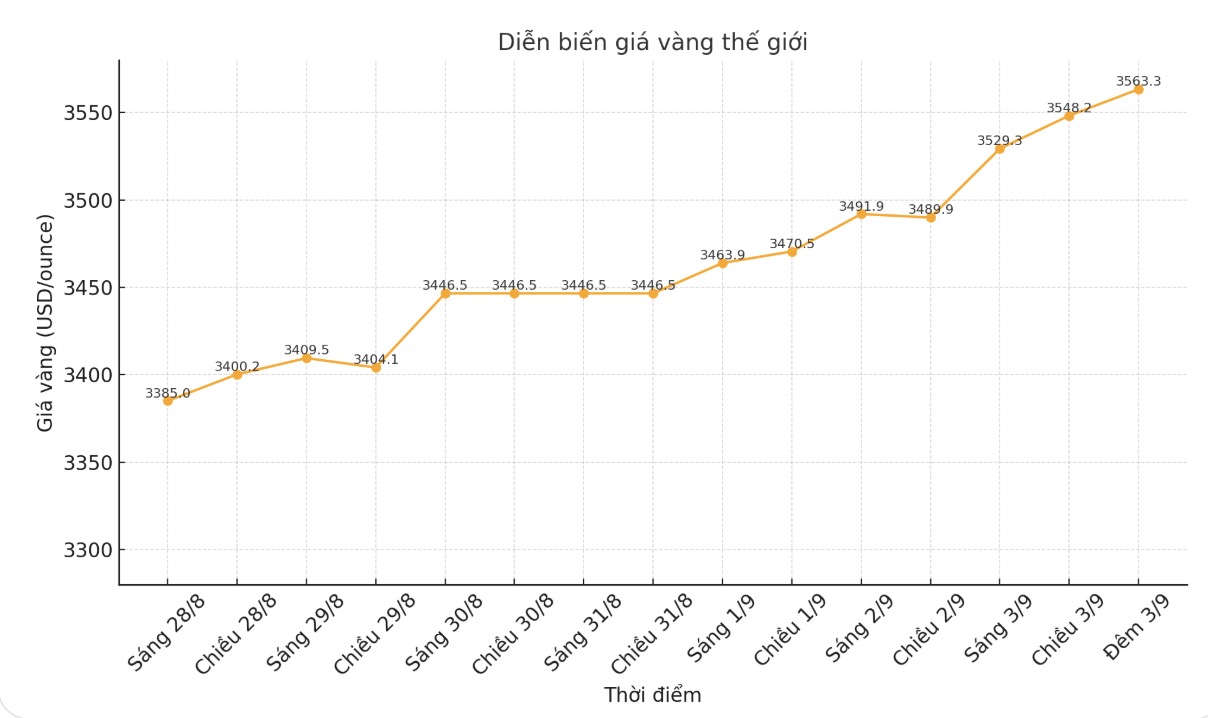

Technically, December gold buyers are holding a clear advantage in the short term. The next target for this side is to bring prices above the resistance level of 3,700 USD/ounce. On the contrary, the sellers aim to pull the price below the important support zone of 3,500 USD/ounce.

According to the analysis, the most recent resistance level was at 3,650 USD and 3,675 USD/ounce, while the support was at 3,592.4 USD/ounce and 3,550 USD/ounce, respectively.

See more news related to gold prices HERE...