Although many people may be surprised by the recent breakthrough in gold prices, in fact, experts have warned investors about this possibility throughout the summer.

Gold can be an extremely boring asset when moving sideways for a long time, but when it explodes, the increase can be unstoppable.

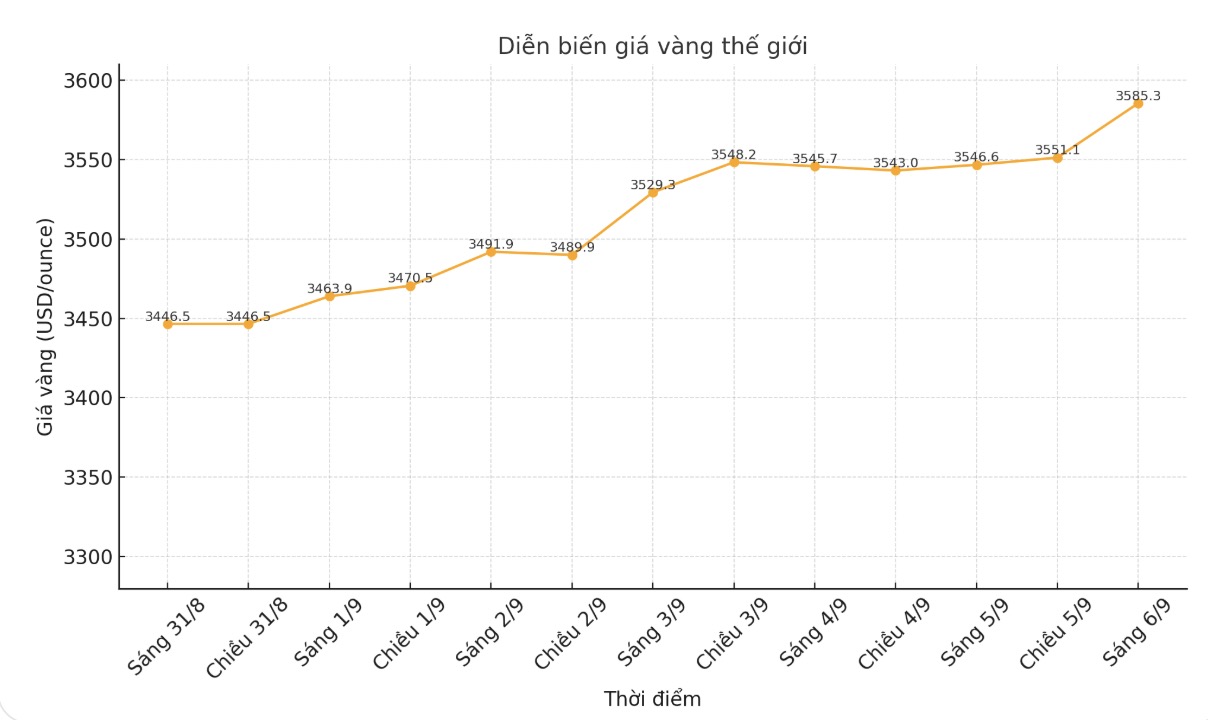

Once again, expected resistance levels are like slowing edges on golds rally. Analysts now see $3,500/ounce as a new key support level, replacing $3,350/ounce just a week ago.

Factors that driven gold's nearly 3-year rally are still around. Gold continues to be attractive as an alternative asset, as confidence in the "special" of the US economy shows signs of decline.

This is not just a wave of speculation, but reflects investors' increasingly clear perception of the value of holding tangible assets in the context of increasing public debt, causing higher inflation and weakening economic activity.

In particular, gold is still strongly supported by demand from central banks as they continue to diversify reserves, moving away from the USD.

Last week, Tavi Costa - partner and macro strategist at Crescat Capital noted that for the first time since 1996, the holding of gold by global central banks exceeded the holding of US Treasury bonds.

Mr. Costa emphasized that the most important thing is that central bank demand for gold is only in the early stages. He predicted that gold could account for 80% of total global reserves.

Earlier this week, we saw that potential when a central bank announced its first gold purchase in more than 30 years. On Thursday, the Central Bank of El Salvador said it had purchased 13,999 ounces of gold, worth $50 million.

Notably, in an official statement, the bank said it used the profits from Bitcoin reserves to finance the deal. bank Central de Reserva de El Salvador currently holds 6,287 bit bit bittors, worth about $698 million.

Despite the fluctuations in cryptocurrencies in recent years, El Salvador's holding value has increased by about 400 million USD. This means that the Central American country has enough potential to continue buying more gold.

The Central Bank of Poland is another example of gold demand. This is one of the largest gold buyers in recent years; however, buying activities have stagnated in 2025.

This bank stopped buying when the proportion of gold in reserves reached 20%. But according to some sources, Governor Adam Glapiński recently said the threshold could be raised to 30%.

According to many analysts, strong demand from central banks continues to consolidate the real value of the market. And despite the explosive rally, hardly anyone sees gold as overvalued.

See more news related to gold prices HERE...