Disappointing US jobs data has given the Federal Reserve a green ticket to cut interest rates this month, thereby pushing gold out of accumulation and back to record levels.

almost monetary policy movements were shaped on Friday after data from the US Bureau of Labor Statistics showed that the country's economy only created 22,000 more jobs in August, much lower than expected.

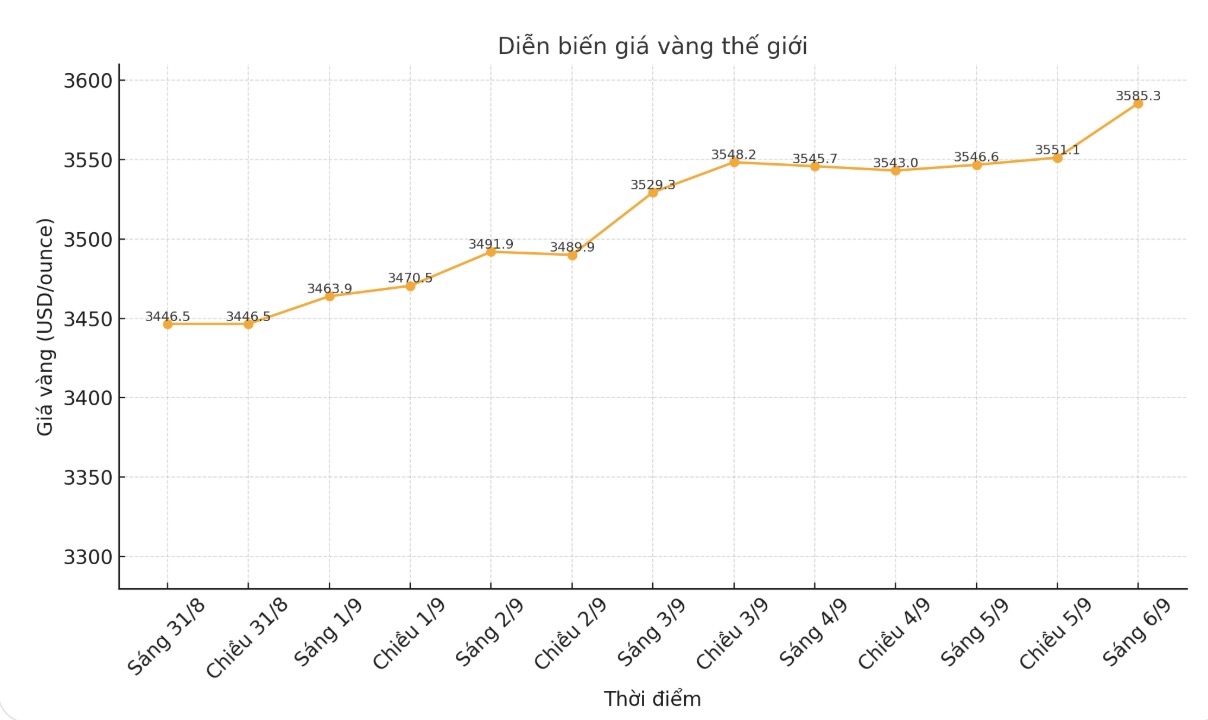

This weak data adds strength to gold, helping prices sometimes reach $3,600/ounce before the end of the week. The spot gold contract at 9:05 a.m. on September 6 (Vietnam time) was listed at 3,585.3 USD/ounce, up 38.7 USD compared to a day ago, and also marked a week increase of about 4%. This is also the best increase since mid-May, when prices maintained a accumulation zone around 3,300 USD/ounce.

The US non-farm payrolls report ended a gloomy week of labor data: ADP released weaker-than-expected private payrolls, while JOLTS showed a sharp decline in July recruitment positions.

Although the market expects the Fed to continue cutting interest rates after September, many experts have begun to question the room for further increases. In the long term, the sentiment towards gold remains extremely optimistic, but technically, some believe that prices are in the overbought zone.

Lukman Otunuga, Senior Market Analyst at FXTM, said: Fridays explosive rally is like a high-speed train heading towards the psychological threshold of $3,600/ounce.

With a foundational foundation supporting buyers, there is still room for gold prices to increase, but technically, prices are being overbought and can be adjusted.

If gold prices fall below $3,570 an ounce, sellers could target $3,540 an ounce and even $3,500 an ounce before the uptrend returns.

Ole Hansen - Head of Commodity Strategy at Saxo Bank said that with the current momentum, gold could move towards 3,800 USD/ounce in the next 3-4 months, especially as expectations of stronger interest rate cuts are growing, along with geopolitical risks and the Fed's independence.

Robert Minter - ETF Strategy Director at abrdn predicts gold will reach the target of 3,700 USD/ounce by the end of the year, even if the short term shows signs of overbought. He emphasized that central bank demand and investors before interest rate cuts are playing a pivotal role.

Aaron Hill - Market Analyst at FP Markets also agreed that gold is not overbought: "Dynamics such as safe-haven demand, net buying from central banks and trade concerns "geopolitics still maintain strong demand".

Some experts believe that the decisive factor is still the FED. Currently, the market expects a cut of 25 basis points, but the possibility of 50 basis points is still open, especially when inflation data is about to be released.

Aaron Hill added: If inflation in August (CPI/PPI) falls sharply, the scenario of a 50 basis point cut will have more reasons, although it is still uncertain.

Even if the Fed does not take drastic action, a prolonged easing cycle will provide the same reassurance for gold.

The likelihood of a 50 basis point cut is still low because the risk of inflation still exists, but even if there is a correction, I see it as a buying opportunity, notes Michael Brown, senior market analyst at Pepperstone.

Economic data to watch next week

Wednesday: US Producer Price Index (PPI).

Thursday: ECB monetary policy meeting, US consumer price index (CPI), US weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.