Gold price developments last week

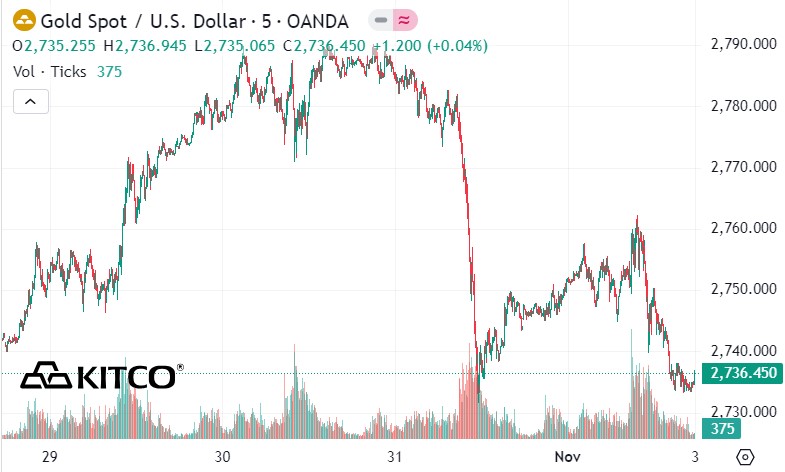

Gold prices sold off sharply on Thursday after hitting a new record high. Despite a modest rally on weak U.S. data, they ended the week nearly where they started.

Spot gold started the trading week above $2,733 an ounce. After rising to $2,757 an ounce on Monday evening and repeatedly testing $2,750 an ounce, traders pushed gold to a series of new highs on Tuesday.

Notably, gold prices rose as high as $2,788 an ounce before falling back to the mid-$2,770s at the open on Wednesday. After several unsuccessful attempts to break above the $2,788 resistance level, gold prices began to slide back to $2,775 an ounce on Wednesday evening.

The real surprise came on Thursday morning, when US core PCE data triggered a sell-off, sending the precious metal from $2,781 an ounce to $2,734 an ounce in less than three hours.

After that, gold prices tried many times to conquer the resistance level of 2,755 USD/ounce but failed.

On Friday morning, the market continued to receive US economic news. The October non-farm payrolls report showed that only 12,000 new jobs were created in September, much lower than the expected 100,000.

This immediately pushed the gold price down to $2,761/ounce. The price then gradually decreased and closed the trading week at $2,736.4/ounce.

Experts predict gold price next week

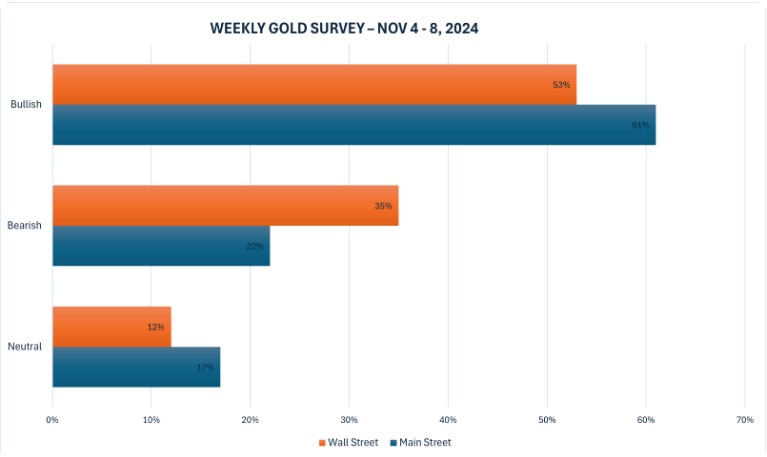

The latest Kitco News weekly gold survey shows bearish sentiment from both industry professionals and retail traders, with recent pullbacks and election uncertainty clearly weighing on the metals market.

Seventeen analysts participated in the Kitco News gold survey this week. Nine analysts see gold prices rising next week, while six see prices falling. Two analysts see gold trading sideways, saying they are waiting to see what the U.S. election and the Federal Reserve's next move will bring.

Meanwhile, 139 investor votes were cast in Kitco’s online poll, with the majority of investors looking for gold to trend higher next week, although many votes were cast before the October 31 sell-off.

85 traders expect gold prices to rise next week. Another 31 expect the precious metal to fall. The remaining 23 investors see gold prices moving sideways next week.

The US election will have a big impact on gold prices next week. Central banks will also be in focus, with the Reserve Bank of Australia’s monetary policy decision scheduled for Monday evening and the Bank of England and the US Federal Reserve’s monetary policy decisions due on Thursday.

Markets will also be looking ahead to Thursday's US weekly jobless claims numbers and Friday morning's preliminary report on consumer sentiment from the University of Michigan.

See more news related to gold prices HERE...