Central exchange rate of VND/USD

This morning (October 27), the State Bank of Vietnam announced the central exchange rate at 25,098 VND/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,894 - VND 26,302/USD.

At the State Bank of Vietnam Transaction Office, today's reference exchange rate is specific as follows:

Buy in: VND 23,894/USD.

Selling: VND 26,302/USD.

Domestic bank USD prices remain unchanged and black market USD increases

At most commercial banks, the USD price today is flat in both buying and selling directions. Meanwhile, the price of black market USD is still vibrant, fluctuating between 27,571 - 27,673 VND/USD (buy - sell), increasing by 116 VND/USD and 98 VND/USD respectively at the close of the previous session.

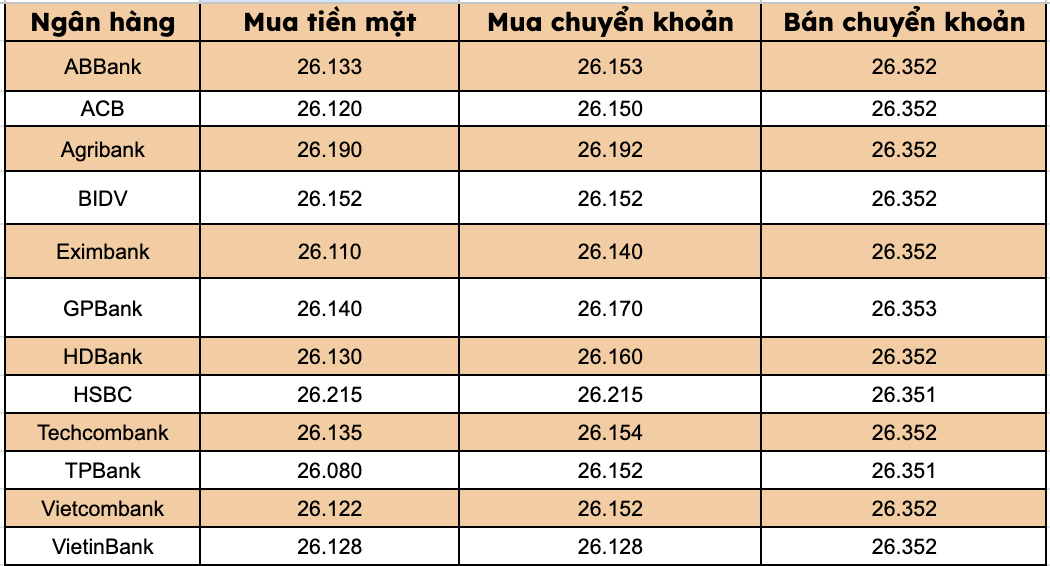

Banks listed USD selling prices at VND26,352/USD, unchanged from the previous session.

The bank with the highest cash and transfer price of USD: HSBC (26,215 VND/USD).

The difference between buying and selling prices at banks ranges from 137-272 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against the USD was currently trading at 152.87 USD/JPY, maintaining an increase of 0.18%. Similarly, in the free market, this pair of exchanges is trading between 177.45 - 178.65 USD/JPY (buy - sell), all raising prices compared to the previous session's close.

Assessment and forecast

According to Reuters, US major stock indexes increased sharply with all three major indexes closing at record highs, after news of US inflation last month increased lower than expected, while the USD index was almost flat.

According to the report, the US consumer price index (CPI) increased by 0.3% in September, lower than the forecast of 0.4%, after increasing by 0.4% in August. This data reinforces expectations that the US Federal Reserve (Fed) will continue to cut interest rates at its policy meeting next week.

"Inflation data shows that we are not in the same crisis as in 2022", Callie Cox, chief strategist at Ritholtz Wealth Management ( Charles, North Carolina) said. Prices are still increasing, but at a controllable level. That is good news if the Fed continues to cut interest rates."

The fact that the Fed is likely to cut interest rates often weakens the USD in the global market. For Vietnam, this will help reduce pressure on exchange rates, which have been under a lot of pressure since the beginning of the year.