Central exchange rate of VND/USD

This morning (October 25), the State Bank of Vietnam announced that the central exchange rate remained unchanged, currently at VND 25,098/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,894 - VND 26,302/USD.

At the State Bank of Vietnam Transaction Office, today's reference exchange rate is specific as follows:

Buy in: VND 23,894/USD.

Selling: VND 26,302/USD.

Domestic bank USD and black market USD increase and decrease alternately

At most commercial banks, the USD price today increased and decreased alternately in the buying and selling directions. In the same direction, the price of black market USD reversed and increased, fluctuating between 27,455 - 27,575 VND/USD (buy - sell), and increased by 146 VND/USD compared to the previous session's close.

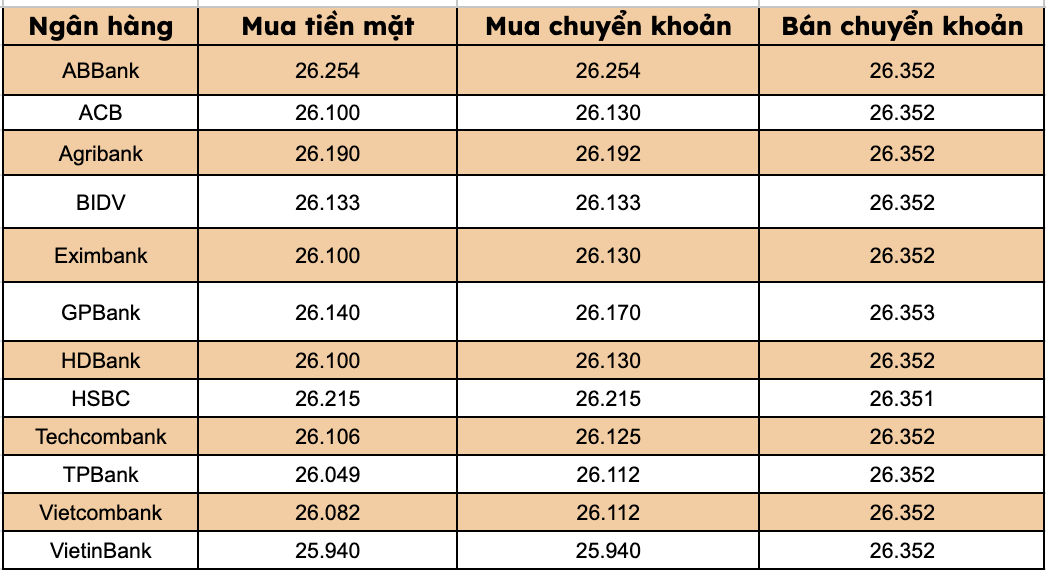

Banks listed USD selling prices at VND26,352/USD, unchanged from the previous session.

Bank with the highest cash and transfer price: HSBC (26,215 VND/USD, down 5 VND/USD).

The difference between buying and selling prices at banks ranges from 137-272 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against USD was currently trading at 152.69 USD/JPY, continuing to increase. Meanwhile, in the free market, this pair of exchanges is trading between 177.19 - 178.39 USD/JPY (buy - sell), all increasing in price compared to the previous session's close.

Assessment and forecast

The USD remained stable in the previous trading session, preparing to record a slight increase this week as investors were ready to wait for US late inflation data. This data is not expected to change the US Federal Reserve's decision to lower interest rates next week.

In addition to policy meetings of the Japanese and US central banks next week, investors are also focusing on the upcoming meeting between President Donald Trump and Chinese President Xi Jinping in South Korea, causing the currency market to be quite quiet during the day.

New US sanctions against two major Russian oil and gas companies Rosneft and Lukoil, along with previous UK sanctions, have contributed to pushing up oil prices, putting pressure on oil import currencies such as the Japanese Yen.

The fate of the Japanese Yen is also affected by the policies of current Prime Minister Sanae Takaichi - who supports fiscal and monetary stimulus measures.

Takaichi is preparing an economic stimulus package that could surpass last year's $92 billion to help people cope with inflation.

This policy could make the Bank of Japan more cautious about raising interest rates, with a probability of increasing by only about 19% at its meeting on October 30.

With the close coordination between the Japanese government and the BOJ, the rate hike could be delayed until the stimulus package is approved by the National Assembly, according to Joseph Capurso.