Central exchange rate of VND/USD

This morning (October 26), the State Bank of Vietnam announced the central exchange rate unchanged, currently at 25,098 VND/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,894 - VND 26,302/USD.

At the State Bank of Vietnam Transaction Office, today's reference exchange rate is specific as follows:

Buy in: VND 23,894/USD.

Selling: VND 26,302/USD.

Domestic bank USD prices remain unchanged and black market USD increases

At most commercial banks, the USD price today is flat in both buying and selling directions. Meanwhile, the price of black market USD is still vibrant, fluctuating between 27,571 - 27,673 VND/USD (buy - sell), increasing by 116 VND/USD and 98 VND/USD respectively at the close of the previous session.

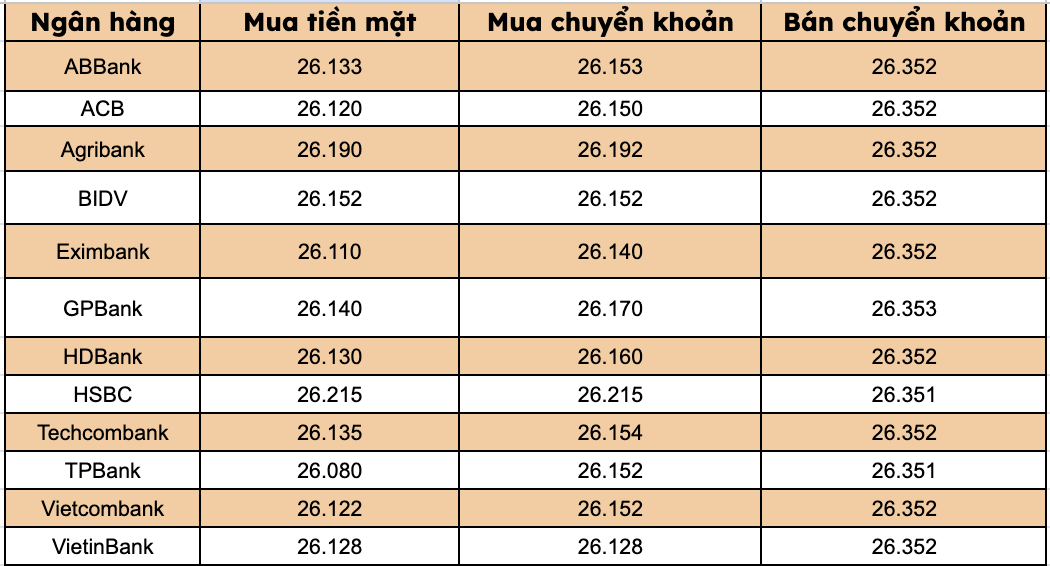

Banks listed USD selling prices at VND26,352/USD, unchanged from the previous session.

The bank with the highest cash and transfer price of USD: HSBC (26,215 VND/USD).

The difference between buying and selling prices at banks ranges from 137-272 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against USD was currently trading at 152.87 USD/JPY, continuing to increase by 0.18%. Similarly, in the free market, this pair of exchanges is trading between 177.45 - 178.65 USD/JPY (buy - sell), all raising prices compared to the previous session's close.

Assessment and forecast

The greenback is supported by the existing US home sales report, showing sales increased by 1.5% compared to the previous month, reaching 4.06 million units. This is the highest level in 7 months, this figure is also in line with the forecast.

In addition, rising US Treasury yields also help widen the yield gap to benefit the USD.

The weak Yen continues to give the USD an advantage, as the Yen falls to its lowest level in 1.5 weeks due to concerns that new Japanese Prime Minister Sanae Takaichi will pursue a more dovish monetary policy, reducing the attractiveness of the Japanese Yen.

The USD is further supported after the White House confirmed that President Donald Trump will meet with Chinese President Xi Jinping in South Korea, on the sidelines of the Asia-Pacific Economic Cooperation (APEC) Summit.

However, the USD's gains have been held back by continued US government shutdowns. The longer it takes, the higher the risk of damage to the US economy, increasing the possibility that the Federal Reserve (Fed) will have to cut interest rates.

The market is currently pricing in a 99% chance that the Fed will cut by 25 basis points at the FOMC meeting on October 28-29.