USD Index

On December 1, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies continued to maintain a slight decrease of 0.14%, anchored at 99.46 points.

The US dollar ended the week on November 24-30, which was its biggest decline since late July, as traders increased their bet that the US Federal Reserve (Fed) would continue to cut interest rates next month.

The USD Index, which measures the strength of the greenback against a basket of six major currencies, fell to 99.44 points for the week. This is the lowest mark since July 21.

The greenback weakened this week as investors concluded that a series of weak labor data would force the Fed to cut interest rates further, although many Fed officials were still concerned about high inflation.

Mr. Eric Theoret - foreign exchange strategist at Scotiabank (Toronto) - commented: "It can be seen that after a series of data released after the reopening period of the government, it has generally weakened... The overall data is leaning towards the possibility of the Fed cutting interest rates".

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on December 1, the State Bank announced that Vietnam's central exchange rate is currently at VND 25,155.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: 23,948 VND - 26,362 VND.

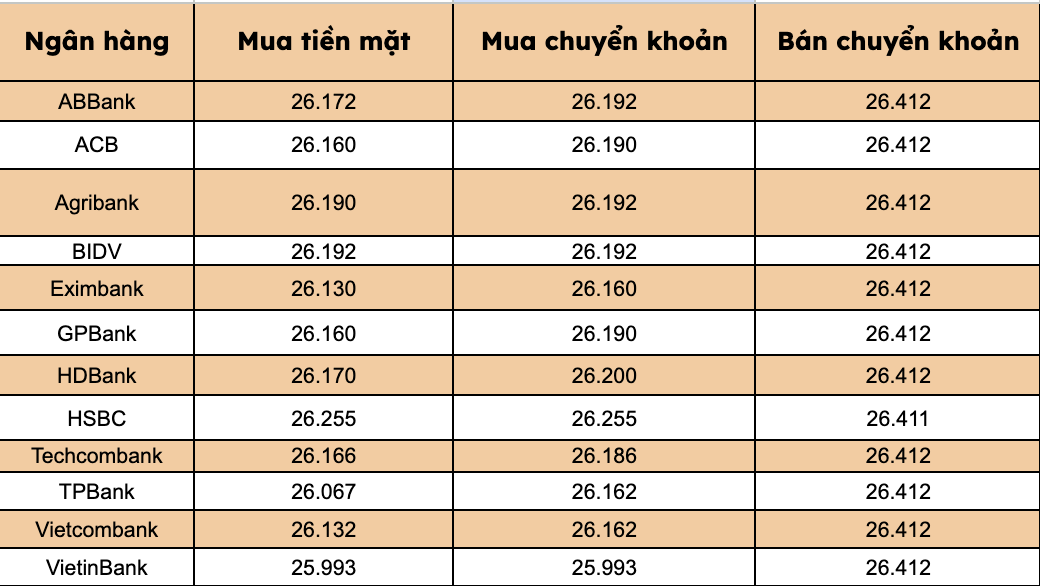

At commercial banks, USD prices have a strong price drop at the closing session of the week.

Most banks listed USD selling prices at VND26,412/USD.

Bank with the highest cash and transfer price: HSBC (26,255 VND/USD).

The difference between buying and selling prices at banks fluctuates within a large range of 157-419 VND/USD.