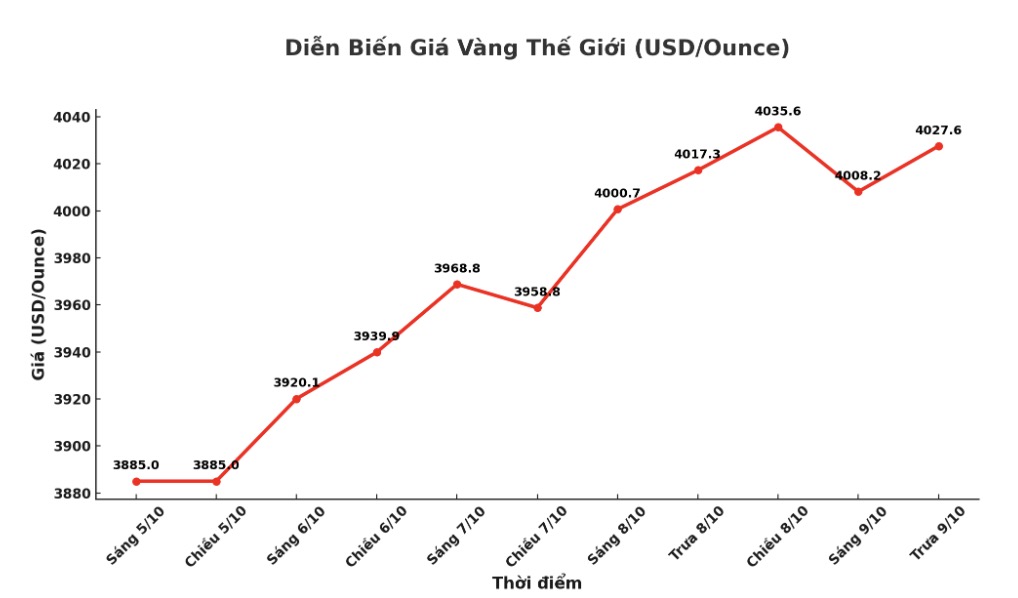

The world is paying attention to the historic milestone when gold prices surpassed the threshold of 4,000 USD/ounce. Expert Bernard Dahdah - one of the first to predict this milestone, said that although gold is showing impressive upward momentum, the market could still fluctuate strongly as investor sentiment changes.

Dahdah believes there will be a period of adjustment in the short term, but the medium-term outlook to 2026 is still positive. Gold prices may be at risk of falling in the coming months, but there will be many factors supporting price increases in 2026, he said.

According to Dahdah, selling pressure may appear when the exchange increases its deposit, forcing investors to use leverage to sell off, along with profit-taking activities. This situation has happened many times in the past, causing a 5-10% decline in just a few days, such as the US public debt period in 2011, the COVID-19 pandemic in 2020 or the Ukrainian conflict in 2022.

Gold could also face difficulties if the US Congress passes a new budget bill to end a government shutdown, which has now entered its second week. According to him, the previous US government shutdowns (2013 under Barack Obama and 2019 under Donald Trump) have all cooled the gold market after the problem was resolved.

The two most effective factors affecting gold today, according to Dahdah, are US monetary policy and fluctuations in Treasury bond yields. Although the US Federal Reserve (FED) is expected to cut interest rates at two upcoming meetings, there is still much uncertainty about policy orientation until 2026.

He also noted that concerns about stagflation and recession caused by new tariffs and global trade tensions are causing international investors to reduce their holdings of US bonds.

In just two weeks after Liberation Day, capital outflows from US exchange-traded funds have reached $150 billion the highest level since the financial crisis, and some of them have flowed into gold, contributing to a strong rally in prices, he said.

According to Natixis' calculations, if only 1% of capital flows withdraw from US monetary funds, if 20% of them turn to physical gold, gold prices can increase by about 10%. However, Dahdah has warned that current high prices could reduce physical demand for gold, especially in the jewelry industry, and slow central bank purchases.

At this price, we have seen a decline in demand for jewelry and a slowdown in central bank purchases. These two sources of demand account for about 70% of total global gold demand, he said.

Natixis forecasts that the average gold price in 2026 will be around 3,760 USD/ounce.

See more news related to gold prices HERE...