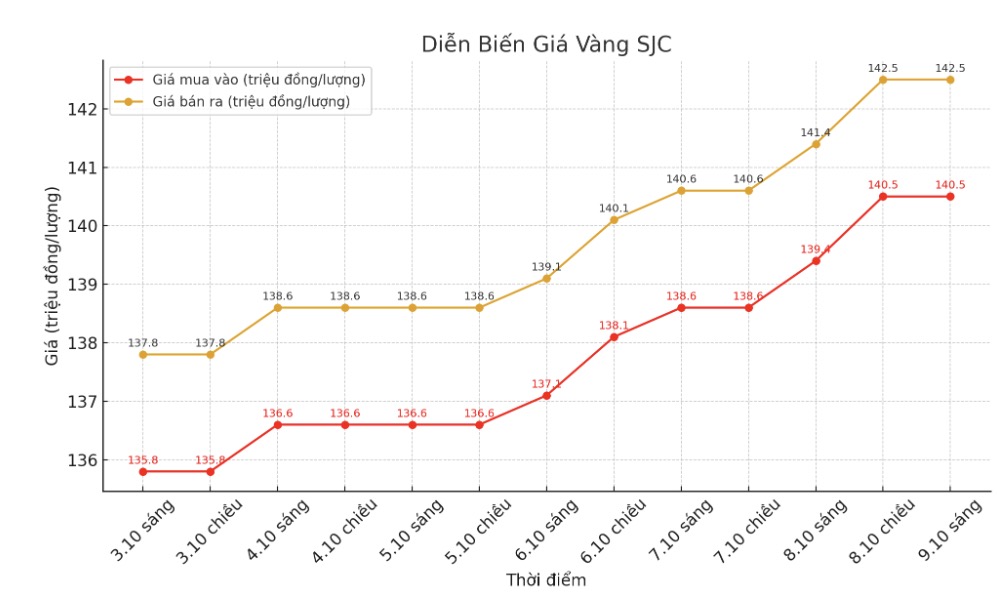

Updated SJC gold price

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at VND 140.5-142.5 million/tael (buy in - sell out), an increase of VND 1.1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 140.5-142.5 million VND/tael (buy in - sell out), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 140-142.5 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 1.1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

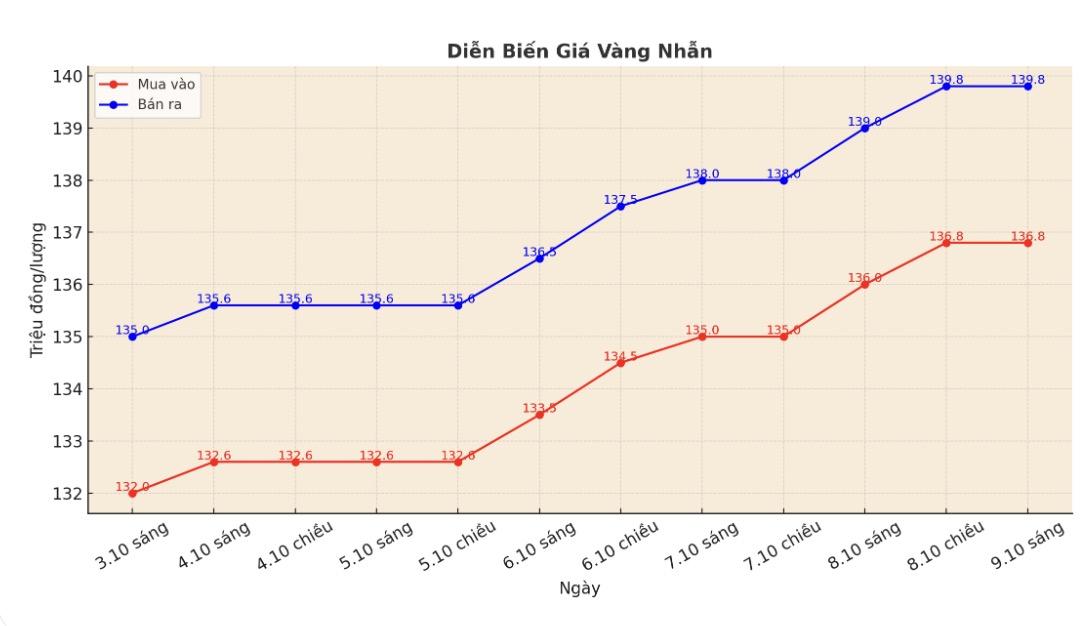

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 136.8-139.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 138.2-141.2 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 137.5-140.5 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

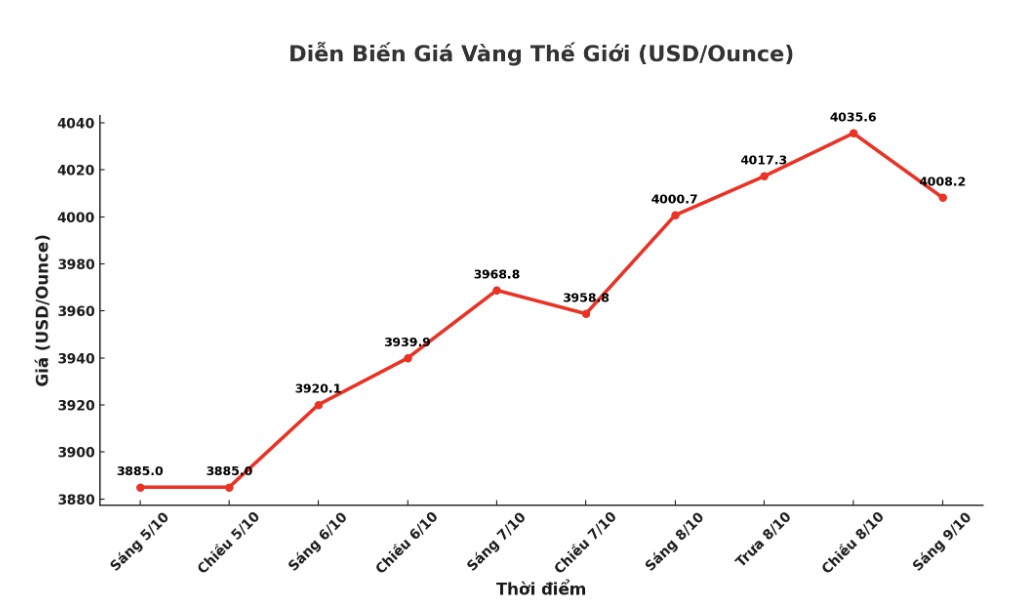

World gold price

At 9:20 a.m., the world gold price was listed around 4,008.2 USD/ounce, up 7.5 USD.

Gold price forecast

World gold prices are facing a wave of profit-taking as prices skyrocket to a record high.

In the latest report on gold's upward momentum, Mr. Bart Melek - Head of Commodity Strategy at TD Securities - said that with the current strong growth rate and growth, the risk of taking profits in the short term may appear. He noted that since gold's August breakthrough, prices have risen $670 an ounce, or more than 20% in just two months. At the same time, spot gold prices are currently at 4,043.8 USD/ounce, up more than 50% since the beginning of the year.

This precious metal is in a state of overbought, which means that any factor that makes the market suspect the speed of the Fed's interest rate cuts or increases volatility can also pull prices down sharply. The market could see a significant correction in the late summer in the short term, Melek said.

Regarding the downside risk, he said gold prices could adjust to around $3,600/ounce. However, Melek sees the declines as a buying opportunity, as he expects the uptrend to continue into the first half of next year.

Commenting on the recent increase in gold, Ole Hansen - Head of Commodity Strategy at Saxo Bank said that this precious metal has entered an unprecedented level as the market witnessed spot prices surpassing the threshold of 4,000 USD/ounce and then increasing steadily - despite the recovery of the USD and the FED's return to caution about the speed of interest rate cuts in the future.

Hansen wrote in the latest update: This milestone changes the markets view of the driver of gold prices and perhaps the concept of safe-haven assets in the eyes of todays investors.

Hansen believes that gold's surpass of the $4,000 mark comes not only from interest rate factors or currency fluctuations. This is a sign of change in global sentiment and capital flows.

In the context of many fluctuations in the world economy, confidence in traditional safe havens such as the USD and US government bonds is being affected. Geopolitical risks, fiscal policies and the need to diversify portfolios have caused both institutional and national investors to increase their access to tangible assets such as gold, he said.

Technically, analysts said that buyers are still clearly dominating the short-term technical chart. Gold's next target is to close above the strong resistance level of 4,100 USD/ounce. On the contrary, the sellers will aim to pull the price below the technical support zone of 3,850 USD/ounce.

The first resistance level was today's record high (US$4,072.40/ounce), then US$4,100/ounce; the closest support was at the bottom of the night at $4,005.6/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...