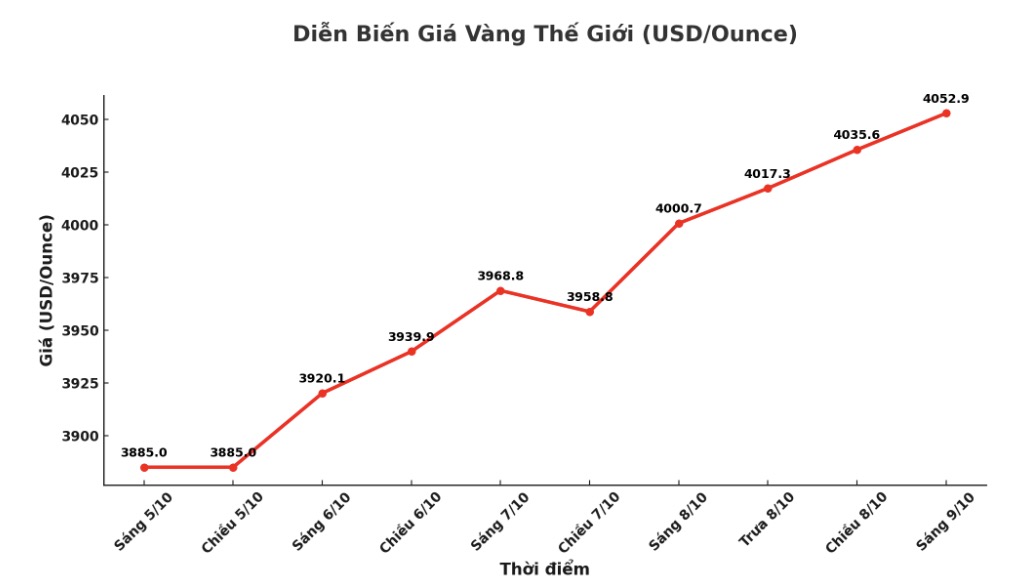

Ole Hansen - Head of Commodity Strategy at Saxo Bank commented that the continuous increase in gold has entered an unprecedented level as the market witnessed spot prices surpassing the threshold of 4,000 USD/ounce and then increasing steadily - despite the recovery of the USD and the FED's return to caution about the speed of interest rate cuts in the future.

Hansen wrote in the latest update: This milestone changes the markets view of the driver of gold prices and perhaps the concept of safe-haven assets in the eyes of todays investors.

Hansen believes that gold's surpass of the $4,000 mark comes not only from interest rate factors or currency fluctuations. This is a sign of change in global sentiment and capital flows.

In the context of many fluctuations in the world economy, confidence in traditional safe havens such as the USD and US government bonds is being affected. Geopolitical risks, fiscal policies and the need to diversify portfolios have caused both institutional and national investors to increase their access to tangible assets such as gold, he said.

He said 2022 was a turning point, as Western sanctions froze Russia's central bank reserves and China began to increase its gold holdings. Since then, central banks have added more than 1,000 tonnes of gold per year a record high, while institutional investors have also increased their holdings of physical gold and gold-backed ETFs.

Accordingly, the market is no longer dominated by short-term speculative cash flow reacting to real interest rates, but by long-term demand, with a safety search structure. The correlation that was once tightly linked between gold prices and real US yields has clearly weakened, suggesting that political, fiscal and strategic factors are now the main drivers, Hansen said.

For decades, gold has often moved in reverse to real US interest rates. When real yields increase, gold decreases; when real yields decrease, gold increases. The simple reason is that gold does not yield interest, so it is difficult to compete with assets with interest rates. But that model began to crack in 2022 when the Fed increased interest rates sharply while gold prices remained steady, Hansen explained.

Even with the Fed raising 525 basis points in 17 months, gold prices have not collapsed thanks to central bank buying and demand in China compensating for selling pressure from Western funds. At the end of 2022, many attempts to pull prices below $1,615/ounce failed, paving the way for a recovery and a breakthrough in March 2024 when it surpassed $2,075/ounce - the ceiling that has existed for three years. When this threshold is exceeded, the increase will be reinforced by strong capital flows from both institutional and individual investors, he said.

Since then, gold has not returned, and other precious metals have also joined the race. Since the beginning of the year, gold has increased by about 52%, silver has increased by 64%, platinum has increased by 86%, while palladium has also increased by nearly 50%. The spread of this rally shows that this is not just a story of gold, but an overall shift to intangible assets, Hansen said.

Hansen stressed that demand from China - mainly from domestic economic factors - was the key driver of this increase. As real estate prices have fallen after many years of continuous increases, Chinese households tend to seek gold as an alternative investment channel, driven by the psychology of prioritizing safe-haven assets.