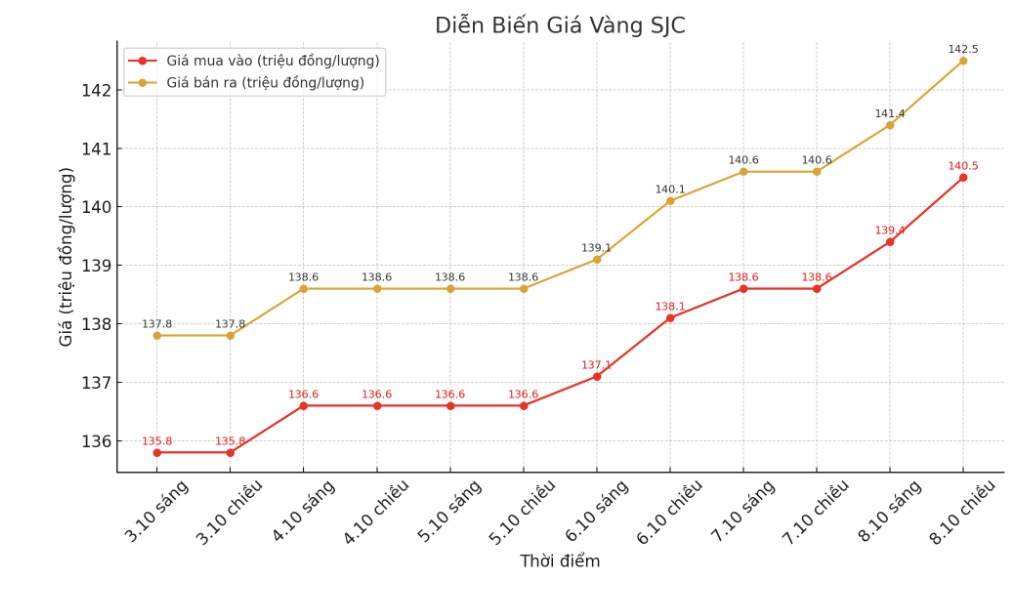

SJC gold bar price

As of 5:45 p.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 140.5-142.5 million VND/tael (buy in - sell out), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 140-142.5 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and an increase of 1.9 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

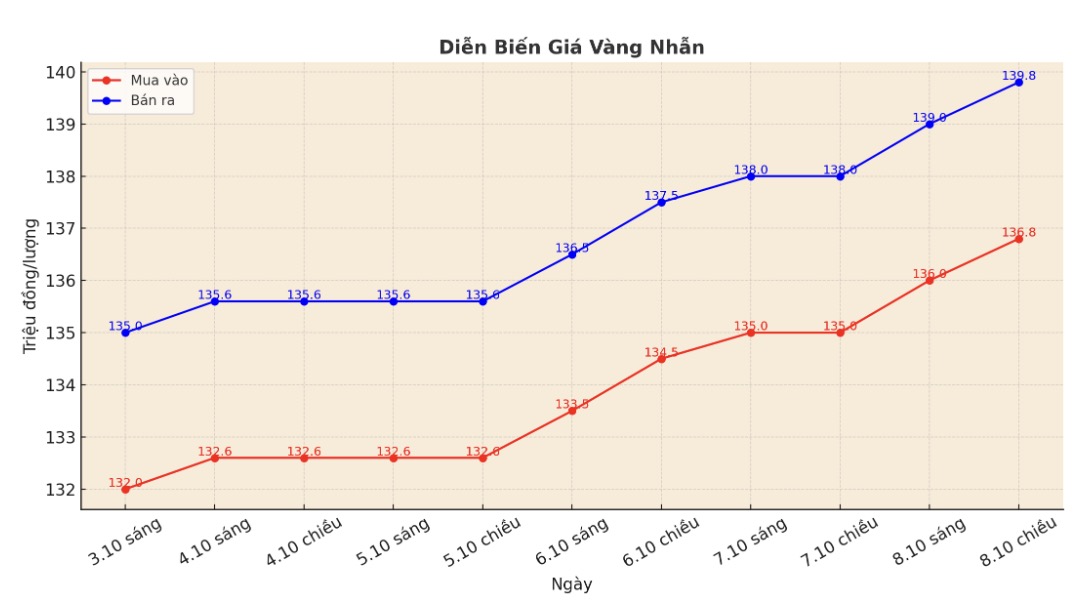

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 136.8-139.8 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 138.2-141.2 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 137.5-140.5 million VND/tael (buy in - sell out), an increase of 2.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

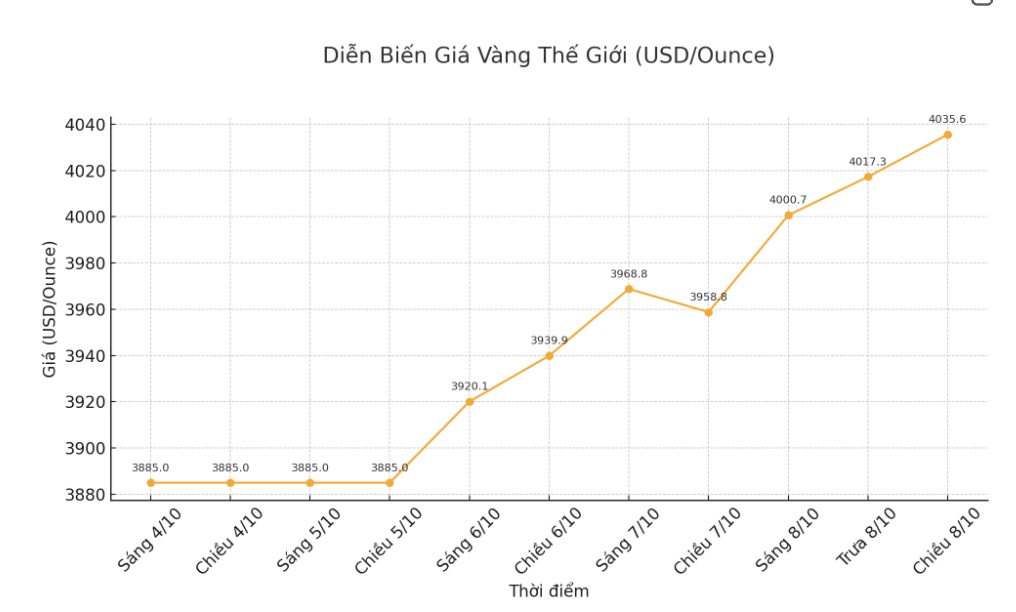

World gold price

The world gold price was listed at 5:45 p.m. at 4,035.6 USD/ounce, up 76.8 USD compared to a day ago.

Gold price forecast

After surpassing the 4,000 USD/ounce mark, world gold prices continued to maintain a strong increase, setting many new records in history.

The gold price increase is driven by the psychology of finding a safe haven amid global economic and geopolitical instability and expectations that the US Federal Reserve (FED) will continue to lower interest rates.

Independent metals trader Tai Wong commented: "If the belief in this trend is too strong, the market will continue to move towards the next round of 5,000 USD/ounce, especially when the FED is likely to continue to lower interest rates".

He also said that although there may be technical stops such as extended ceasefire agreements in the Middle East or Ukraine, fundamental factors such as huge public debt, the trend of diversifying reserves and a weak USD will still maintain the leading role in gold prices in the medium term.

The market is betting on the possibility of the Fed cutting 25 basis points at its meeting this month, and another 25 basis points in December, said Tim Waterer, chief analyst at KCM Trade. High levels of uncertainty often fuel gold prices to increase, and that is happening again.

Lower interest rates in the US and the continued government shutdowns are supporting gold, but profit-taking pressure around the $4,000 mark could pose a risk of short-term adjustment.

Despite the rising gold price, the People's Bank of China (PBOC) continued to increase gold reserves in September, marking the 11th consecutive month of buying.

As of the end of September, China's gold reserves reached 74.06 million ounces, up slightly from 74.02 million ounces at the end of August. According to the PBOC, the value of the country's gold reserves at the end of last month reached 283.29 billion USD, higher than the 253.84 billion USD in August.

This strong figure reinforces the view that China is looking to reduce its dependence on the US dollar and accelerate de-dollarization, Ross Norman, an independent precious metals analyst, told Reuters.

Even small purchases will be seen as a positive domestic signal, helping to narrow the significant price difference on Loco Shanghai and strengthening the confidence of investors, ETFs and institutions that gold prices will continue to increase, he added.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...