According to Kitco, three weeks ago, December silver contracts hit a peak of 53.76 USD/ounce, attracting the attention of speculators looking for opportunities. The important reason for the sharp increase in prices is the shortage of physical silver in the London market, when lending interest rates increased due to increased demand for silver-backed ETFs, and consumers in India shifted from gold to silver.

However, silver shipments from the US and China have since helped ease supply pressure, contributing to a sharp drop in silver prices by 9.86% compared to a 52-week high.

Philip Streible, chief strategist at Blue Line Futures, said the recent 10% correction could worry investors, but this is a normal short-term volatility in the market. "These changes do not affect the fundamental elements of silver, which is very stable" - he commented.

The expert added that the long-term outlook for silver remains positive thanks to a 5-year supply shortage, while demand continues to outperform supply.

"Industrial demand is increasing, especially from the fields of solar energy, electric vehicles, 5G networks and AI hardware, continuing to boost the market. In addition, silver supply is limited because silver is often a byproduct of other metals such as copper and zinc, so increasing output to meet price fluctuations is almost impossible" - he analyzed.

Philip Streible believes that the above factors will play an important role in the fluctuations of silver prices in the coming time.

Similarly, Ole Hansen - Director of Commodity Strategy at Saxo Bank - said that gold and silver have both fallen sharply in recent periods of fluctuations, although prices have previously increased sharply. However, both metals recovered quickly as the market stabilized, showing that the fundamentals remained strong.

In fact, he believes that the risk of volatility still exists, especially from adjustments related to stocks and AI, but the main impact is the short term and mechanical.

"Even markets with a solid foundation can be temporarily affected if capital flows are withdrawn or suddenly move," the expert said.

However, Ole Hansen believes that long-term supporting factors for gold and precious metals remain stable, including: fiscal instability, persistent inflation, demand from central banks and investors, falling real interest rates, and geopolitical risks.

Meanwhile, industrial metals continue to benefit from structural needs such as electrification, power grid expansion, data center infrastructure, when supply is still limited.

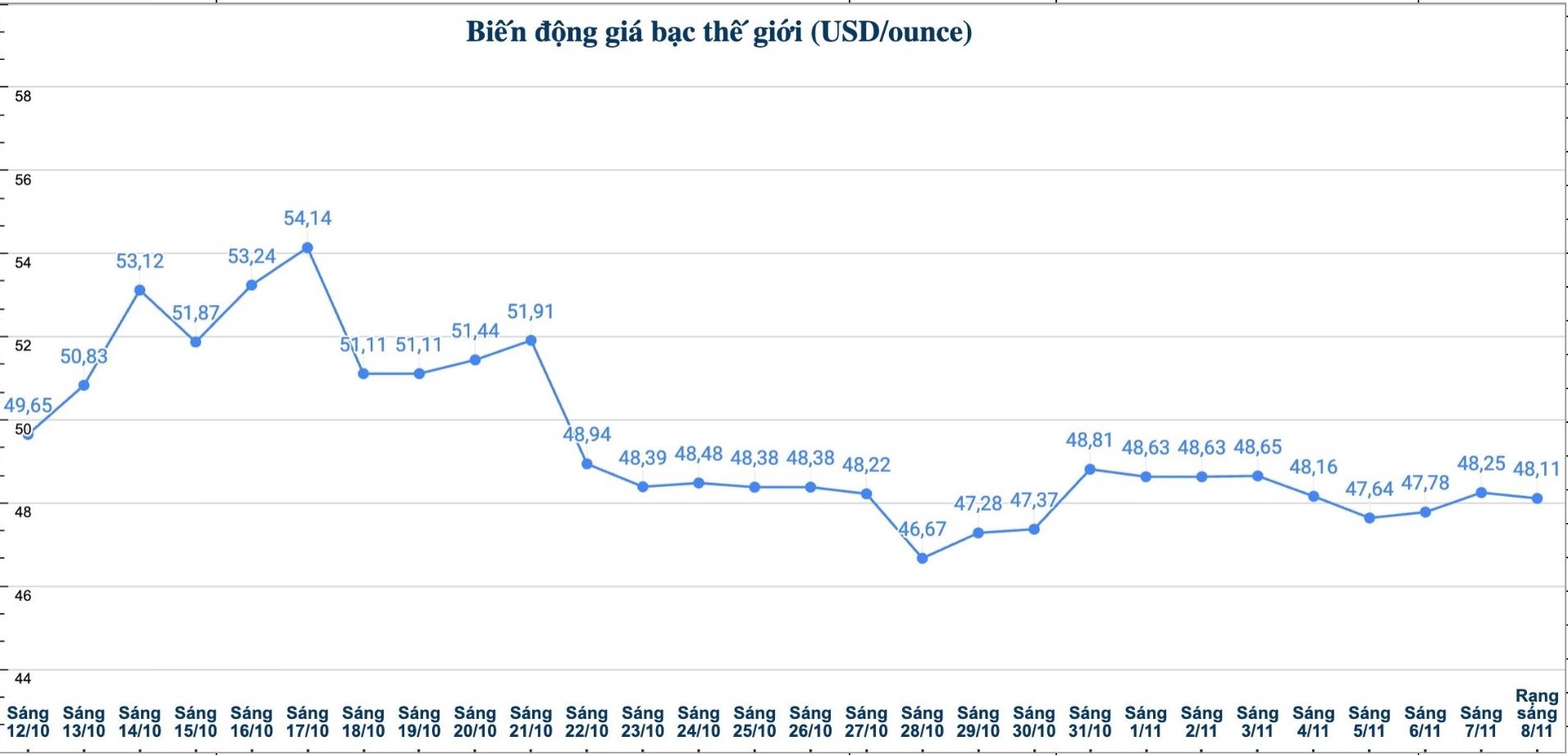

Updated silver price

As of 6:00 a.m. on November 8, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.860 - 1.902 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 48.910 - 50.270 million VND/kg (buy - sell).

The price of 999 gold bars of Golden Rooster 999 (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) is listed at 1.854 - 1.902 million VND/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.870 - 1.928 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.866 - 51.413 million VND/kg (buy - sell).

See more news related to silver prices HERE...