Domestic silver price

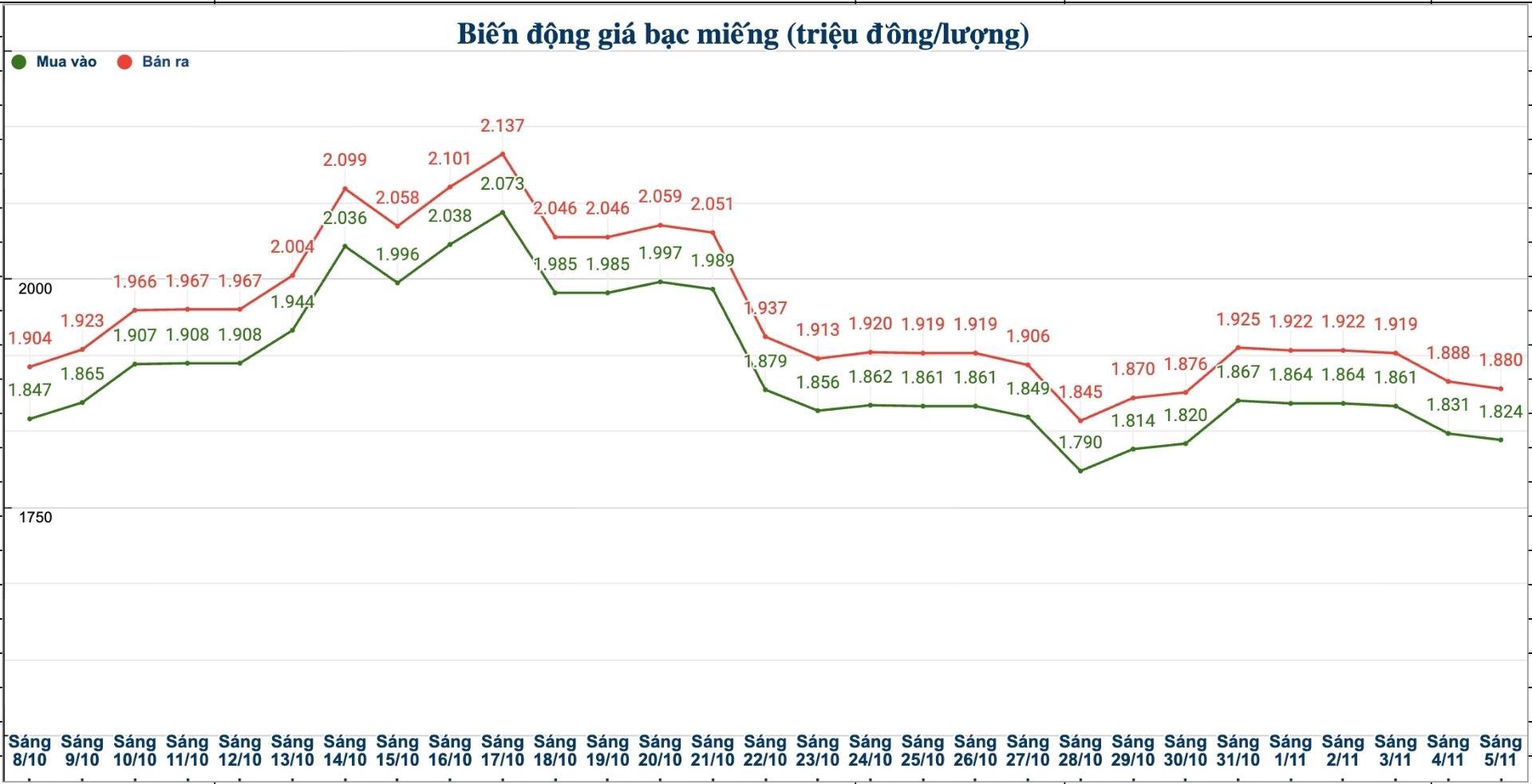

As of 10:30 a.m. on November 5, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.819 - 1.861 million VND/tael (buy - sell); down 22,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 47.846 - 49.176 million VND/kg (buy - sell); down 578,000 VND/kg for buying and down 588,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.812 - 1.860 million VND/tael (buy - sell); down 21,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.824 - 1.880 million VND/tael (buy - sell); down 7,000 VND/tael for buying and down 8,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 48.639 - 50.133 million VND/kg (buy - sell); down 187,000 VND/kg for buying and down 213,000 VND/kg for selling compared to yesterday morning.

World silver price

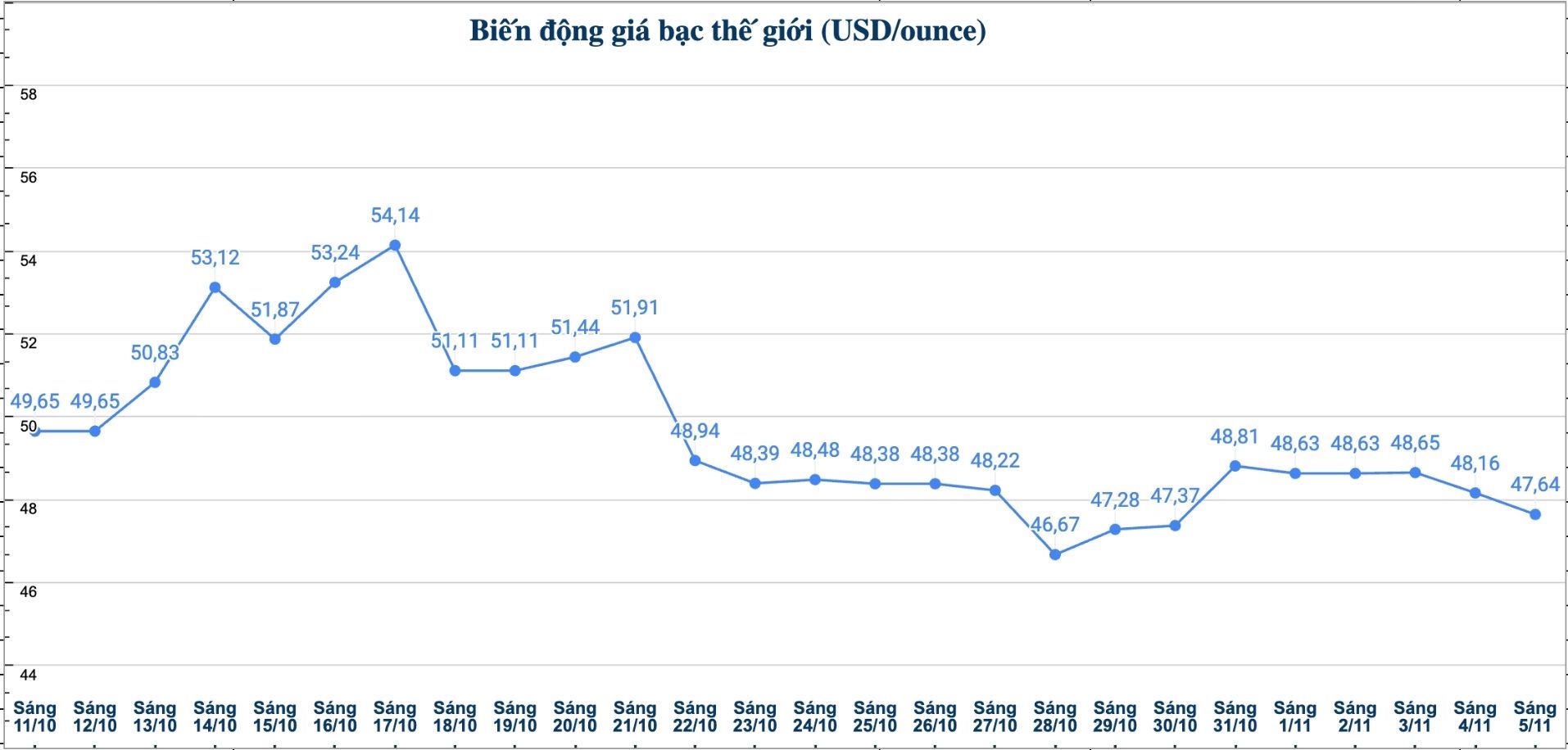

On the world market, as of 10:30 a.m. on November 5 (Vietnam time), the world silver price was listed at 47.64 USD/ounce; down 0.52 USD compared to yesterday morning.

Causes and predictions

Spot silver prices continued to fall in the trading session on Wednesday. If silver breaks through the $45.79/ounce mark, the previous uptrend could break, opening up the possibility of deeper corrections to support zones of $44.22/ounce and $41.40/ounce, according to FX Empire precious metals analyst James Hyerczyk.

"On the contrary, the nearest resistance level is determined around 49.38 - 49.46 USD/ounce, while the 50.02 - 51.07 USD/ounce zone is considered a strong barrier. Currently, the 45.79 USD/ounce area is still an important fulcrum for the short-term trend," he said.

James Hyerczyk said the US dollar index surpassed the 100-point mark - its highest level since early August - as expectations of the US Federal Reserve (FED) continuing to cut interest rates in December weakened.

"The stronger US dollar is putting significant pressure on the precious metal group, as gold falls below $4,000/ounce and silver is under further downward pressure," the expert said.

He added that safe-haven demand is also increasing for the US dollar, Japanese yen and Swiss francs, amid weak risk sentiment due to weak manufacturing data and the risk of a US government shutdown.

"The strong USD, risk-off sentiment and weak expectations of the Fed continuing to cut interest rates will continue to put pressure on silver prices in the coming time, until there are clearer signals from the US economy or monetary policy" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...