Stress on material silver supply

The pressure is mounting on the physical silver market, focusing on the world's two most important trading floors: COMEX in New York - the largest futures exchange in the US - and the London market - the world's leading physical silver trading floors.

Mr. Robert Gottlieb - Former precious metals trader and CEO at JPMorgan Chase & Co - said that the amount of physical silver withdrawn from COMEX's warehouses is accelerating, signaling great pressure in the global metal delivery system.

"In the past two weeks alone, 29 million ounces of silver have been withdrawn from COMEX's warehouse," he said.

He added that the physical withdrawal came after a volatile week, when gold plummeted nearly 5.5% in the third session, from more than 4,360 USD/ounce to nearly 4,120 USD/ounce and then rebounded; while silver fell as much as 7.5% in the same session.

According to Gottlieb, strong demand has caused the "free circulation" of silver in London warehouses to run out.

"The amount of free silver in London has fallen from 305 million ounces to only about 125 million ounces. That creates this tension," he said.

According to the expert, the shortage in London has caused a fierce reversal in metal flows. Higher spot silver prices in London help banks make a profit when withdrawing silver from COMEX to the UK.

Gottlieb also gave a remarkable figure for the shortage of supply: "I believe the London market needs about 100-150 million ounces of physical silver to return to normal."

"Leak" speculation - but warns of greater risks

Mr. Gottlieb said that the recent shocking decline was actually a positive development, helping the market "squeeze" less investors with weak psychology and short-term speculation.

Looking ahead, Gottlieb said, the important thing to watch is the results of the Section 232 assessment of silver - an investigation into whether silver is considered an important mineral for US national security.

If classified, the expert noted that the market could be strongly affected: The biggest possibility is the tax - causing the flow of silver from COMEX abroad to be blocked and domestic silver prices to increase; or a more extreme scenario is to limit exports or control inventories to serve the defense industry, AI, energy, etc.

He also warned that tightening imports will not help replenish domestic supply: "Tax will not create even an ounce of silver in the US, because more than 70% of silver is mined as a by-product of other metals."

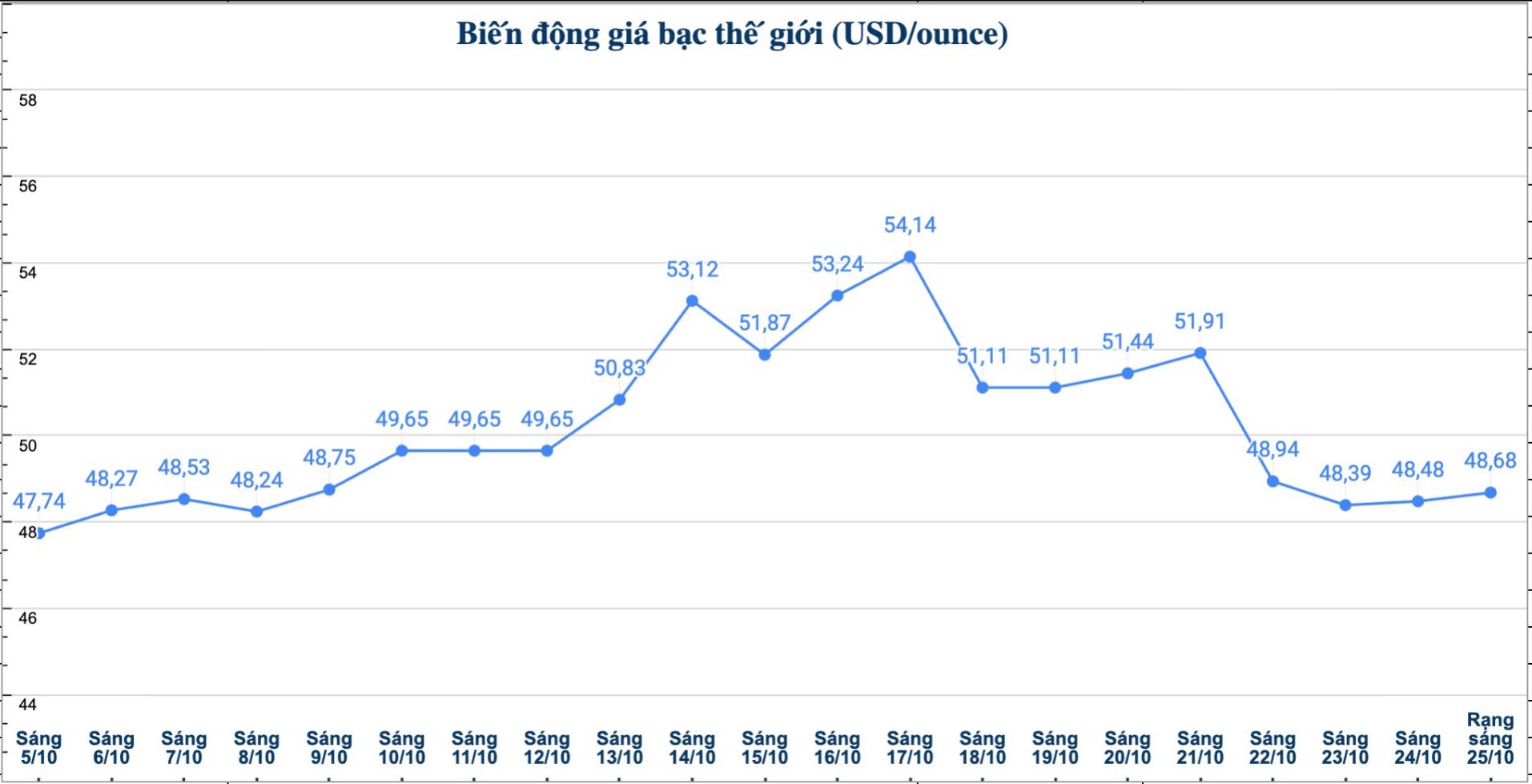

As of 00:45 on October 25 (Vietnam time), the world silver price was listed at 48.68 USD/ounce.

Update on domestic silver prices

As of 6:00 a.m. on October 25, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.866 - 1.908 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 49.010 - 50.430 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.845 - 1.902 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.199 - 50.719 million VND/kg (buy - sell).

See more news related to silver prices HERE...