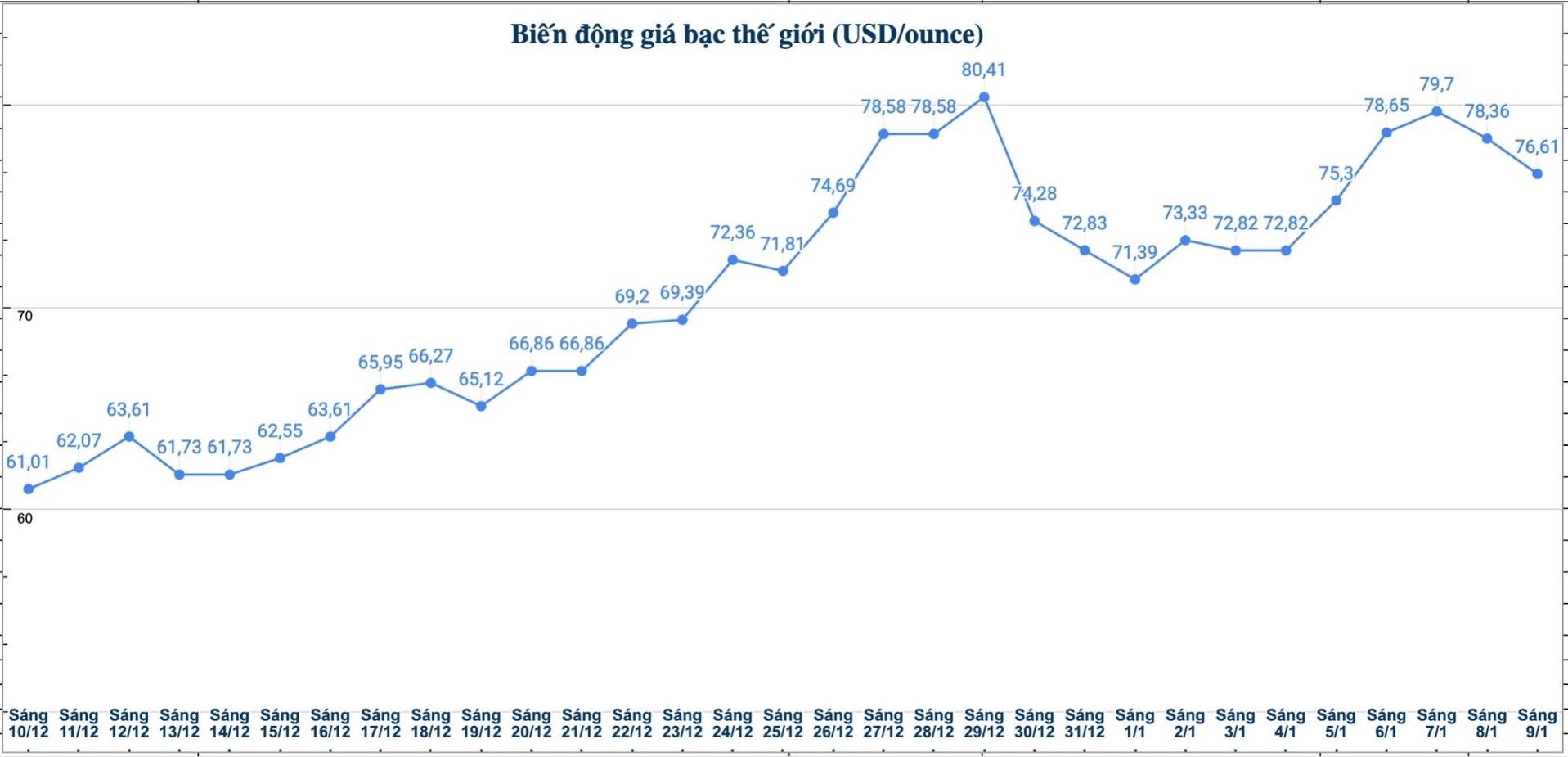

Despite a positive start in the new year, the silver market is still facing difficulties as it cannot maintain a price above 80 USD/ounce. This precious metal has not yet recovered from the sell-off last week, which took place right after the Chicago Mercantile Exchange (CME) increased margins for precious metal contracts.

While the market is forecast to continue to fluctuate strongly, a fund manager and strategist warned investors not to be swept away by superficial turbulence.

In the last week of 2025, silver futures recorded the strongest weekly decline since March, when the global market was shaken by US President Donald Trump's global tax plans.

In a recent comment posted on LinkedIn, Jen Bawden - founder and CEO of Bawden Capital - said that CME's increase in margin for speculative control is actually just a "vent" to hide a more serious issue, which will ultimately push silver prices much higher. She said she expects silver prices to rise to $200/ounce.

According to Bawden, mainstream media would argue that this price drop is due to excessive speculation and year-end profit-taking activities, but she affirms that view is wrong. She said that for those who experienced the 2000 and 2008 crises, this was not a market crash but a coordinated rescue to protect the banking system, especially large banks and financial institutions specializing in trading precious metals and materials, especially gold and silver, on a global scale that are suffering heavy losses due to virtual silver sales, taking place right before the global physical silver market is at risk of leaving the paper market.

According to her, this deposit increase is a "price gouging" on the paper market, used as a tool to reduce pressure on financial institutions facing material inadequacy.

Bawden believes that the decrease in silver futures prices does not reflect the reality of the physical market. On the contrary, the underlying factors show that the supply of physical silver is becoming increasingly tense and will tighten further, especially after China restricted refined silver exports from January 1. According to her, this policy, which affects about 70% of global physical silver supply, will fundamentally change the flow of metals in the world market.

Some analysts see the CME increase in margin as a sign that the market may have peaked, similar to what happened in the early 1980s when the Hunt brothers sought to manipulate the silver market. At that time, they bought nearly two-thirds of global silver production with borrowed capital, and when regulators tightened margin trading, silver prices collapsed, ending their acquisition efforts. However, Bawden believes the current situation is very different.

She said that it is not a separate group trying to dominate the market, but many major powers competing for supply as land-based silver inventories are depleting, including China, the solar energy industry and European central banks.

She believes that when the US and the European Union consider silver as a strategic mineral, the race to win about the remaining 22,000 tons of silver in London's warehouses has become a national security issue, and large cash flow is seeking to accumulate silver before China's export restrictions make the market even scarcer.

Another factor creating a "perfect storm" for silver, according to Bawden, is the prospect of the US Federal Reserve (FED) cutting interest rates next year. She believes that when interest rates fall and the USD index falls below 100, the opportunity cost of holding silver almost disappears, and when the USD weakens, silver not only increases in price but can also increase very strongly.

Update on domestic silver prices

As of 10:00 AM on January 9, domestic silver prices continued to decrease at most businesses. At Ancarat Jewelry Company, Ancarat 999 silver bars (1 tael) were listed at 2.893 - 2.964 million VND/tael; while Ancarat 999 silver bars (1kg) traded at 76.220 - 78.540 million VND/kg.

At Sacombank-SBJ, Kim Phuc Loc 999 silver bars (1 tael) were listed at 2.934 - 3.012 million VND/tael, down 130,000 - 132,000 VND per tael. Meanwhile, Phu Quy Jewelry Group listed 999 silver bars (1 tael) at 2.898 - 2.988 million VND/tael and 999 silver bars (1kg) at 77.279 - 79.679 million VND/kg.