Early this morning (January 14 Vietnam time), world silver prices approached the threshold of 90 USD/ounce. Immediately, domestic silver prices were strongly adjusted upwards by some business units.

As of 9:15 am, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company is listed at the threshold of 3.376 - 3.481 million VND/tael (buying - selling). The price of 2025 Ancarat 999 silver bars (1kg) at Ancarat Jewelry Company is listed at the threshold of 90.027-92.827 million VND/kg (buying - selling).

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.367 - 3.471 million VND/tael (buying - selling). The price of 999 silver bars (1kg) at Phu Quy Jewelry Group was listed at the threshold of 89.786 - 92.559 million VND/kg (buying - selling).

Market developments surprised many investors because of the profits earned after a short period of time in cash.

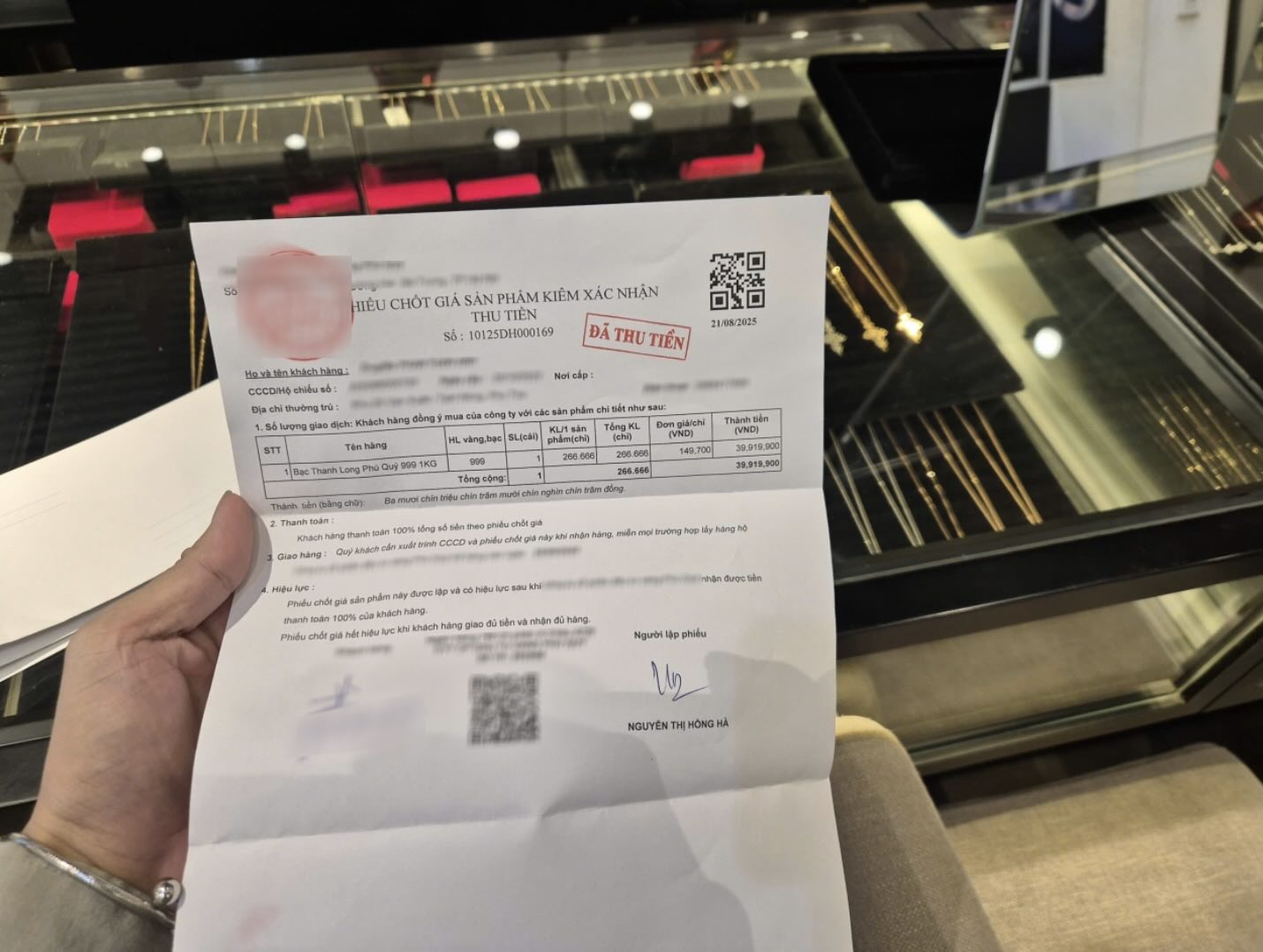

Mr. Nguyen Van Anh (Cau Giay - Hanoi) said that he bought 1kg of silver on August 21, 2025 at a price of 39.919 million VND/kg. To date (January 14), the store bought it at a price of 90.186 million VND/tael. Thus, he has made a profit of more than 50 million VND.

I was very surprised because for a long time I only considered silver as a jewelry item. In August 2025, I bought 1kg of silver because I went with friends, seeing friends buying, I also bought. Unexpectedly, after buying, the price continuously increased sharply. I set a threshold that if silver reaches 90 million VND/kg, I will sell it. Yesterday I saw the price of 88 million VND/kg and I intended to sell it. Unexpectedly, this morning when I woke up, I saw the price of nearly 93 million VND/kg".

Like Anh, Ms. Do Thi Phuong (Dong Anh - Hanoi) said that she bought 1kg of silver stored on October 16, 2025 at a price of 43.173 million VND/kg. "This morning I checked the price and the brand I bought is selling at 92.986 million VND/kg, while buying at 90.186 million VND/kg.

So in less than three months, 1kg of silver I bought has earned more than 47 million VND in profit. I was really surprised and shocked because I did not expect such a large profit.

At many gold, silver and gemstone stores in Hanoi, the trading atmosphere became bustling. Right from 4 am, many people flocked to the front of the stores to get order numbers, queuing to buy silver.

Only after a short period of opening, some points of sale were forced to announce that they were out of stock and temporarily stop trading due to a sudden increase in customer volume. Notably, most transactions today are in the form of ordering and receiving money after 2-3 months, showing that supply is under great pressure from the strong stockpiling wave of investors.

Mr. Nguyen Tien Dung (Dong Da, Hanoi) said that at about 7 am he was present at a silver business store on Tran Nhan Tong street with the intention of buying, but in the immediate future it was already a scene of people queuing tightly. “Today I couldn't buy because the store stopped reporting out of stock. I didn't think demand would increase so strongly, coming early but still couldn't buy” - Mr. Dung shared.

Although silver prices are increasing sharply and bringing very attractive profits in the short term, investors need to be very cautious with FOMO sentiment (fear of missing opportunities). Silver is an asset with a large fluctuation range, directly affected by world silver prices, interest rate policies, the USD and financial speculation. When prices have increased too quickly in the short term, the risk of strong correction can completely occur if the international market cools down or speculative cash flow withdraws.

Therefore, instead of chasing hot waves, investors should carefully consider strategies, risk management and not use borrowed capital or all assets to invest in a hotly growing channel.