As of 11:40 am on January 12, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 3.133 - 3.210 million VND/tael (buying - selling); an increase of 128,000 VND/tael on the buying side and an increase of 131,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 82.590 - 85.100 million VND/kg (buying - selling); an increase of 3.394 million VND/kg on the buying side and an increase of 3.494 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Gold, Silver and Gems One Member Limited Liability Company (Sacombank-SBJ) is listed at the threshold of 3.156 - 3.237 million VND/tael (buying - selling); an increase of 108,000 VND/tael in both directions compared to yesterday morning.

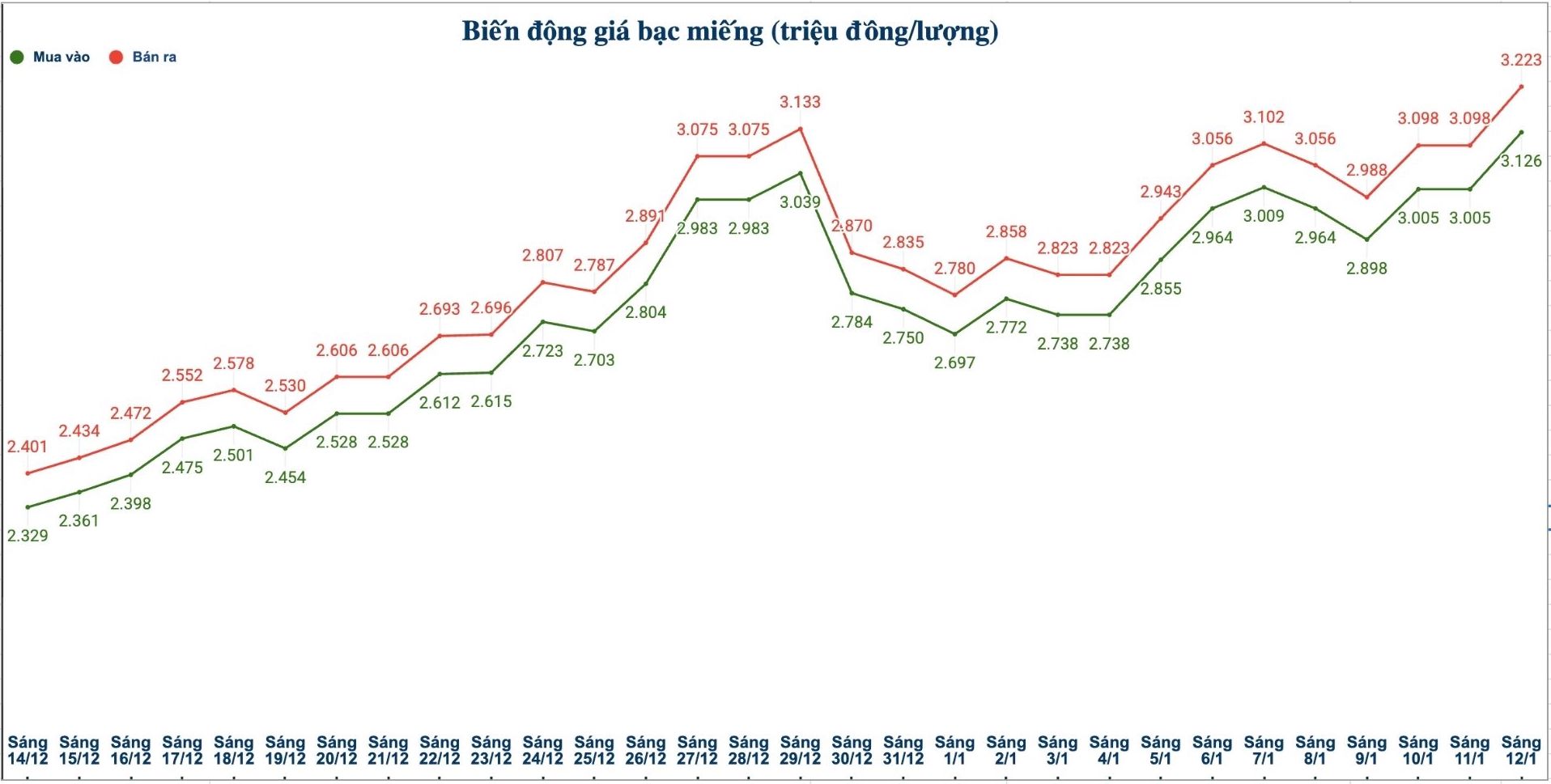

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.126 - 3.223 million VND/tael (buying - selling); an increase of 121,000 VND/tael on the buying side and an increase of 125,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 83.359 - 85.946 million VND/kg (buying - selling); an increase of 3.226 million VND/kg on the buying side and an increase of 3.333 million VND/kg on the selling side compared to yesterday morning.

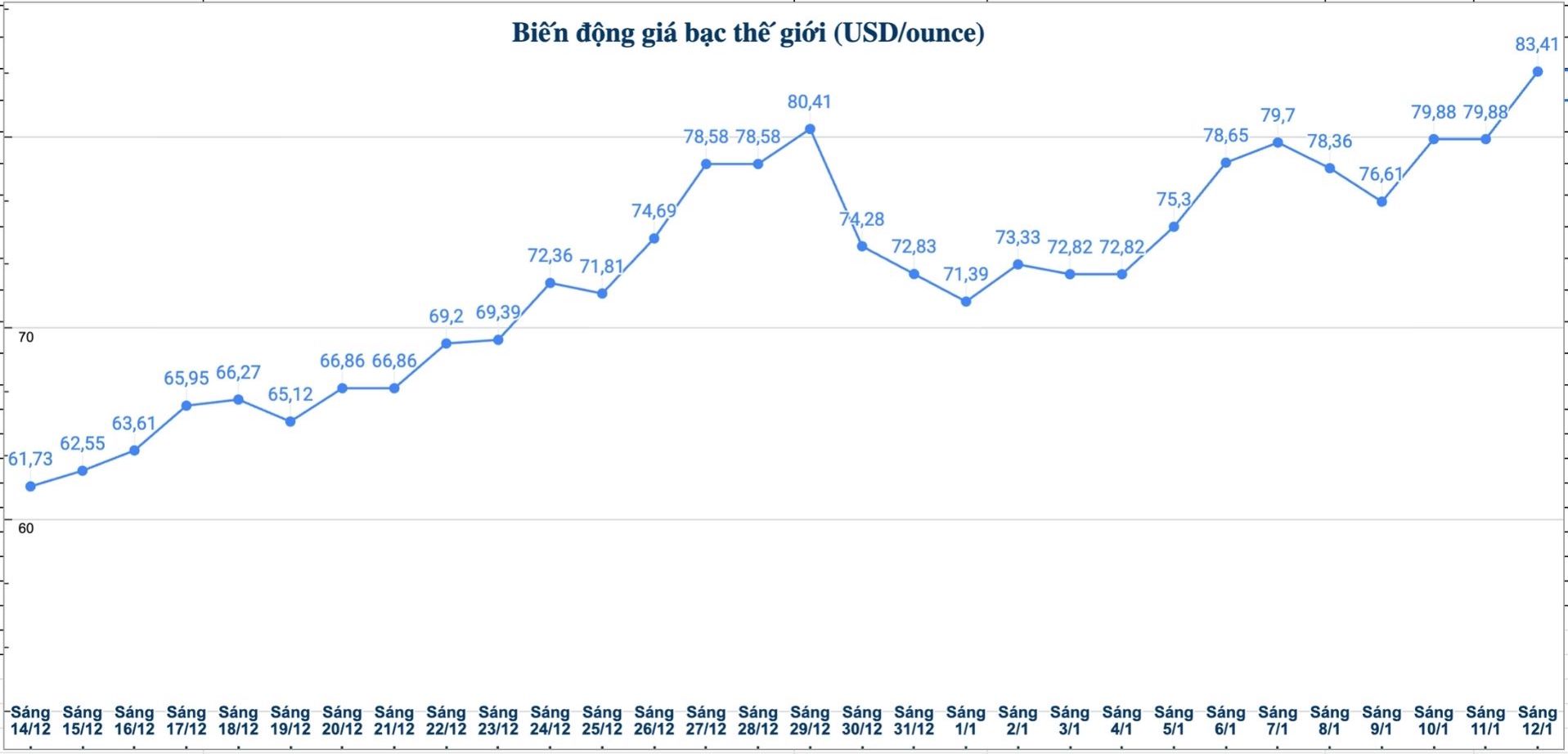

World silver prices

On the world market, as of 12:00 on January 12 (Vietnam time), the world silver price was listed at 83.41 USD/ounce; up 3.53 USD compared to yesterday morning.

Causes and forecasts

Silver prices continued to increase sharply in the first trading session of the week. According to Gary Wagner - commodity broker and market analyst at Kitco, the main driving force pushing up precious metal prices comes from increased geopolitical instability along with expectations that the US Federal Reserve (Fed) will soon ease monetary policy.

Meanwhile, the need for safe havens of investors in the face of escalating geopolitical tensions in the Americas also helped precious metal prices soar.

With silver, Gary Wagner believes that the overall dien bien follows the trend of gold but with a larger fluctuation range, characteristic of metals with smaller market sizes. "Silver was under stronger selling pressure in the middle of last week when production data was positively announced, but still maintained impressive performance" - Gary Wagner said.

The expert believes that silver still has more room to increase in price than gold in the near future. The gold-silver ratio has now decreased to 56.43, the lowest level since January 2013, showing that silver is gradually narrowing the growth gap with gold. "In the event that this ratio continues to decrease, important support levels are identified at 50 and 46 respectively" - Gary Wagner said.

See more news related to silver prices HERE...