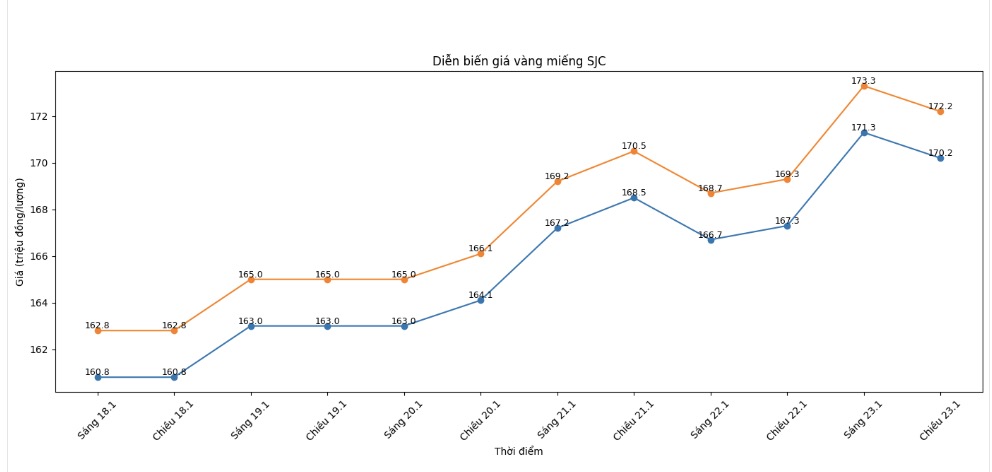

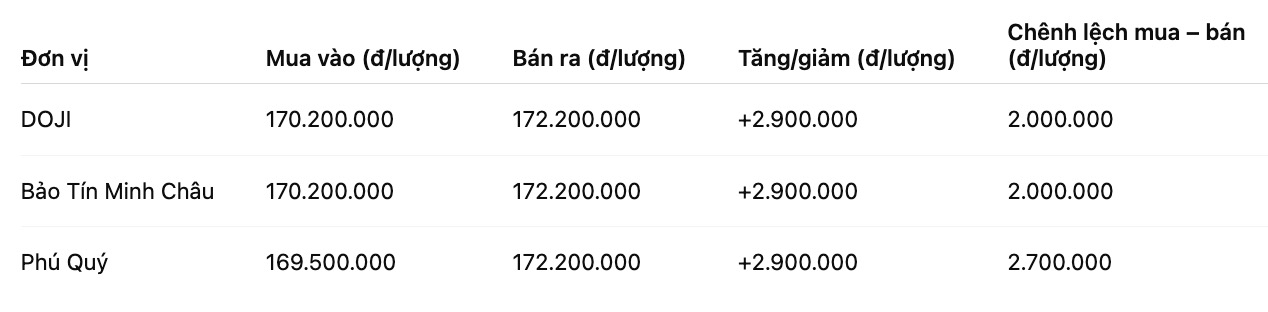

SJC gold bar price

As of 6:35 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 170.2-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 170.2-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 169.5-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

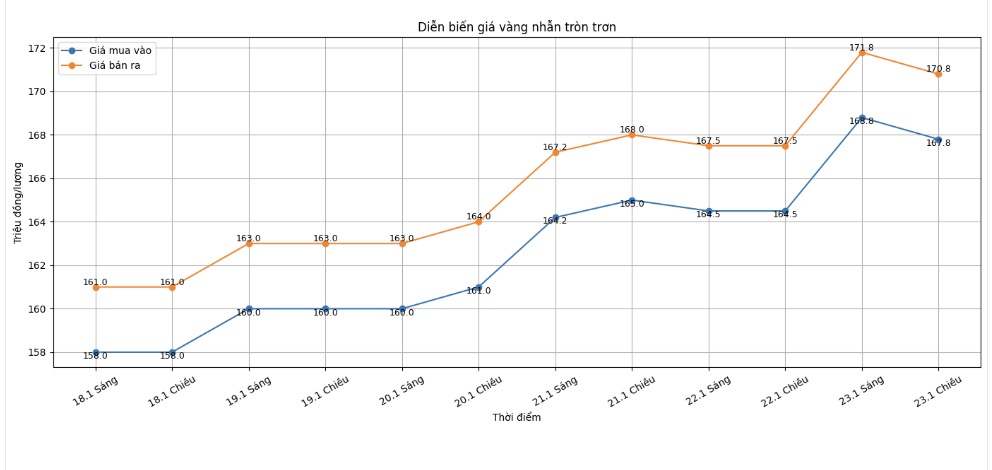

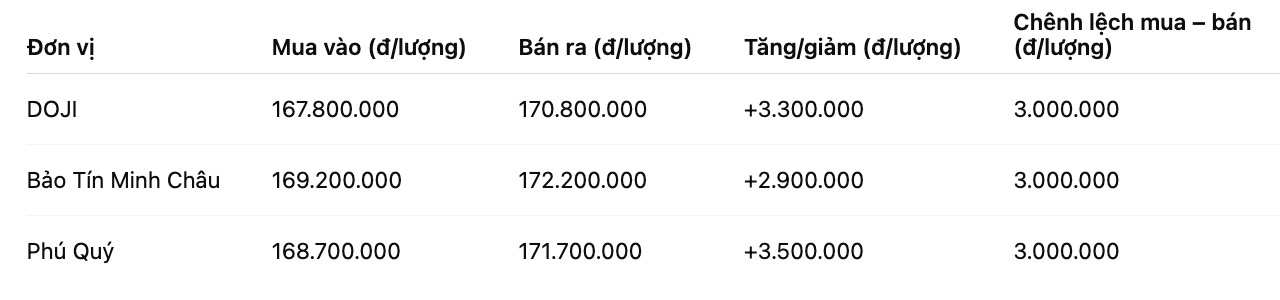

9999 gold ring price

As of 6:35 PM, DOJI Group listed the price of gold rings at 167.8-170.8 million VND/tael (buying - selling), an increase of 3.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 169.2-172.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 168.7-171.7 million VND/tael (buying - selling), an increase of 3.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

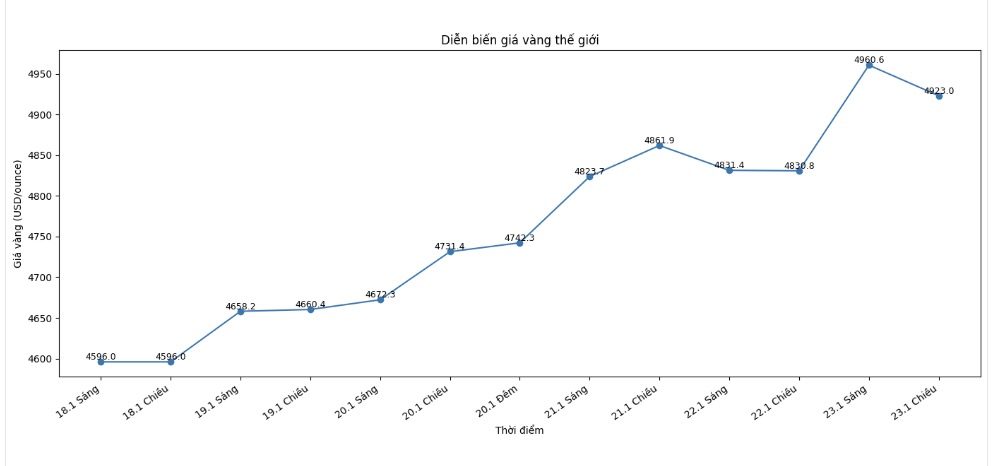

World gold price

At 6:35 PM, world gold prices were listed around the threshold of 4,923 USD/ounce, up 92.2 USD compared to the previous day.

Gold price forecast

The strong increase in world gold prices in recent sessions is creating significant support for the domestic market. The fact that international gold prices continuously reach new peaks and approach the psychological threshold of 5,000 USD/ounce shows that safe-haven cash flow is still maintained at a high level, in the context of geopolitical instability and changes in global monetary policy expectations.

According to analysts, the current increase in gold not only stems from technical factors but also reflects a long-term shift in the asset allocation structure.

The strong weakening of the USD in the past week has made gold more attractive to investors holding other currencies. Along with that, unpredictable fluctuations in US bond yields also reduced the attractiveness of fixed-yield assets, thereby supporting precious metals.

Commenting on this trend, Mr. Yuxuan Tang - Head of Macroeconomic Strategy for Asia at J.P. Morgan Private Bank, said that gold is entering a clear revaluation phase as systemic risks increase.

According to this expert, in the context of the global economic and financial order facing many challenges, gold continues to be considered an effective risk hedging tool, especially for long-term investors.

From an supply-demand perspective, persistent buying power from central banks is also an important factor in supporting gold prices. Some emerging economies are promoting a strategy of diversifying foreign exchange reserves, reducing dependence on US government bonds and increasing the proportion of gold. This makes market supply more limited, while demand tends to increase.

Pepperstone strategist Ahmad Assiri said that the market is currently quite sensitive to political and financial shocks. He believes that in conditions of tighter liquidity and increased risk, gold's technical resistance levels may break down faster than expected, leading to a large fluctuation range.

Regarding the domestic market, observers believe that if world gold prices remain above the high zone, SJC gold and gold rings prices are likely to continue to adjust upwards. However, the increase range may not be uniform between product lines, due to dependence on supply, operating policies and price differences between domestic and foreign countries. Investors are recommended to closely monitor international developments and consider risks when prices are in historical highs.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...