Domestic silver price

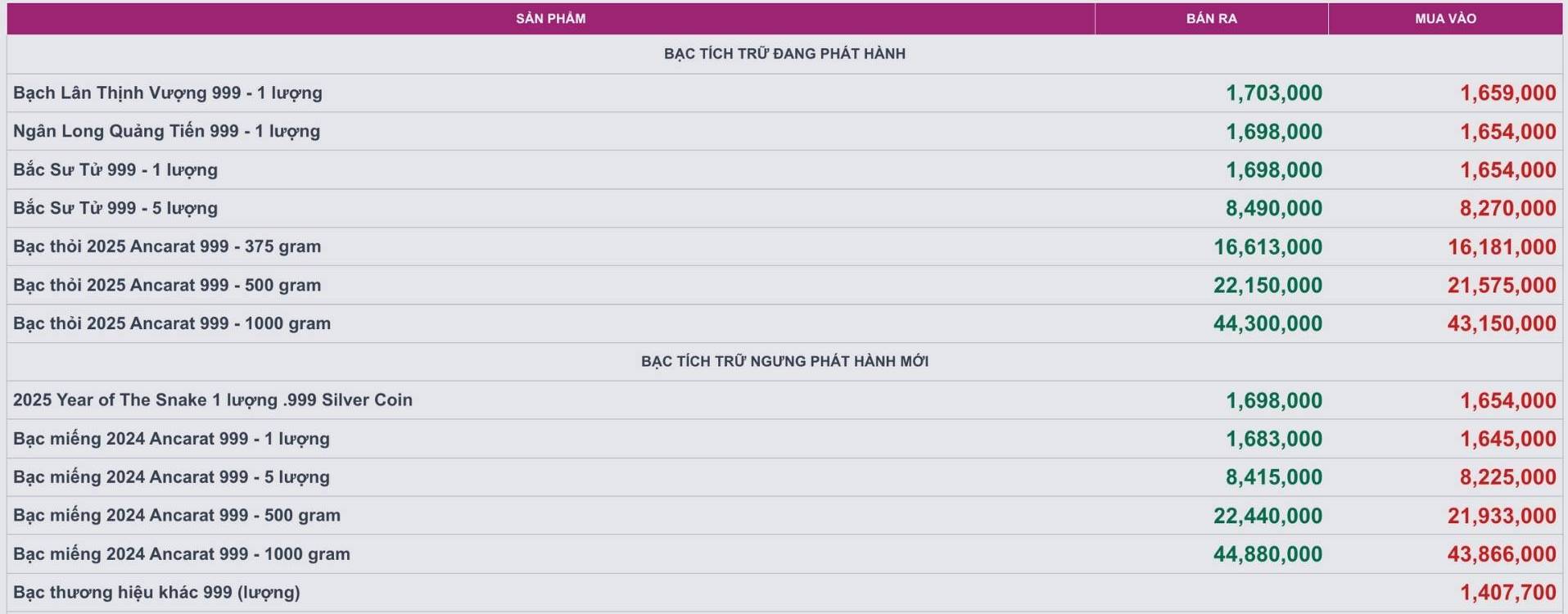

As of 9:45 a.m. on September 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.645 - 1.698 million VND/tael (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 43,866 - 44.880 million VND/kg (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 43,150 - 44.300 million VND/kg (buy - sell).

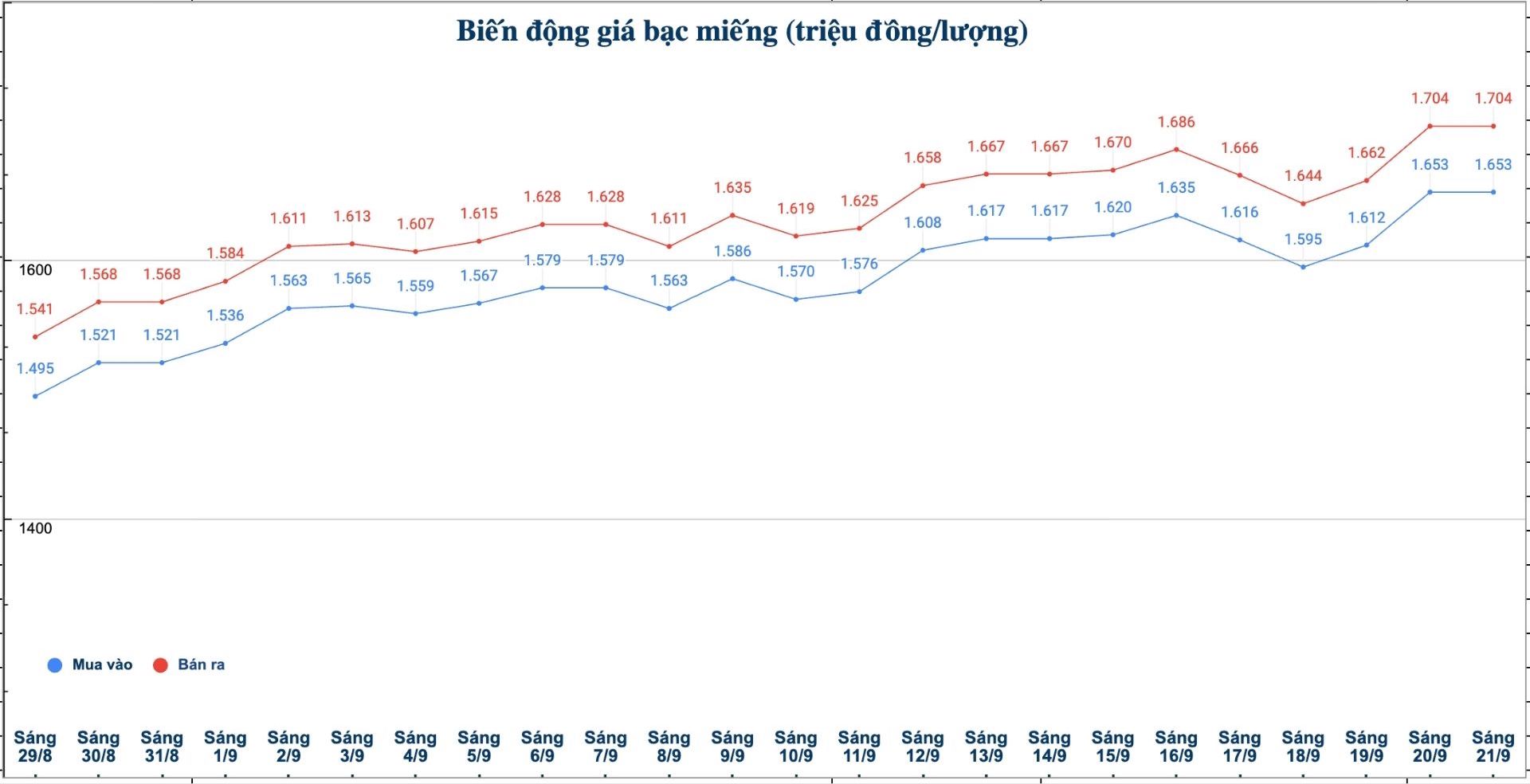

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.653 - 1.704 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels of silver (1 tael) at Phu Quy Jewelry Group was listed at 1.653 - 1.704 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at VND44.079 - 45.439 million/kg (buy - sell); unchanged in both directions compared to yesterday morning.

World silver price

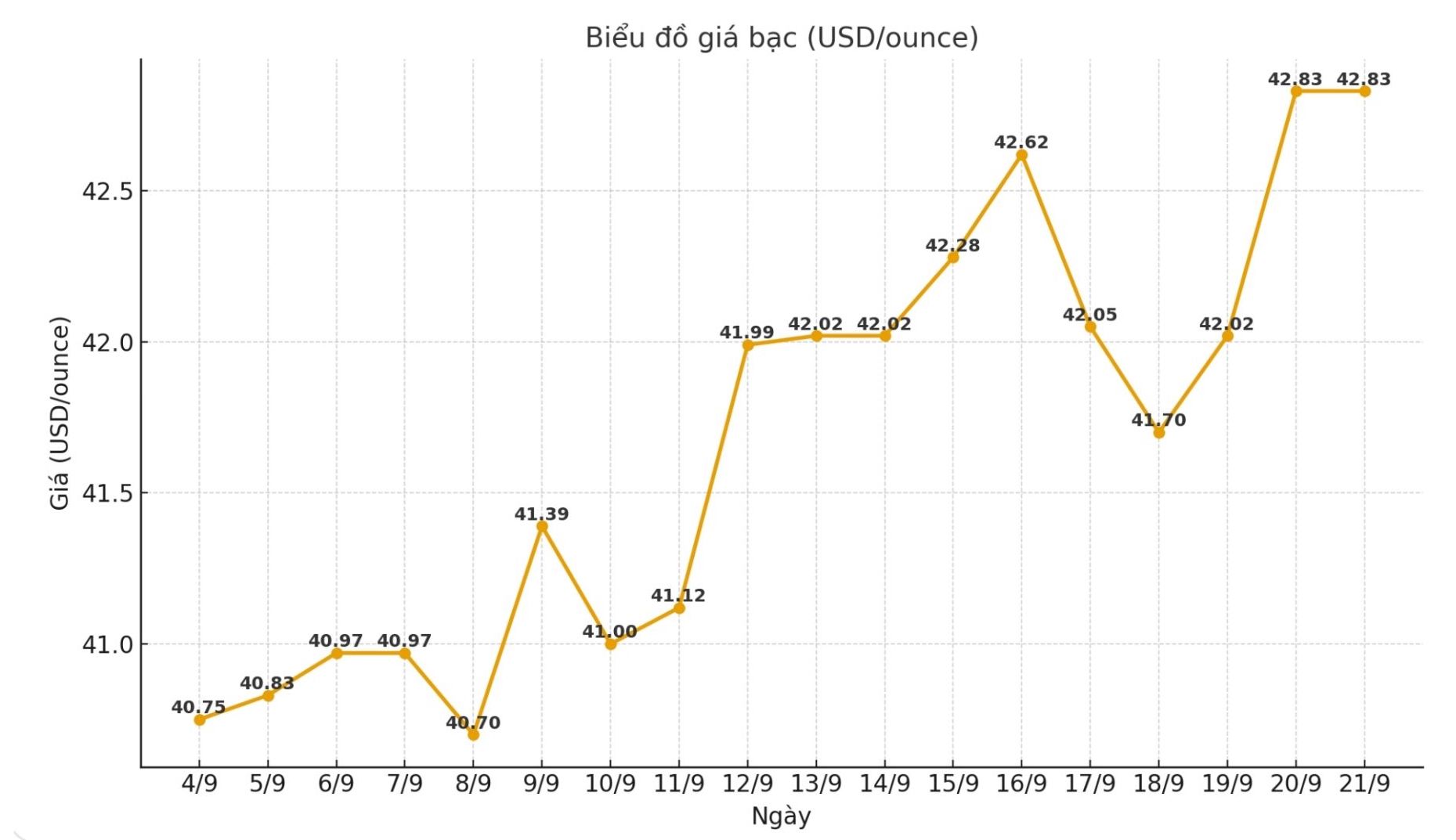

On the world market, as of 9:45 a.m. on September 21 (Vietnam time), the world silver price was listed at 42.83 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Entering the fourth quarter, silver prices recovered strongly, increasing by 44% since the beginning of the year and recently reaching a peak of 43.43 USD/ounce (December futures contract). After analyzing the main factors, Phillip Streible - Chief Market Strategist at Blue Line Futures - has raised the forecast for late-night silver prices in the fourth quarter from 42 - 44 USD/ounce to 44 - 46 USD/ounce, and expects to reach 50 USD/ounce in the first quarter of 2026.

He added that the outside market is also very positive as all four major stock indexes set new records for the first time since 2021, contributing to strengthening confidence in the precious metal.

"Thanks to that, capital flows into ETFs have increased strongly: Gold and silver holdings have increased by 14% and 13% respectively since the beginning of the year," said Phillip Streible.

Looking at the end of the year, Phillip Streible said that optimism will continue as the economy shifts from a period of stagnant inflation to a recovery of inflation. He said that although gold is still expected to reach the target of 3,950 USD/ounce, the new context will be especially favorable for industrial metals.

"With demand from production and investment, silver has many outstanding opportunities, helping the gold-siber ratio to fall below 80:1 by the end of the year" - Phillip Streible expressed his opinion.

See more news related to silver prices HERE...