Domestic silver prices

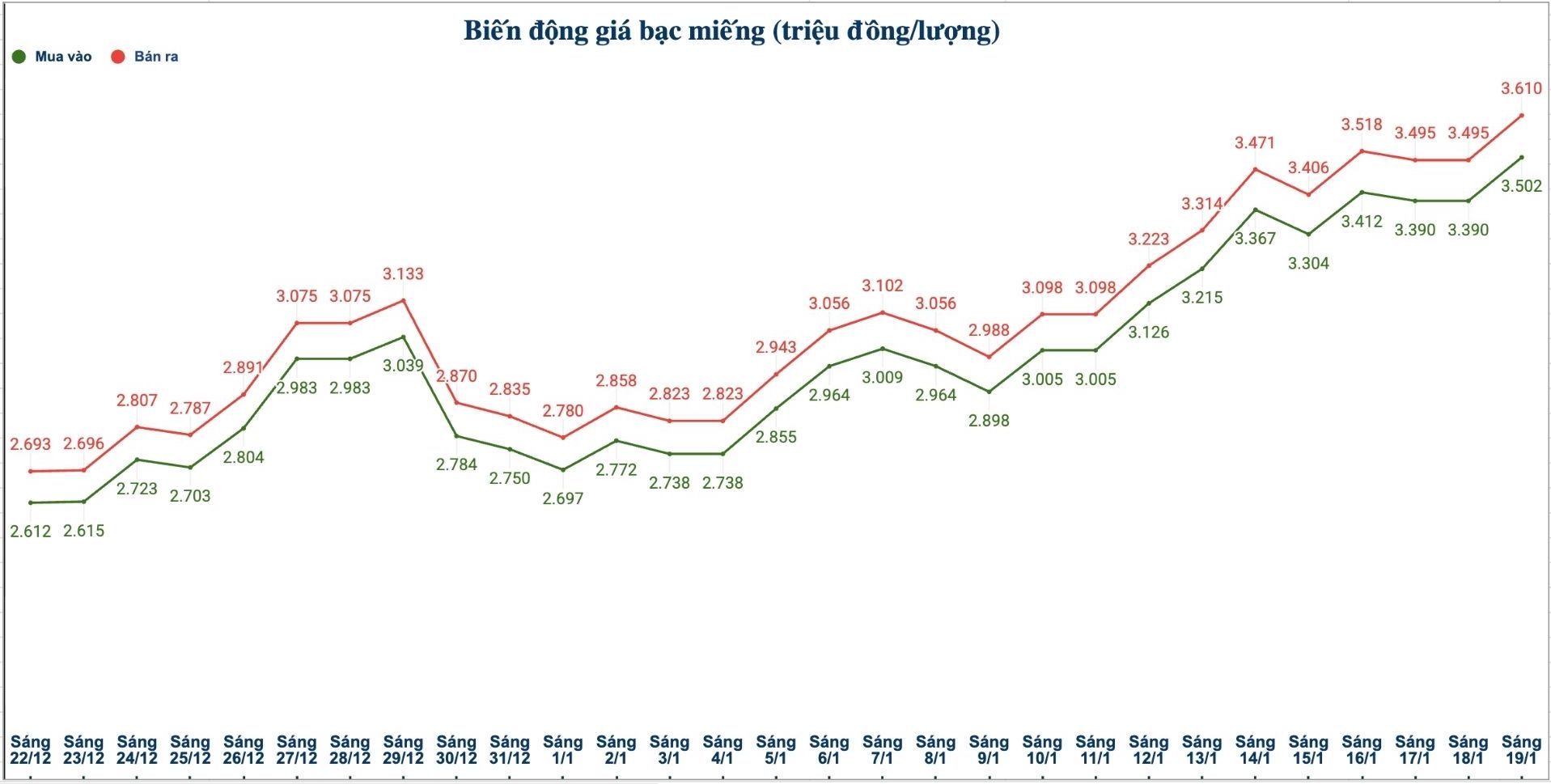

As of 9:50 am on January 19, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at 3.505 - 3.591 million VND/tael (buying - selling); an increase of 112,000 VND/tael on the buying side and an increase of 115,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 92.450 - 95.260 million VND/kg (buying - selling); an increase of 2.978 million VND/kg on the buying side and an increase of 3.066 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 3.528 - 3.618 million VND/tael (buying - selling); an increase of 36,000 VND/tael on the buying side and an increase of 39,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3,502 - 3,610 million VND/tael (buying - selling); an increase of 112,000 VND/tael on the buying side and an increase of 115,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 93.386 - 96.266 million VND/kg (buying - selling); an increase of 2.987 million VND/kg on the buying side and an increase of 3.067 million VND/kg on the selling side compared to yesterday morning.

World silver prices

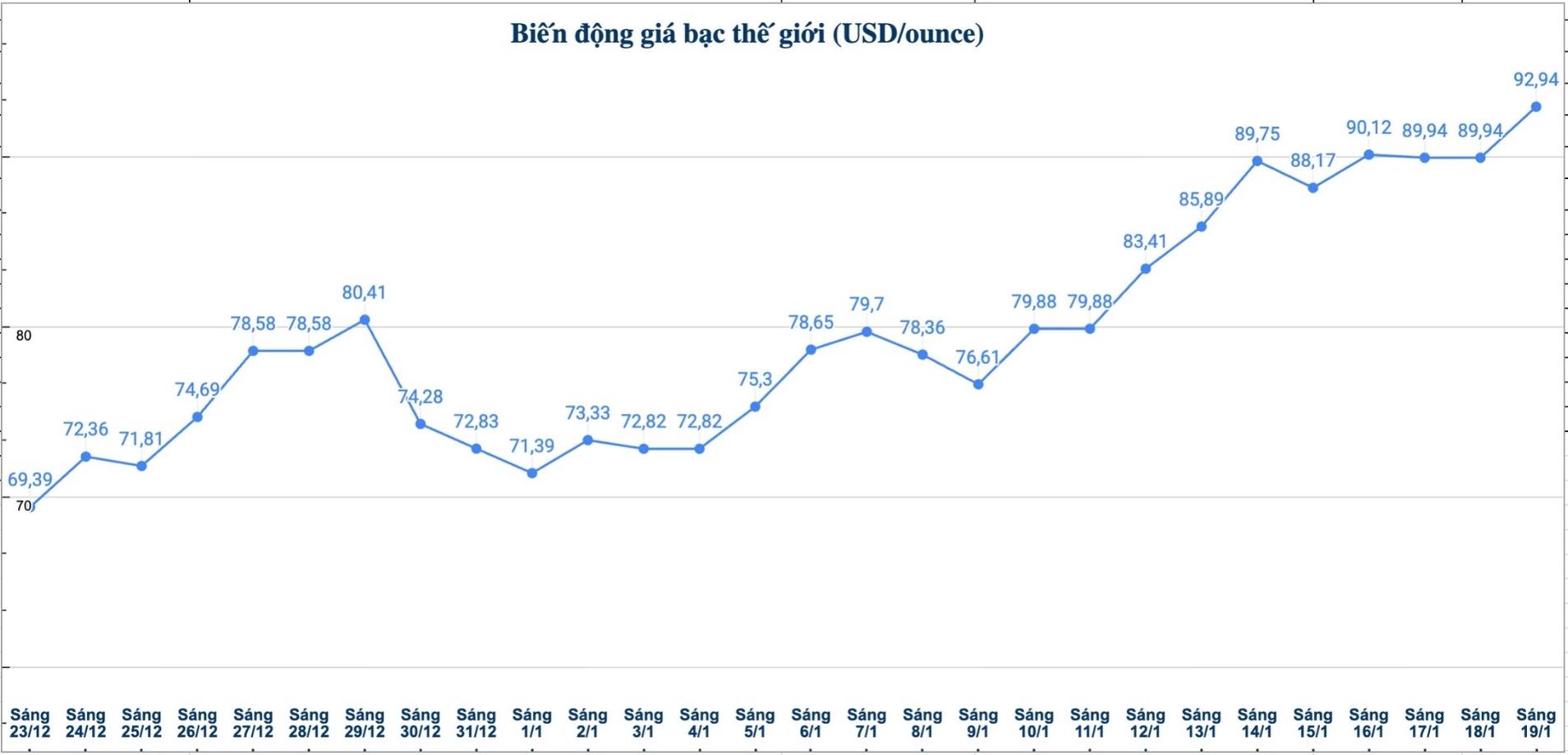

On the world market, as of 10:00 AM on January 19 (Vietnam time), the world silver price was listed at 92.94 USD/ounce; up 3 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices opened up sharply in the first session of the week, after closing the previous trading week with two consecutive declining sessions - the first time since January 8.

Precious metal analyst James Hyerczyk at FX Empire said that in the past week, silver prices were under adjustment pressure due to investor profit-taking activities. However, every time the price decreases, buying power still appears, helping the closing price of sessions not to be too far from the peak of the day.

This development contributed to creating momentum for the first session of the week, when silver prices surged and set a new record high of 94.11 USD/ounce, slightly higher than the peak of 93.51 USD last week" - he said.

However, James Hyerczyk believes that the upward momentum has not really broken through, in the context that buying and selling activities are still quite cautious. "Sales during the US holiday are generally sluggish, while the market is starting to show new concerns related to supply" - James Hyerczyk said.

In the medium and long term, the expert said that the supporting factors for silver prices are still assessed as positive. "However, hesitation signals appeared last week, when the market recorded two consecutive declining sessions right after hitting a new peak" - James Hyerczyk said.

He said that supply outside the US shows signs of easing, while capital flows are withdrawing from silver ETFs due to weakening industrial demand. "Besides, stricter trade restrictions from China may also put silver prices at risk of strong corrections in the near future" - James Hyerczyk put forward his opinion.

See more news related to silver prices HERE...