The recovery momentum of silver and the price approaching recent record peaks above 93 USD/ounce have pulled the gold/silver ratio down to about 50 points, the lowest level since March 2012. This reversal took place very strongly after the above ratio jumped above 100 points in April 2025.

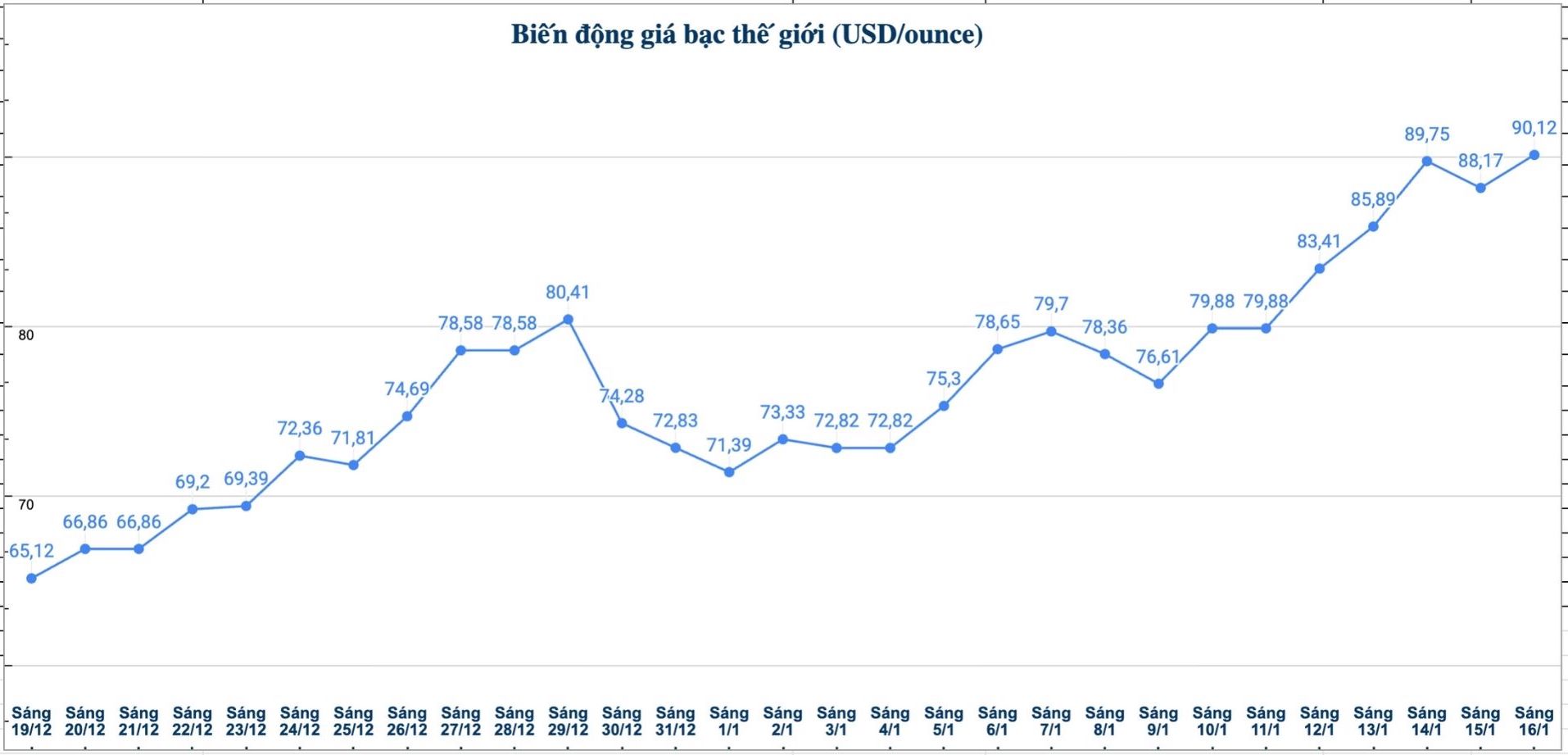

Silver benefits from a new wave of speculative demand, combined with solid industrial demand, sparking supply chain and liquidity problems, and activating a "fictitious selling pressure" lasting for months. Last year, silver prices increased by about 150% and continued to climb in the early days of 2026.

Meanwhile, gold prices maintained above the support level of 4,600 USD/ounce, up more than 6% from the beginning of the year to date; while silver prices have exceeded 91 USD/ounce, up more than 27%.

In a report released on Wednesday, commodity analysts at BMO Capital Markets said that the gold/silver ratio still has room to decrease further in the short term; however, supply changes may make the current trend difficult to sustain.

In the context of increasing geopolitical instability, along with a trend-based speculative investment wave, the gold-silver ratio may continue to decrease further in a very short time. However, we forecast that the surplus silver in the physical market will become increasingly large, thereby forcing the gold-silver ratio to increase again in the coming years, in line with the trend that has lasted since the 1970s.

Since the Bretton Woods system ended in the 1970s, we have seen a close link between the silver supply surplus and the dien bien of the gold/silver ratio: When a large surplus appears in the market, this ratio usually increases steadily over time and vice versa" - analysts said.

“If including net physical investment demand, the silver market seems to be lacking, implying that inventory must be reduced - but when most inventory is in the hands of investors, this is only reasonable if they are selling physical silver. Our analysis shows that a more appropriate measure is balancing between silver consumption (industry + jewelry + silver items) and supply (often exceeding this consumption level)” - the report stated.

In the current context, BMO emphasizes that investors need to closely monitor silver demand in the solar power sector.

Solar power accounts for 58% of silver consumption growth since 2020; however, due to the stagnation of installation projects and the trend of saving silver in solar panel technology, the demand for silver from this sector is likely to have surpassed its peak" - analysts said.

At the same time, BMO also noted that it is too early to confirm whether other industries can compensate for the reduced demand from solar power or not.

After many years of promising many but slow deployment, there is now a signal showing that solid-state batteries may be about to become a reality - in which silver-carbon anode technology is a key factor. We estimate that if the commercialization efforts of businesses such as BYD, Samsung and LG Ensol are successful, this sector could contribute up to 100 million ounces of silver to demand by 2030" - the report said.

However, until solid-state batteries are truly commercialized, BMO forecasts that silver supply will increase, making this metal less likely than gold.

Even if we assume that silver savings are minimal and demand from the electric vehicle sector is increasing sharply, we still believe that the physical silver surplus will continue to expand in the forecast period. Although the current excitement in the silver market may cause the gold/silver ratio to fall more sharply in the next few weeks, we still expect the long-term trajectory of this ratio to go up" - analysts concluded.