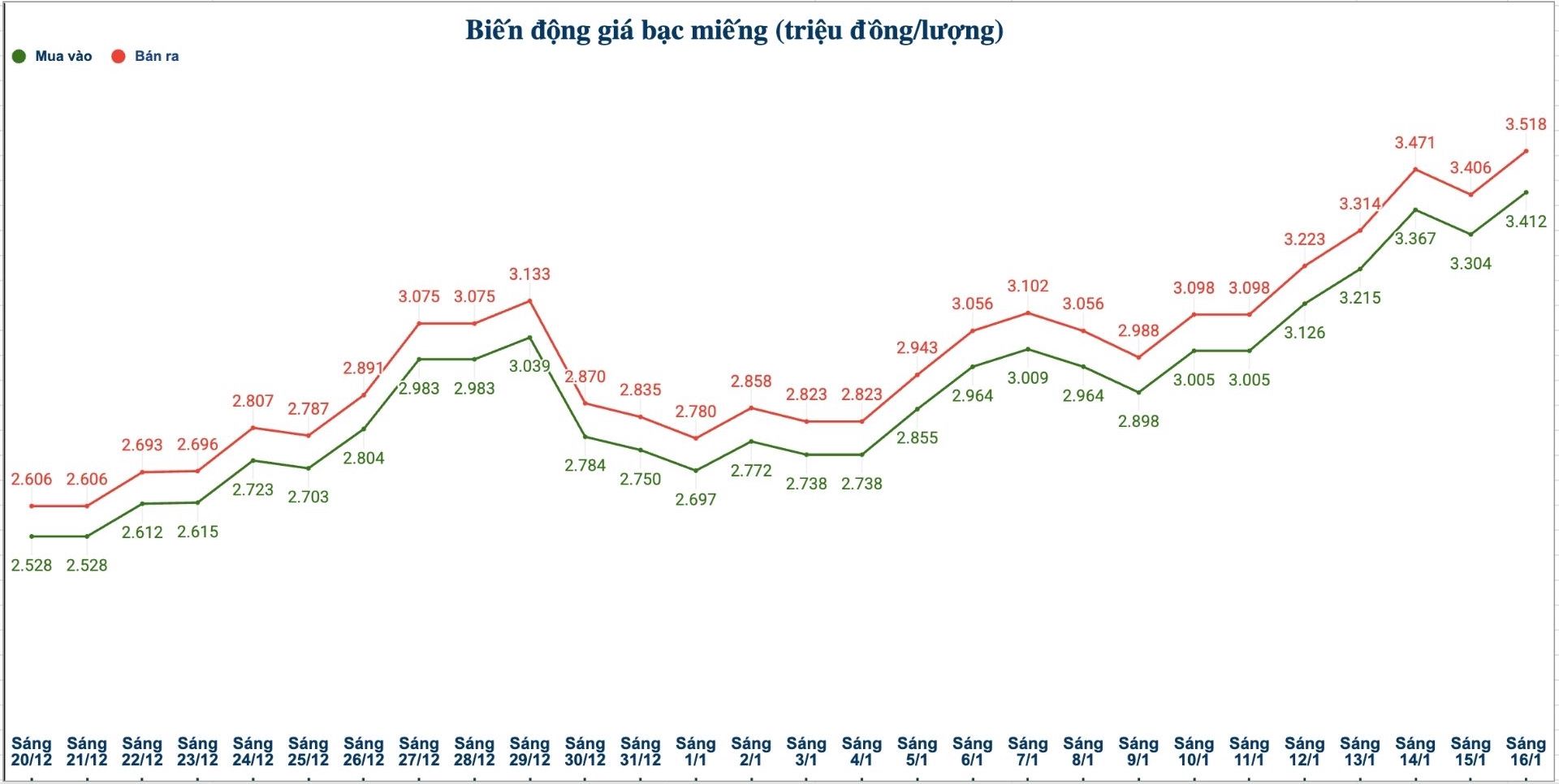

Domestic silver prices

As of 9:30 am on January 16, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) was listed at the threshold of 3.456 - 3.543 million VND/tael (buying - selling); an increase of 78,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.412 - 3.518 million VND/tael (buying - selling); an increase of 108,000 VND/tael on the buying side and an increase of 112,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 90.986 - 93.813 million VND/kg (buying - selling); an increase of 2.88 million VND/kg on the buying side and an increase of 2.987 million VND/kg on the selling side compared to yesterday morning.

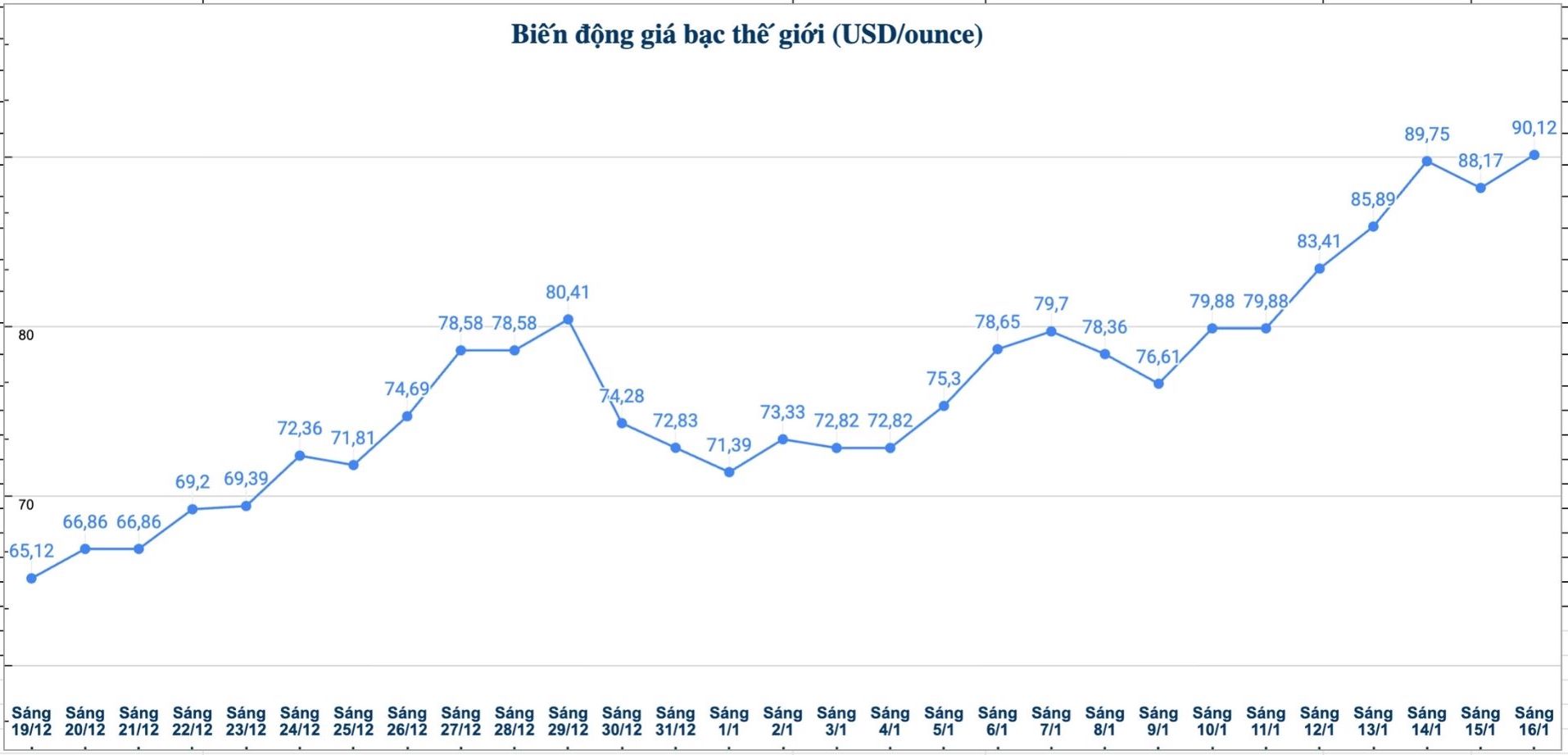

World silver prices

On the world market, as of 9:50 am on January 16 (Vietnam time), the world silver price was listed at 90.12 USD/ounce; up 1.95 USD compared to yesterday morning.

Causes and forecasts

The silver market continues to record positive developments as prices rise sharply. According to financial analyst Arslan Ali at FX Empire, this increase mainly comes from growing expectations that the US will continue to ease monetary policy, along with concerns surrounding the independence of the US Federal Reserve (Fed).

Arslan Ali said that after the US released inflation data lower than forecast, investors are tending to shift cash flow to safe-haven assets such as gold and silver. The market is currently betting that the Fed may soon cut interest rates in the near future.

In the currency market, the USD is showing signs of weakening after previous slight increases. The depreciation of the greenback has positively supported the precious metal, because weaker USD helps the precious metal become cheaper for investors holding other currencies" - the expert commented.

Besides, Arslan Ali believes that the price of precious metals is also reinforced by increasingly clear expectations that the Fed may conduct interest rate cuts this year, in the context of decreasing inflationary pressure in the US.

According to newly released data, the US Consumer Price Index (CPI) shows that inflation continues its downward trend. Core CPI - excluding food and energy prices - only increased by 0.2% in December, lower than forecast, pulling annual core inflation down to 2.6%, the lowest level in four years. Meanwhile, overall CPI increased by 0.3% compared to the previous month, in line with expectations, bringing annual inflation to 2.7%.

Arslan Ali believes that these "cooling down" inflation signals are creating favorable conditions for gold and silver to maintain their upward momentum, while putting downward pressure on the USD, as the market increasingly believes in the possibility that the Fed will soon ease monetary policy.

See more news related to silver prices HERE...