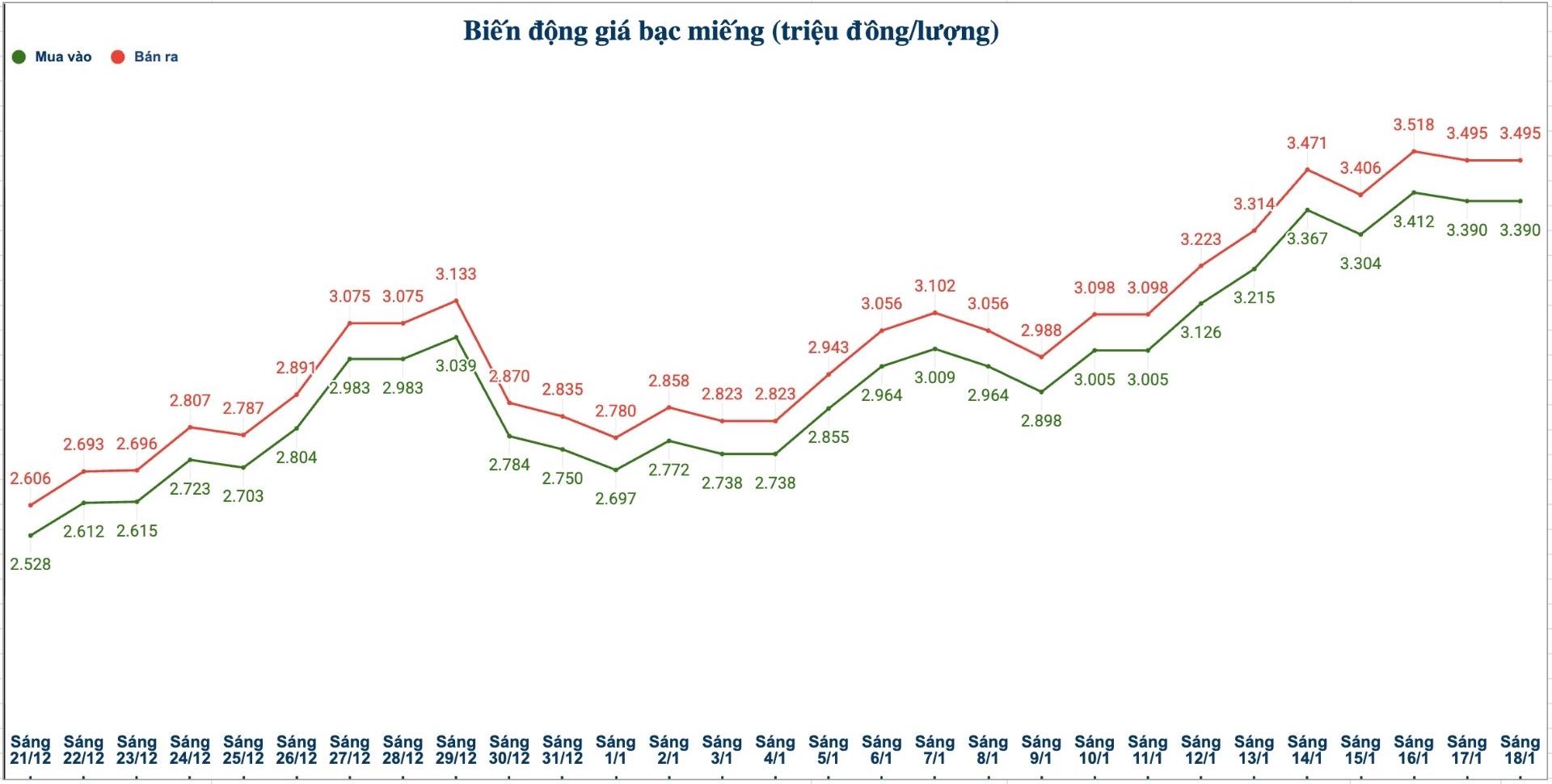

Domestic silver prices

As of 9:50 am on January 18, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company is listed at the threshold of 3.393 - 3.476 million VND/tael (buying - selling).

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 89.474 - 92.194 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 11, 2026), the price of 2025 Ancarat 999 (1kg) silver bar at Ancarat Jewelry Company was listed at 79.196 - 81.606 million VND/kg (buying - selling).

Thus, if you buy 2025 Ancarat 999 (1kg) ingots at Ancarat Jewelry Company in the session on January 11, 2026 and sell them in the session this morning (January 18, 2026), the buyer will make a profit of 7.868 million VND/kg.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.390 - 3.495 million VND/tael (buying - selling).

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 90.399 - 93.199 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 11, 2026), the price of 999 silver bars (1kg) at Phu Quy Jewelry Group was listed at 80.133 - 82.613 million VND/kg (buying - selling).

Thus, if you buy 999 silver bars (1kg) at Phu Quy Jewelry Group on the session of January 11, 2026 and sell them on the session this morning (January 18, 2026), the buyer will make a profit of 7.786 million VND/kg.

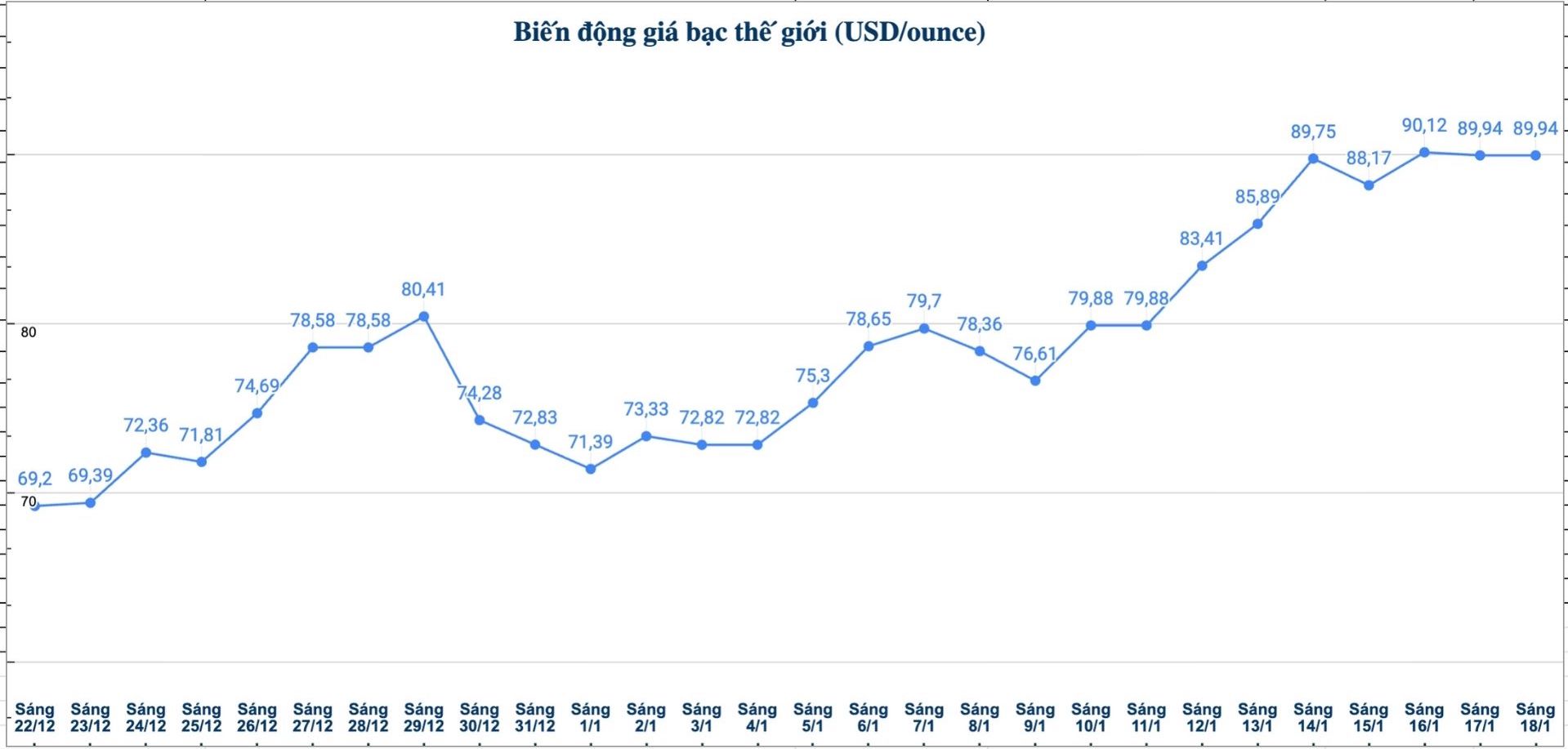

World silver prices

On the world market, as of 10:00 AM on January 18 (Vietnam time), the world silver price was listed at 89.94 USD/ounce.

Causes and forecasts

Silver price fluctuations in recent trading sessions show that the upward trend is dominating despite short-term market fluctuations.

According to Citigroup - one of the largest financial and banking groups in the US, gold and silver prices are expected to set new milestones in the first quarter of 2026.

However, Citi believes that gold's upward momentum may face significant correction pressure at the end of the year, amid global geopolitical tensions showing signs of cooling down. Conversely, silver and other industrial metals are forecast to continue to maintain positive developments.

The strategist group led by Kenny Hu has sharply increased short-term forecasts, raising the gold price target for 0-3 months to 5,000 USD/ounce and silver to 100 USD/ounce. According to Citi, the price increase cycle of the precious metal group is likely to last until early 2026.

The bank's report points out three main drivers behind the above strong increase, including: escalating geopolitical risks, material supply shortages in the market and new concerns related to the independence of the US Federal Reserve (Fed).

Although gold and silver both set new historical peaks in the first trading sessions of the year, Citi still maintains the view that silver will have a superior increase over gold. In the long term, the industrial metal group is expected to become the focus of market leadership.

We are consistent with the notion that silver will be a prominent growth metal, before the price increase cycle spreads to industrial metals - and ultimately this group will play a central role" - Citi's strategists emphasized.

See more news related to silver prices HERE...