Just after the first two weeks of the year, the precious metal market fluctuated strongly as if it had been going through a whole year. Gold and silver simultaneously set record highs at the beginning of the year, but the upward momentum is slowing down as silver begins to adjust, while gold is under pressure from monetary policy and economic developments.

In the context that the US Federal Reserve (Fed) is not in a hurry to lower interest rates and macroeconomic factors continue to intertwine, investors are warned not to be too optimistic about short-term market fluctuations.

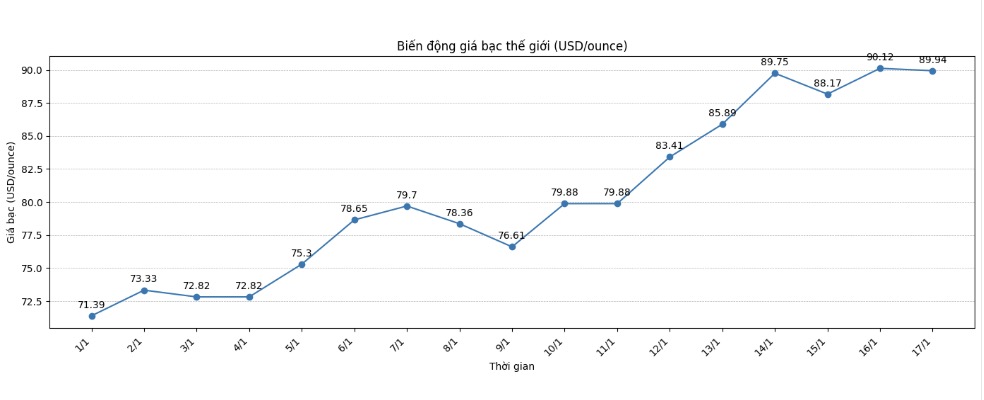

Both gold and silver are recording the strongest year-on-year increase in history. Gold prices have increased by 256 USD since the beginning of the month, while silver jumped to nearly 17.5 USD. Percentage-wise, gold increased by 6%, nearly reaching the 7% increase of January last year. Silver even increased by more than 24%, marking the strongest start of the year since 1983 - a time when matching shoulders and mullet hair were still considered trendy.

Although it is highly likely that the increase in gold and silver has not completely ended, the speed is clearly slowing down. Gold closed the week below the 4,600 USD mark, while silver retreated below 90 USD/ounce, reminding traders that the "gravity" rule still exists.

The correction momentum of silver is not surprising. The "supply crisis" story that once pushed prices up sharply in the second half of 2025 seems to have come to an end - at least temporarily.

Late Wednesday, US President Donald Trump announced that after completing the tax review under Clause 232 (stipulated in the US Trade Expansion Act of 1962, allowing the US President to impose tariffs or restrict imports on some items if those imports are considered a threat to national security), his administration will not impose tariffs on important metals - at least at the present time.

The US has been hoarding silver for nearly a year due to tariff concerns, but as the cloud gradually dissipates, the physical market may return to a near-normal state.

Meanwhile, gold is hitting the "wall" of economic reality. Recent data shows that the Fed has no urgent reason to cut interest rates. Although interest rates are still expected to fall this year, the first cut is likely to come at least in June - and patience, as usual, is still the most expensive "goods".

Short-term selling pressure and accumulation periods are completely possible, but the possibility of the market returning to the "normal" state as before is not high.

Traders have long abandoned the traditional rules of the precious metal market, to enter a new environment shaped by tight supply, persistent demand and constantly changing macroeconomic stories.

With the Fed forecast to maintain its policy in the first half of the year, gold is facing pressure from higher bond yields and a stronger USD.

However, the long-standing relationship between gold and interest rates has been broken for quite a long time, and it seems that no one is interested in "repairing" it. Prolonged geopolitical instability continues to play a solid support for safe haven needs.

For investors who are considering choosing, some experts believe that gold is slightly higher. The 150% increase in silver in the past 12 months has pulled the gold/silver ratio to the lowest level since 2012.

Just like the fact that this rate could not be maintained above the 100 mark last year, many opinions suggest that the current level is only "living on borrowing time".