According to Citigroup (one of the largest financial and banking groups in the world in the US), both gold and silver can conquer a new peak in the first quarter of 2026.

However, although silver and other industrial metals are forecast to continue to prevail, gold prices are at risk of strong corrections at the end of the year as global tensions cool down.

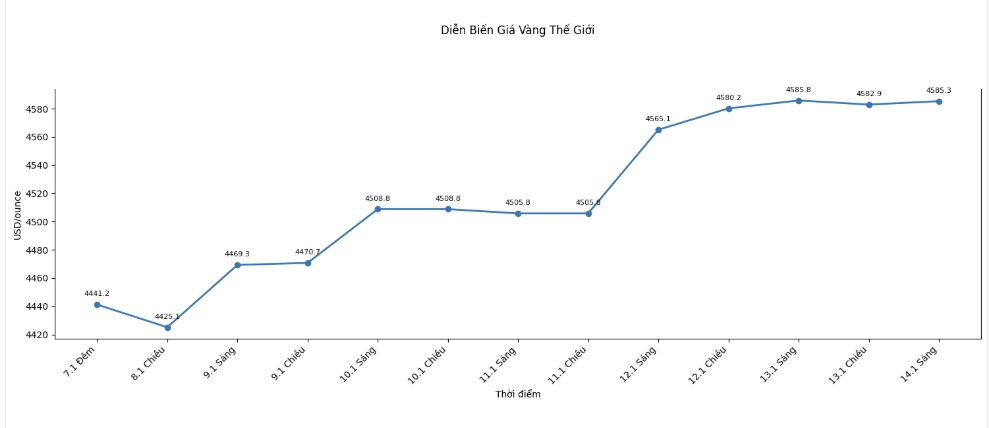

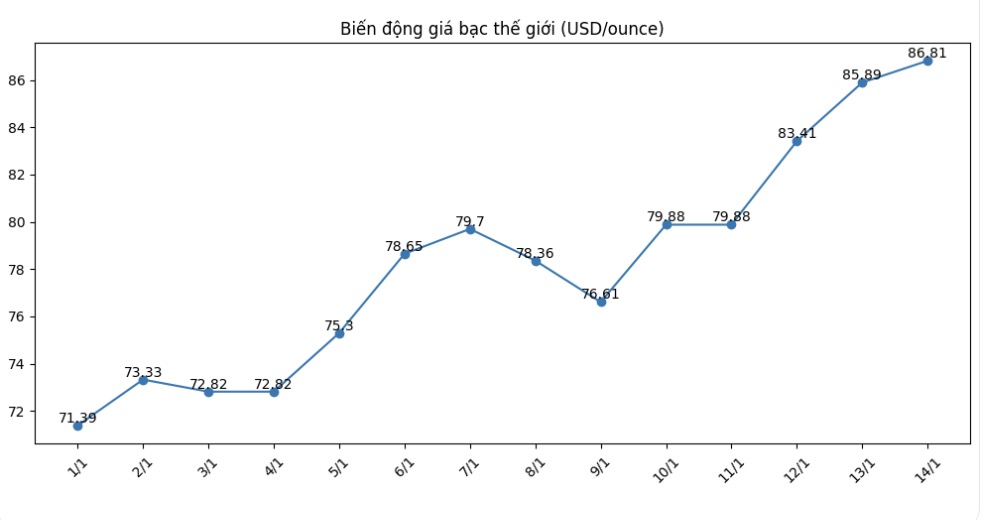

A group of strategists led by Kenny Hu has raised the gold price target for 0-3 months to 5,000 USD/ounce and silver to 100 USD/ounce, as the Wall Street bank forecasts that the precious metal's price increase cycle will last until early 2026.

According to Citi, the three main factors driving this sharp increase in adjustment include: increased geopolitical risks, material shortages in the market, and new instability in the independence of the US Federal Reserve (Fed).

Although both gold and silver have set new historical peaks in the early days of the year, Citi still maintains the view that silver will continue to increase more strongly than gold, but in the long term, industrial metals are the dominant group.

Our consistent view that silver will prevail and the upward cycle of precious metals will spread to industrial metals and eventually industrial metals will play a central role - is evolving as predicted" - Citi strategists wrote.

Citi also noted that the physical market is very tense, especially with silver and platinum metals, in the context of delays and uncertainty in tariff decisions under Section 232 for strategic minerals, creating great risks and strong fluctuations for trade flows and prices.

The bank warned that in a high tax scenario, material shortages could become more serious, even causing extreme price shocks, as metals are pushed into the US. However, when tax policy is clarified, this amount of metal could flow back into the global market, reducing scarcity and creating downward pressure.

Citi believes that if silver prices plummet sharply due to metal being withdrawn from the US under the impact of Section 232 (a clause in US commercial law), this could lead to a short-term sell-off wave across the entire precious metal and base metal market. However, they emphasize that they will consider it an opportunity to buy in, because the long-term upward trend of the metal market remains intact.

In Citi's baseline scenario, geopolitical tensions will cool down after the first quarter, causing shelter demand to decrease, and gold will be the most volatile metal. Conversely, the bank still expects industrial metals - especially aluminum and copper - to be active in the second half of 2026.