Domestic silver price

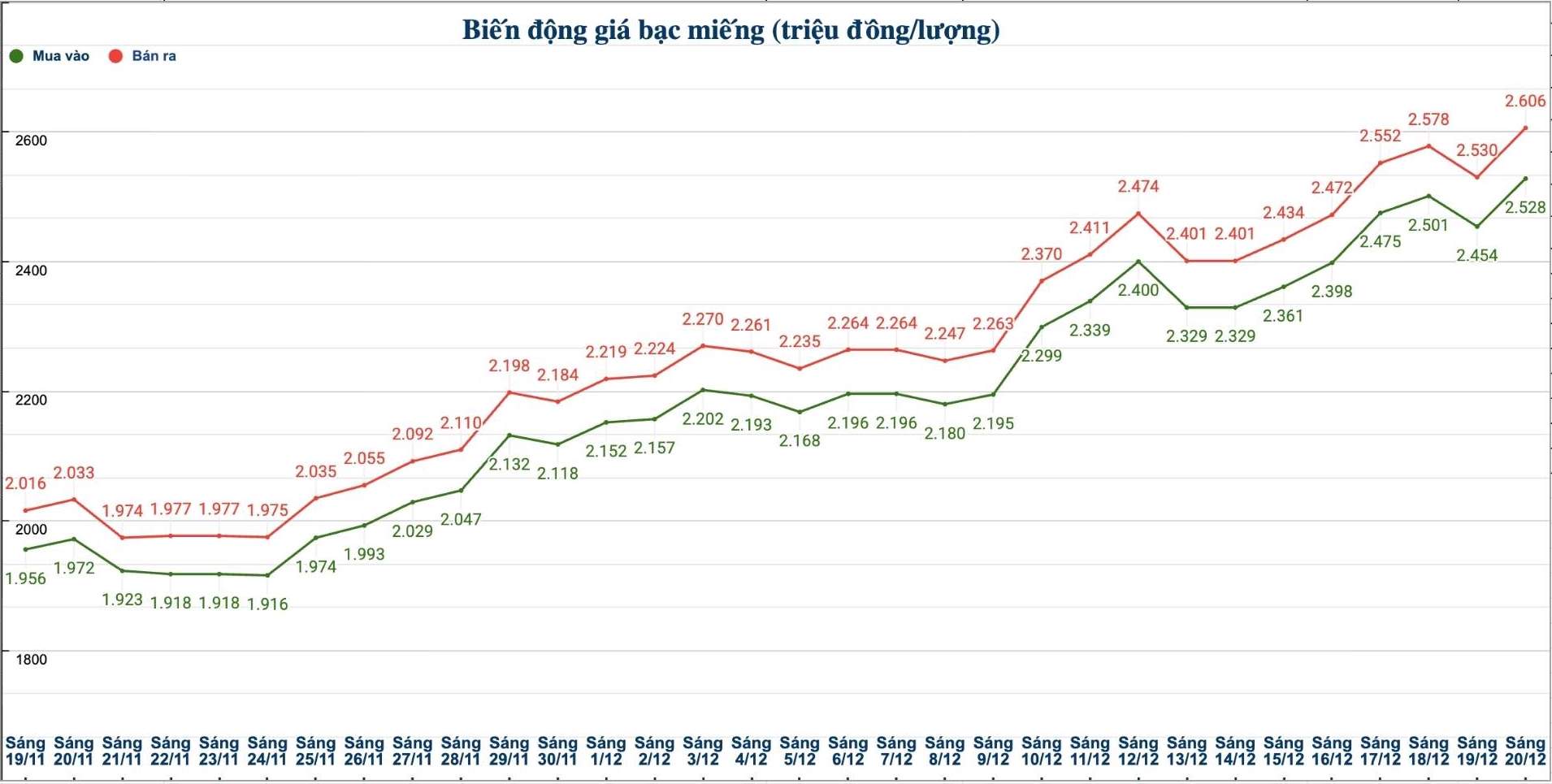

As of 9:40 a.m. on December 20, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.524 - 2.586 million VND/tael (buy - sell); an increase of 77,000 VND/tael for buying and an increase of 79,000 VND/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 66.440 - 68.460 million VND/kg (buy - sell); an increase of 2.046 million VND/kg for buying and an increase of 2.106 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND2.502 - VND2.562 million/tael (buy - sell); an increase of VND39,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.528 - 2,606 million VND/tael (buy - sell); an increase of 74,000 VND/tael for buying and an increase of 76,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 67.413 - 69.493 million VND/kg (buy - sell); an increase of 1.974 million VND/kg for buying and an increase of 2.027 million VND/kg for selling compared to yesterday morning.

World silver price

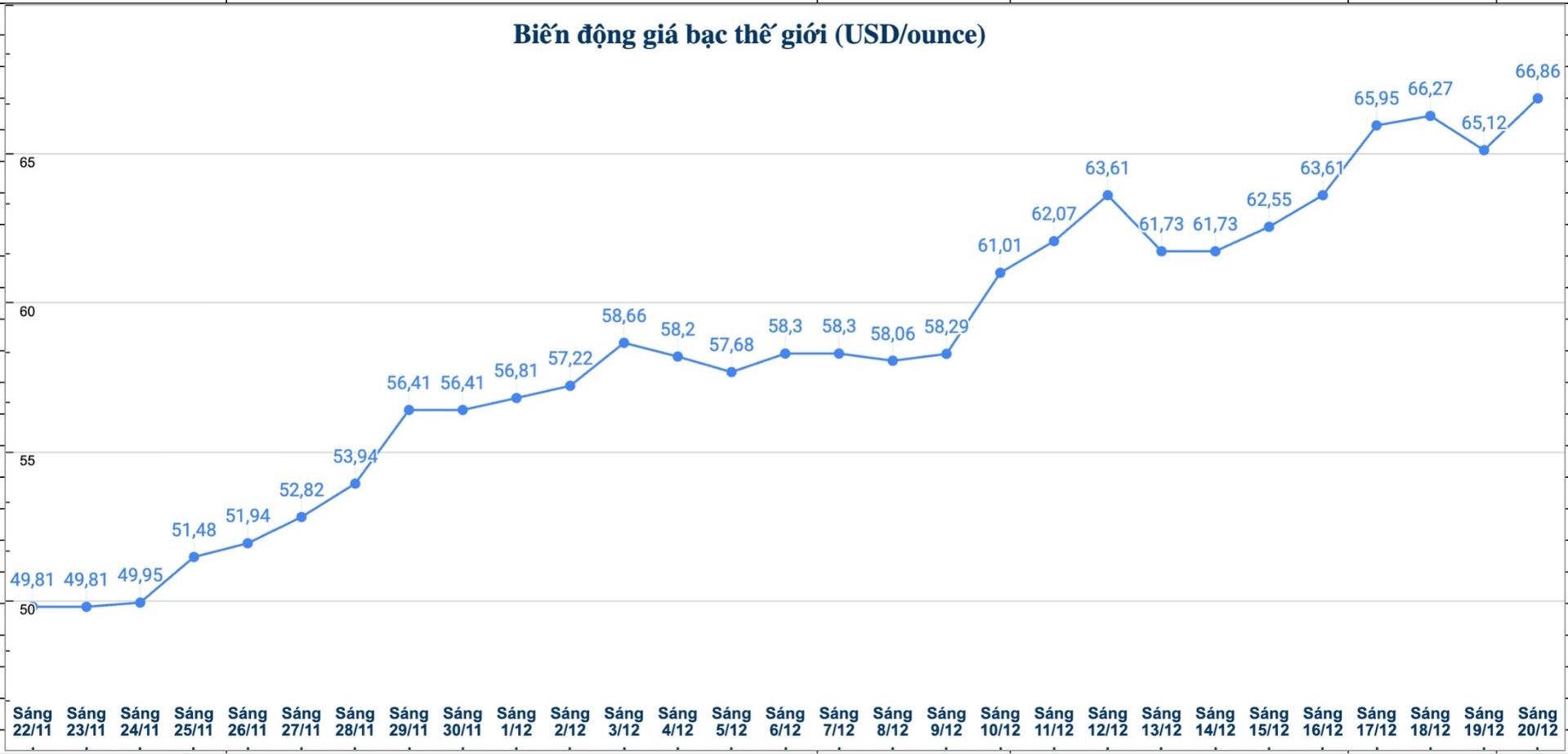

On the world market, as of 9:40 a.m. on December 20 (Vietnam time), the world silver price was listed at 66.86 USD/ounce; an increase of 1.74 USD compared to yesterday morning.

Causes and predictions

Silver prices increased in the last trading session of the week. According to precious metals analyst James Hyerczyk at FX Empire, the upward momentum comes from many factors at the same time: US inflation cooling down, increasingly clear expectations of the US Federal Reserve (Fed) cutting interest rates next year, and especially the shortage of physical silver in the market.

"In that context, investors are considering silver a more attractive choice than gold at the moment," he said.

He said that while gold prices are under slight pressure due to the stronger USD, silver prices are hardly affected, showing that cash flow is focusing more on this metal.

"The latest US inflation data is low enough to maintain expectations of a Fed easing monetary policy. This causes real yields to decrease, which is a very beneficial factor for silver. Not only does silver play the role of a currency asset like gold, it also benefits from industrial demand, helping prices increase more strongly" - James Hyerczyk commented.

Meanwhile, silver supply continues to tighten. According to James Hyerczyk, most of the silver is mined from basic metals mines, so supply cannot increase rapidly, even when prices are already high.

"This is an advantage that gold does not have, and it is also an important reason why silver is superior to gold at the present time" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...